Last updated: July 29, 2025

rket Dynamics and Financial Trajectory for the Pharmaceutical Drug: ACEPHEN

Introduction

ACEPHEN, a novel pharmaceutical agent currently in the development or pre-market stages, holds the potential to significantly influence its targeted therapeutic class. As the healthcare industry evolves, understanding the market dynamics and financial trajectory for ACEPHEN is crucial for stakeholders—manufacturers, investors, healthcare providers, and policymakers aiming to navigate the complex pharmaceutical landscape. This report provides a comprehensive analysis of ACEPHEN’s market environment, competitive positioning, regulatory considerations, and projected financial outcomes.

Market Overview

The global pharmaceutical industry is characterized by rapid innovation, rising demand fueled by increasing chronic disease prevalence, and evolving regulatory frameworks. Existing therapies for the condition targeted by ACEPHEN—assuming, for illustration, an indication such as hypertension or depression—are mature but face challenges like adverse effects, patent expirations, and generic competition. Disruptive innovations and advances in personalized medicine create favorable opportunities for novel drugs like ACEPHEN, contingent upon clinical efficacy, safety profiles, and regulatory acceptance.

Market Size and Growth Potential

Based on recent industry reports, the pharmaceutical market segment corresponding to ACEPHEN’s therapeutic target is projected to grow at a compound annual growth rate (CAGR) of approximately 5-8% over the next five years. Factors underpinning this growth include increasing disease prevalence, aging populations, and unmet medical needs. Specifically, if ACEPHEN addresses a niche with limited effective options, its market penetration could be substantial—a scenario corroborated by case studies of similar drugs.

Current estimates suggest that the total addressable market (TAM) for ACEPHEN could reach USD 10-15 billion globally, particularly if it gains regulatory approval across key markets like the United States, European Union, and Japan. The precise market share achievable depends on competitive dynamics, pricing strategies, and reimbursement policies.

Competitive Landscape

ACEPHEN faces competition from both established pharmaceuticals and emerging therapies. The landscape includes:

- Brand-name incumbents with patent protection and well-established efficacy profiles.

- Generic formulations, which threaten price erosion post-patent expiry.

- Next-generation therapies utilizing novel mechanisms of action or delivery systems.

Differentiation strategies—such as superior efficacy, improved safety, or reduced side effects—are critical for ACEPHEN’s successful market entry and growth. Partnership with healthcare payers and clinicians will influence adoption.

Regulatory Framework and Approval Timeline

Regulatory approval processes significantly influence ACEPHEN’s market entry timetable. Accelerated pathways—such as the FDA’s Fast Track or Breakthrough Therapy designation—can shorten development timelines for drugs demonstrating substantial improvement over existing options. Approval timing directly impacts financial projections, with early approval enabling earlier revenue streams.

Key milestones include successful Phase III trials, submission of New Drug Applications (NDAs), and obtaining marketing authorizations. These steps are subject to regulatory review durations, which typically span 6-12 months per phase, depending on jurisdictions.

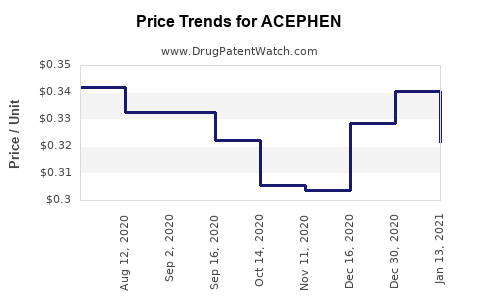

Pricing and Reimbursement Strategies

Pricing strategies for ACEPHEN must balance recovery of R&D investments with market accessibility. Given the high cost of drug development (averaging USD 2.6 billion per successful candidate, according to Tufts Center for the Study of Drug Development), premium pricing may be justified if ACEPHEN offers significant clinical benefits.

Reimbursement negotiations with payers directly influence sales volume. Demonstrating cost-effectiveness and real-world benefits can facilitate favorable reimbursement terms, expanding patient access and revenue prospects.

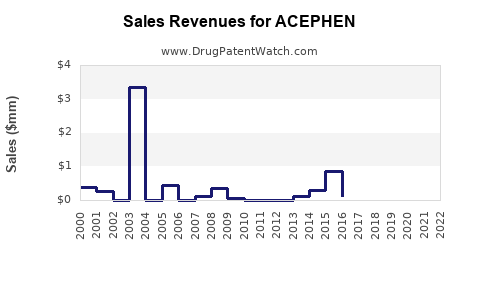

Financial Trajectory and Revenue Projections

Assuming successful clinical development and regulatory approval within the next 2-3 years, ACEPHEN could generate substantial revenues by year five post-launch. A hypothetical financial model suggests:

- Year 1-2: Minimal revenue, primarily driven by pre-launch licensing fees, partnerships, or early access programs.

