Last updated: October 15, 2025

Introduction

Abacavir sulfate, marketed primarily under the brand name Ziagen, is a nucleoside reverse transcriptase inhibitor (NRTI) used in antiretroviral therapy (ART) for HIV-1 infection. Since its initial approval by the U.S. Food and Drug Administration (FDA) in 1998, the drug has played a pivotal role in HIV management, contributing to the broader landscape of antiretroviral medicines. This analysis delineates the evolving market dynamics and financial trajectory of abacavir sulfate, considering patent landscapes, therapeutic trends, competitive environment, regulatory factors, and pricing strategies.

Market Overview and Epidemiological Context

The global HIV/AIDS epidemic remains a significant public health challenge, with an estimated 38 million individuals living with HIV in 2022 [1]. The continued need for effective ART solutions sustains demand for key drugs like abacavir sulfate, especially in regions with high HIV prevalence such as Sub-Saharan Africa, Southeast Asia, and parts of Latin America.

Advancements in HIV treatment guidelines—endorsed by organizations like WHO and CDC—favor combination therapies that include abacavir, especially for patients intolerant to other NRTIs like tenofovir or zidovudine. The shift towards integrase inhibitor-based regimens has impacted abacavir’s market share but has not diminished its importance entirely.

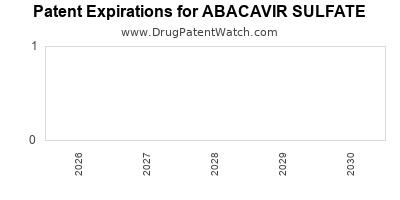

Patent Landscape and Regulatory Environment

Initially protected by primary patents, abacavir sulfate's exclusivity extended until approximately 2015. Post-expiry, the market saw a proliferation of generic manufacturers, dramatically reducing acquisition costs and expanding access in low- to middle-income countries.

Regulatory approvals have also evolved to improve the safety profile of abacavir. Notably, the introduction of genetic testing for the HLA-B*57:01 allele improved treatment safety and facilitated its incorporation into treatment algorithms.

Furthermore, regulatory shifts in different territories, such as the approval of fixed-dose combinations (FDCs) incorporating abacavir, have driven commercialization and market penetration.

Competitive Landscape

The market for HIV NRTIs is highly competitive, with major pharmaceutical players including Gilead Sciences, ViiV Healthcare, and Mylan. Gilead’s tenofovir and emtricitabine-based products—such as Truvada and Descovy—pose significant competition owing to their favorable safety profiles and once-daily dosing.

However, abacavir’s unique position—particularly in formulations like Triumeq (abacavir, dolutegravir, lamivudine)—cements its relevance. Moreover, the availability of generic formulations has expanded access, especially in emerging markets.

The ongoing development of next-generation NRTIs and integrase inhibitors influences the pipeline, potentially impacting future demand for abacavir.

Market Dynamics

Pricing and Reimbursement Trends

Post-patent expiration, generic versions of abacavir sulfate have driven down prices substantially in developed markets, with costs decreasing by over 80% in some regions over the past decade [2]. This price decline has increased accessibility but compressed profit margins for manufacturers.

In contrast, branded formulations, especially FDCs, command premium pricing in high-income countries due to branding, safety data, and perceived quality differences.

Reimbursement policies have similarly shifted, favoring cost-effective generics, influencing procurement strategies for healthcare systems.

Therapeutic Trends

The evolution of HIV treatment underscores a gradual shift from monotherapy towards fixed-dose combination regimens that enhance adherence. Abacavir’s inclusion in widely used FDCs boosts its market penetration, especially in developed countries adhering to latest guidelines.

Additionally, safety concerns, such as hypersensitivity reactions associated with HLA-B*57:01 positivity, limit universal applicability but are manageable with genetic testing.

Emerging Markets and Access

In regions with high HIV burdens but limited healthcare infrastructure, the broad availability of affordable generics has increased treatment coverage. International health agencies and NGOs facilitate access, influencing demand dynamics favorable to abacavir.

