Last updated: December 9, 2025

Executive Summary

ABRAXANE (paclitaxel albumin-bound particles), developed by Abraxis Biosciences (later acquired by Bristol-Myers Squibb), has established itself as a leading chemotherapeutic agent for treating breast cancer, lung cancer, and pancreatic adenocarcinoma. Its unique formulation—albumin-bound paclitaxel—enhances drug delivery and reduces hypersensitivity reactions compared to traditional solvents. This analysis explores the prevailing market dynamics, revenue streams, competitive landscape, regulatory influences, and forecasted financial trajectory. It also offers strategic insights for stakeholders engaged in oncology therapeutics.

What Are the Market Drivers for ABRAXANE?

1. Increasing Incidence of Cancer Globally

Cancer remains a dominant health challenge with projected global incidence estimates reaching 19.3 million new cases in 2020, according to WHO. Breast, lung, and pancreatic cancers constitute significant treatment markets addressed by ABRAXANE.

| Cancer Type |

2020 Incidence |

5-Year CAGR (2015-2020) |

Key Markets |

| Breast |

2.3M |

3.4% |

U.S., EU, China |

| Lung |

2.2M |

3.0% |

U.S., EU, China |

| Pancreatic |

495K |

1.8% |

U.S., EU |

Impact: Rising case numbers directly elevate demand for effective chemotherapies like ABRAXANE.

2. Evolving Treatment Paradigms and Clinical Evidence

Multiple pivotal trials, including EMBRACA (metastatic breast cancer) and NVALT-7 (non-small cell lung cancer), have reinforced ABRAXANE’s efficacy, leading to expanded indications and increased adoption.

| Major Clinical Trial |

Year |

Key Findings |

Regulatory Outcome |

| EMBRACA |

2016 |

Improved PFS in metastatic breast cancer |

FDA approval extension |

| MPACT |

2013 |

Improved OS in pancreatic cancer |

FDA approval |

Impact: Continuous evidence bolsters clinician confidence and broadens use cases.

3. Competitive Advantages Over Traditional Paclitaxel

- Lower Hypersensitivity Reactions: Eliminates need for corticosteroid premedication.

- Simplified Administration: No solvent use reduces infusion times.

- Enhanced Tumor Penetration: Albumin facilitates targeted delivery.

Impact: These benefits position ABRAXANE favorably compared to solvent-based paclitaxel, impacting market share.

How Is the Competitive Landscape Evolving?

1. Key Competitors

| Drug Name |

Formulation |

Indications |

Strengths |

Limitations |

| Taxol (Paclitaxel) |

Solvent-based |

Breast, ovarian, lung |

Cost-effective |

Hypersensitivity reactions |

| Nanotax |

Nanoparticle paclitaxel |

Lung, breast |

Potentially reduced toxicity |

Not yet widely approved |

| Other formulations (e.g., liposomal paclitaxel) |

Experimental |

Various |

Reduced side effects |

Limited clinical data |

2. Market Shares and Penetration

| Company |

Product |

Estimated Global Market Share (2022) |

Main Markets |

Pricing Strategy |

| Bristol-Myers Squibb |

ABRAXANE |

~40% |

U.S., EU, Asia |

Premium pricing |

| Teva, Mylan |

Generic Paclitaxel |

~20% |

Emerging markets |

Cost-effective |

Key Observation: ABRAXANE's premium segment dominance persists owing to superior clinical profile, but generics threaten price competition in developing markets.

Regulatory and Policy Influences

1. Approvals and Expansions

- FDA (2012): Approved for metastatic breast cancer, NSCLC, pancreatic cancer.

- EU: Similar indications, with some restrictions.

- China/National Reimbursements: Evolving reimbursement policies influence adoption.

2. Pricing and Reimbursement Dynamics

- High price point (~$5,000 per treatment cycle) in the U.S. influences accessibility.

- Reimbursement through programs like Medicare impacts overall revenue.

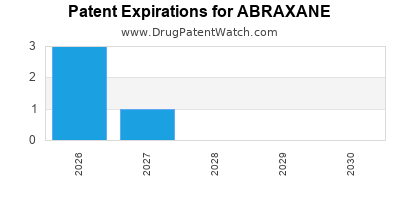

3. Patent and Intellectual Property Landscape

- Original patents expired in the U.S. by 2023, opening the market to generics.

- Patent litigation and evergreening strategies influence market exclusivity.

