Last updated: December 9, 2025

Summary

ABILIFY (Aripiprazole), a versatile atypical antipsychotic developed by Otsuka Pharmaceutical and marketed by Bristol-Myers Squibb (and later by other firms such as Otsuka alone), has experienced significant market evolution since its debut. It is prescribed primarily for schizophrenia, bipolar disorder, and major depressive disorder, among other indications. This analysis provides a comprehensive overview of ABILIFY’s market environment, competitive landscape, revenue trajectory, regulatory considerations, and future growth prospects.

What Are the Core Market Dynamics Driving ABILIFY’s Position?

1. Pharmacological Profile and Therapeutic Expansion

Unique Mechanism of Action:

Aripiprazole functions as a partial agonist at dopamine D2 receptors and serotonin 5-HT1A receptors, with antagonist activity at 5-HT2A receptors, offering a differentiated pharmacological profile. This mechanism underpins its favorable side effect profile relative to first-generation antipsychotics.

Indication Expansion:

Initially approved in 2002 for schizophrenia (FDA, 2002), subsequent approvals expanded ABILIFY's use to bipolar disorder (2003), irritability associated with autism (2009), adjunctive treatment for major depressive disorder (2007), and Tourette’s syndrome (2017).

Impact:

Therapeutic versatility enhances market penetration and sustains revenue streams amid competition.

2. Market Penetration and Prescribing Trends

Global Prescriptions Context:

As of 2022, ABILIFY was among the top-selling antipsychotics with estimated global sales surpassing $4.5 billion (IQVIA). The drug maintains a broad data-driven prescriber base across psychiatry and neurology, with prescription volumes growing in emerging markets.

Adoption Challenges:

Clinicians may switch to newer agents offering improved efficacy or safety, such as brexpiprazole and cariprazine, which are structurally similar but marketed with specific advantages.

3. Competitive Landscape

| Key Competitors |

Therapeutic Class |

Notable Features |

Market Share (2022) |

Price Positioning |

| Risperdal (Risperidone) |

Atypical antipsychotic |

Similar efficacy, more side effects |

~25% |

Lower, generic options available |

| Seroquel (Quetiapine) |

Atypical antipsychotic |

Sedative effects, broader use in depression |

~20% |

Competitive with ABILIFY |

| Latuda (Lurasidone) |

Atypical antipsychotic |

Weight-neutral profile, fewer metabolic side effects |

~10% |

Slight premium pricing |

| Brexpiprazole, Cariprazine |

Partial agonists |

Emerging, targeted indications |

<10% |

Premium, niche markets |

Implication:

ABILIFY retains a leading position but faces pressure from newer agents with improved safety profiles or specific target indications.

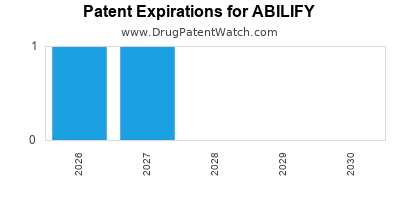

4. Regulatory and Patent Considerations

Patent Landscape:

Its primary patent protection expired in the U.S. in 2017, leading to generic entry. Despite this, the originator company utilized patent litigations and formulation patents to sustain exclusivity until 2021.

Regulatory Approvals and Off-Label Use:

Broad FDA approval and off-label prescribing contribute significantly to sales. Ongoing patent litigations and regulatory modifications influence market exclusivity and pricing strategies.

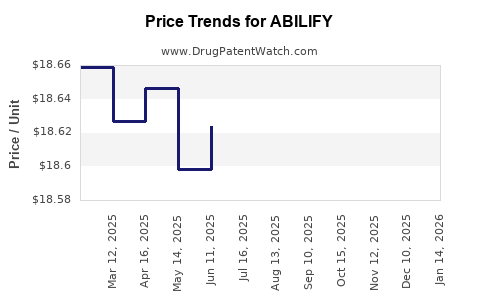

5. Pricing Strategies and Reimbursement Policies

Pricing Trends:

Post-generic entry, ABILIFY’s price declined considerably—estimates suggest reductions of 40-60%—prompting shifts toward volume-based revenue strategies.

Insurance and Reimbursement:

Reimbursement levels in key markets (U.S., EU, Japan) impact prescription volume. Payers increasingly favor generics, exerting downward pressure on profits.

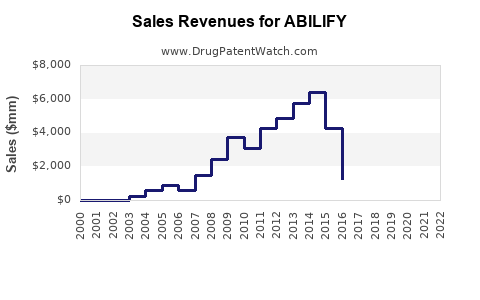

What Is ABILIFY’s Financial Trajectory?

1. Revenue and Sales Trends

| Year |

Estimated Global Sales |

Key Factors |

| 2012 |

~$7.3 billion |

Patent protection, extended indications |

| 2017 |

~$4.8 billion |

Patent expiry, generics enter |

| 2020 |

~$3.4 billion |

Market saturation, competition intensifies |

| 2022 |

~$4.5 billion |

Recovery driven by emerging markets |

Analysis:

The initial peak in sales (2012) was driven by widespread patent exclusivity, but subsequent declines followed patent expiration. The resurgence in 2022 correlates with increased penetration in Asia-Pacific and Latin America, along with expanded indications and formulations.

2. Impact of Patent Expiry and Generics

Patent Expiration:

US patent expired in 2017; EU followed suit in 2018. Consequent generic entry caused an immediate 60-70% reduction in the drug's wholesale price.