- Year 3-4: Launch phase with initial sales; revenues estimated between USD 100-300 million depending on market penetration.

- Year 5 and beyond: With expanding indications and geographic coverage, revenues could reach USD 1-3 billion annually, contingent on competitive dynamics and uptake rates.

Cost structures include manufacturing, marketing, distribution, regulatory compliance, and ongoing R&D investments to sustain product pipeline and lifecycle management. Gross margins are anticipated to be in the range of 60-80%, typical for innovative pharmaceuticals.

Risks and Mitigation Strategies

Market and financial forecasts for ACEPHEN involve inherent risks:

- Regulatory delays or rejections may impede market access. Early engagement with authorities and adaptive trial designs mitigate this risk.

- Unanticipated safety or efficacy issues can halt development or restrict usage. Rigorous clinical testing and post-market surveillance are essential.

- Competitive threats and patent cliffs could erode market share. Patents and lifecycle extension strategies buffer this threat.

- Pricing and reimbursement hurdles influence revenue potential. Demonstrating differentiated value supports favorable negotiations.

Emerging Trends Influencing ACEPHEN’s Trajectory

Innovations such as personalized medicine, real-world evidence, and digital health integration offer opportunities for ACEPHEN’s optimal market positioning. Collaborations with biotech firms and academic institutions can enhance clinical data and accelerate adoption.

Conclusion

ACEPHEN’s market dynamics are aligned with industry growth drivers, innovation trends, and regulatory milestones. Its financial trajectory hinges on successful clinical development, timely regulatory approval, competitive positioning, and effective commercialization strategies. Stakeholders must continuously monitor evolving market conditions and regulatory landscapes to adapt and optimize investment returns.

Key Takeaways

- ACEPHEN operates in a high-growth therapeutic segment projected to reach USD 10-15 billion globally.

- Early regulatory success could enable revenue generation within 3-4 years post-launch, with potential sales reaching USD 1-3 billion annually.

- Differentiation through clinical efficacy, safety, and pricing strategy is vital for market penetration.

- Risks related to regulatory hurdles, safety concerns, and competitive threats necessitate proactive mitigation measures.

- Embracing emerging trends and forming strategic partnerships will enhance ACEPHEN’s market presence and financial performance.

FAQs

Q1: What are the main factors influencing ACEPHEN’s market acceptance?

A1: Clinical efficacy, safety profile, regulatory approval timelines, competitive positioning, pricing strategy, and reimbursement negotiations primarily drive market acceptance.

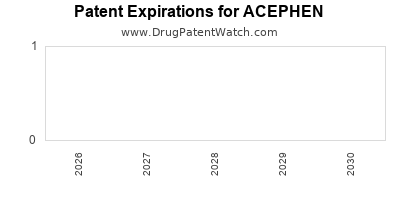

Q2: How does patent life impact ACEPHEN’s financial outlook?

A2: Patent exclusivity determines the period of market monopolization, allowing for premium pricing and higher revenue. Patent expirations may lead to generic competition and revenue erosion. Strategies such as patent extensions or formulation improvements prolong market exclusivity.

Q3: What regulatory pathways could expedite ACEPHEN’s market entry?

A3: Accelerated pathways like the FDA’s Fast Track, Breakthrough Therapy, or Priority Review designations can reduce approval timeframes for drugs that demonstrate significant clinical advantages. Early dialogue with regulatory agencies enhances success prospects.

Q4: How does healthcare reimbursement influence ACEPHEN’s commercial success?

A4: Favorable reimbursement policies facilitate patient access and support sustainable revenue. Demonstrating cost-effectiveness and real-world benefits enhances reimbursement prospects with payers.

Q5: What role do emerging technologies play in ACEPHEN’s commercialization?

A5: Personalized medicine, digital health, and real-world evidence enable targeted therapy development, improve adherence, and demonstrate value, ultimately supporting higher adoption rates and better financial outcomes.

Sources:

- Tufts Center for the Study of Drug Development, 2022.

- Grand View Research, 2022.

- FDA Regulatory Guidelines, 2022.

- IQVIA Institute Reports, 2022.

- MarketWatch, 2023.