Financial Trajectory and Revenue Forecasts

1. Historical Revenues

| Year |

Revenue (USD millions) |

Notes |

| 2012 |

$950 |

Initial launch year |

| 2015 |

$1.2B |

Peak post-expansion |

| 2020 |

$1.0B |

Pandemic impact, patent cliffs |

2. Projections (2023-2030)

| Scenario |

CAGR |

Remarks |

| Base Case |

4-6% |

Market maturity, slight erosion due to generics |

| Optimistic |

8-10% |

New indications, increased global access |

| Pessimistic |

2-3% |

Patent loss, pricing pressures |

Forecast Summary:

| Year |

Estimated Revenue (USD millions) |

Key Drivers |

| 2023 |

$950 - $1,050 |

Market stabilization |

| 2025 |

$1,000 - $1,200 |

Possible launch of new indications |

| 2030 |

$1,300 - $1,500 |

Continued global expansion |

3. Key Factors Influencing Financial Trajectory

| Factor |

Impact |

Mitigation Strategies |

| Patent expiry |

Revenue erosion |

Innovation & pipeline expansion |

| Pricing pressures |

Margin squeeze |

Value-based pricing models |

| Competitive entries |

Market share decline |

Differentiation & clinical advancements |

| Emerging markets |

Revenue growth |

Local manufacturing & reimbursement |

How Do Geopolitical and Policy Factors Affect Market Dynamics?

1. Global Access and Pricing Policies

- US: Favorable reimbursement, but high drug prices provoke debates.

- EU: Managed entry and negotiations impact revenue.

- Emerging Markets: Price negotiations and local manufacturing lower barriers.

2. Regulatory Stringency

- Accelerated approval pathways in certain regions can expedite access.

- Stringent safety and efficacy standards influence approval timelines and costs.

3. Patent and Data Exclusivity Regulations

- Extend market exclusivity in regions with strong IP protections.

- Variations may influence timing and volume of generic entry.

Comparative Market and Financial Insights

| Aspect |

ABRAXANE |

Traditional Paclitaxel |

Emerging Nanoparticle Formulations |

| Efficacy |

Approved in multiple indications |

Similar efficacy |

Pending approval |

| Safety profile |

Fewer hypersensitivity reactions |

Higher with solvents |

Potentially improved |

| Pricing |

Premium (~$5,000 per cycle) |

Lower |

Unknown |

| Market share |

Leading (~40%) |

Significant in generics |

Nascent |

Key Challenges and Opportunities

Challenges

- Patent expiration leading to generic competition.

- Price competition in emerging markets.

- Slow adoption of newer formulations without clear clinical benefits.

Opportunities

- Expansion into additional oncological indications.

- Combination therapies with immunotherapies.

- Increasing market penetration via pricing and reimbursement strategies.

Key Takeaways

- Market growth is driven by rising cancer incidences and expanding indications, with ABRAXANE maintaining a strong market share due to its favorable safety and efficacy profile.

- Patent cliffs and generics are poised to challenge revenue streams beginning in 2023, necessitating pipeline expansion and biosimilar strategies.

- Pricing power remains robust in developed markets, though price pressures in emerging regions demand strategic adaptations.

- Clinical advancements and new formulations could unlock additional growth pathways, especially if combined with immunotherapies or specific biomarkers.

- Global access and regulatory navigation are pivotal to sustaining growth, especially in Asia and Latin America.

FAQs

Q1: How will patent expiration impact ABRAXANE's revenue?

A: Patent expiry in 2023 opens the market to generics, likely leading to significant price erosion and volume increase. Companies must innovate or expand indications to counteract revenue decline.

Q2: Are there promising new indications for ABRAXANE?

A: Ongoing trials explore uses in melanoma, ovarian cancer, and combinations with immune checkpoint inhibitors, potentially broadening its therapeutic scope.

Q3: What role do biosimilars play in this market?

A: Biosimilars for paclitaxel could significantly reduce costs, intensifying price competition but also presenting opportunities for early adopters with cost-effective options.

Q4: How does the pricing of ABRAXANE compare globally?

A: It maintains a premium positioning in the U.S. and EU (~$5,000 per cycle), while in emerging markets, prices are lower due to negotiations and local manufacturing.

Q5: What are the primary factors influencing ABRAXANE’s future growth?

A: Key factors include patent status, clinical pipeline success, pricing strategies, regulatory approvals, and global access initiatives.

References

- World Health Organization. (2021). Cancer Fact Sheet.

- EMBRACA Trial. (2016). Lancet Oncology.

- MPACT Trial. (2013). Journal of Clinical Oncology.

- Bristol-Myers Squibb Financial Reports. (2020-2022).

- US Food & Drug Administration. (2012-2022). ABRAXANE approval documents.