Financial Trajectory Analysis

Revenue Trends

The global revenue for abacavir sulfate, primarily through branded formulations and generics, experienced peak sales around the late 2000s, driven by high HIV prevalence and limited alternative therapies. Following patent expirations, revenues declined sharply in developed markets but have been sustained through generic sales, especially in low- and middle-income countries.

Market Forecast

Projections indicate moderate stability in demand through 2030, predominantly driven by:

- Steady HIV prevalence and the necessity of lifelong ART.

- Continued adoption of abacavir-containing FDCs.

- Ongoing access programs in the developing world.

However, the potential erosion of demand due to newer, more tolerable therapies, and competitive pressures from integrase inhibitors like dolutegravir, suggest a gradual decline in the drug’s market share in affluent markets.

Investment and R&D Outlook

Pharmaceutical manufacturers may focus on patent extensions, formulations with improved safety profiles, or combination products to sustain profitability. R&D investments are also directed toward next-gen NRTIs and alternative mechanisms of action in HIV therapy.

Regulatory and Legal Considerations

Legal challenges, including patent disputes and generic approvals, shape market access and profitability. Recent legal conflicts, such as patent litigations over formulation patents, influence the market landscape [3].

Global regulatory environments continue to evolve, with fast-track approvals and approval pathways for biosimilars or generics further shaping market entries.

Conclusion

The market for abacavir sulfate is characterized by an initial period of growth, significant patent protections, subsequent proliferation of generics, and a shifting landscape towards combination therapies. While revenues in developed markets have declined, demand remains robust in emerging regions due to broad access and HIV prevalence. The transition toward newer therapies potentially constrains future growth but does not eliminate its role entirely in global HIV treatment strategies.

Key Takeaways

- Market decline in developed countries: Patent expiry and competition from generics have compressed profit margins, reducing revenue in high-income regions.

- Sustained demand in emerging markets: Cost-effective generics and international aid sustain high demand in areas with high HIV burdens.

- Pipeline and formulation innovations: Incorporation into fixed-dose combinations and safety improvements continue to bolster market relevance.

- Competitive pressures: Emergence of integrase inhibitors and newer NRTIs challenge abacavir’s market share.

- Regulatory environment: Patent litigation, approval processes, and safety profiles influence ongoing market access and pricing strategies.

FAQs

1. How has patent expiration affected the pricing of abacavir sulfate?

Patent expirations around 2015 allowed multiple manufacturers to produce generic formulations, drastically reducing prices—often by over 80%—which increased global access but eroded profit margins for branded drug producers.

2. What role does abacavir sulfate play in current HIV treatment guidelines?

It remains integral in certain fixed-dose combination regimens, especially those including dolutegravir and lamivudine (e.g., Triumeq), prescribed for treatment-naïve adults due to efficacy and tolerability profiles.

3. Are there safety concerns associated with abacavir that impact its market?

Yes. Hypersensitivity reactions linked to HLA-B*57:01 allele can be life-threatening. However, genetic screening has mitigated this risk, enabling safer use, though safety concerns still influence clinician prescribing practices.

4. How does the availability of generics impact the global HIV treatment market?

Generics significantly lower drug costs, expanding access in low-to-middle income countries, which sustains demand despite declining revenues in high-income countries.

5. What future developments could influence abacavir sulfate’s market trajectory?

Innovations in HIV therapeutics, such as longer-acting injectables and novel mechanisms of action, could reduce reliance on existing NRTIs like abacavir. Conversely, ongoing formulations improvements and expanded access initiatives could prolong its relevance.

Sources

[1] UNAIDS. (2022). Global HIV & AIDS statistics — 2022 fact sheet.

[2] IMS Health. (2016). Global HIV/AIDS market analysis.

[3] Patent Litigation Reports. (2019). Legal disputes over abacavir formulations.