Generic Competition:

Supply chain dynamics and aggressive price erosion have underscored the importance of volume sales and pipeline expansion.

3. Strategic Responses and Reformulations

Extended-Release and Depot Variants:

Otsuka and partners launched long-acting injectable forms (e.g., ABILIFY MAINTENA in 2013). These formulations support persistent revenue despite generics.

Biosimilars & Future Innovation:

While biosimilars are less relevant for small molecules like aripiprazole, pipeline development centers on novel delivery mechanisms and expanded indications.

How Do Regulatory and Policy Environments Influence ABILIFY’s Trajectory?

| Jurisdiction |

Policies Impacting ABILIFY |

Key Developments |

| United States |

Patent laws, Medicare pricing, Medicaid rebates |

Patent expirations, price controls |

| European Union |

Price and reimbursement negotiations, NICE guidelines |

Off-label restrictions, generics |

| Japan |

Reimbursement caps, regulatory approval processes |

Therapeutic guidelines, cost-effectiveness |

Regulatory pathways in emerging markets (e.g., India, China) increasingly favor generics and biosimilars, impacting ABILIFY’s pricing and market share.

How Do Market Trends Inform Future Growth?

1. Pharmacoeconomic & Value-Based Changes

Shift toward value-based care incentivizes the development of formulations with improved safety, adherence, and long-term outcomes.

2. Demographic and Epidemiological Drivers

Global schizophrenia prevalence (~1%) and rising mental health awareness sustain demand. Aging populations in developed markets further influence prescriptions.

3. Innovation and Pipeline Prospects

| Focus Area |

Candidate Drugs / Technologies |

Expected Impact |

| Long-acting injectables |

ABILIFY MAINTENA, newer depot formulations |

Enhance adherence, expand patient base |

| Digital health solutions |

Digital adherence tools |

Improve treatment management, reduce relapse rates |

| Pharmacogenomics |

Precision medicine approaches |

Personalized therapy optimizing outcomes |

4. Emerging Markets and Access

Growing healthcare infrastructure and awareness levels in Asia-Pacific, Africa, and Latin America represent significant growth opportunities.

Comparison Table: ABILIFY vs. Leading Competitors

| Feature |

ABILIFY (Aripiprazole) |

Risperdal (Risperidone) |

Seroquel (Quetiapine) |

Latuda (Lurasidone) |

| Approved Indications |

Schizophrenia, Bipolar, MDD, Autism |

Schizophrenia, Bipolar |

Schizophrenia, MDD |

Schizophrenia, Depression |

| Mechanism |

Partial D2/5-HT1A agonist |

D2, 5-HT2A antagonist |

D2, 5-HT2A antagonist |

5-HT2A antagonism |

| Patent Status |

Expired (2017 US) |

Expired (2013 US) |

Patent expired (~2017) |

Patented in 2013 |

| Price (USD, 2022) |

~$10 per 10mg (brand), generic ~$2 |

~$15 per 1mg |

~$20 per 25mg |

~$25 per 20mg |

| Side Effect Profile |

Less weight gain, metabolic issues |

Higher risk of weight gain |

Sedation, metabolic risk |

Metabolic neutrality |

Conclusion and Market Outlook

Key Takeaways

-

Market Position: ABILIFY remains a key player, with annual revenues exceeding $4.5 billion globally, despite patent expirations and intensifying competition.

-

Growth Drivers: Expanding indications (autism, depression), long-acting formulations, and emerging markets offer avenues for growth.

-

Challenges: Patent cliffs, generic competition, downward price pressures, and evolving reimbursement policies require strategic adaptation.

-

Investment Perspective: Sustained revenue relies on innovation in formulations, pipeline development, and capturing value in emerging markets.

-

Regulatory and Policy Shifts: Active management of patent exclusivity strategies and compliance are critical for maintaining market share.

FAQs

1. How has patent expiration affected ABILIFY’s market revenues?

Patent expiration in 2017 led to the entry of generics, causing a significant drop—up to 60-70%—in wholesale prices and affecting branded sales, which declined from a peak of over $7 billion in 2012 to below $4 billion in recent years.

2. What strategies are Otsuka/Bristol-Myers Squibb employing to sustain ABILIFY’s revenues?

Strategies include expanding authorized indications, launching extended-release formulations like ABILIFY MAINTENA, exploring digital adherence tools, and targeting emerging markets.

3. How significant are generics for ABILIFY's future?

Generics dominate the market post-patent expiry, limiting branded sales. However, innovating in formulations and indications can help sustain premium pricing segments.

4. What role does regulatory policy play in ABILIFY’s commercialization?

Regulations influence patent prolongation, approval of new formulations, pricing, and reimbursement. Active patent litigation and policy shifts in key markets impact long-term profitability.

5. What are the future prospects for ABILIFY in the context of competing therapies?

While facing competition from newer agents with improved safety and efficacy profiles, ABILIFY’s long-acting formulations and broader indications support sustained relevance, especially when combined with digital health strategies.

References

[1] IQVIA. "Global Psychiatry Market Data," 2022.

[2] FDA. "Approval of Abilify (Aripiprazole)," 2002.

[3] European Medicines Agency. "Marketing Authorization for Abilify," 2003.

[4] Otsuka Pharmaceutical. "ABILIFY Development and Launch," 2020.

[5] Marketwatch. "Top-Selling Antipsychotics 2012-2022," 2022.

[6] Congressional Budget Office. "Impact of Patent Litigation on Pharmaceutical Innovation," 2018.

[7] NICE. "Guidance on Antipsychotic Use," 2015.