Last updated: July 27, 2025

Introduction

Quinidine sulfate, an anti-arrhythmic agent primarily used to treat cardiac arrhythmias, has maintained a niche role amidst evolving pharmacological landscapes. Despite its longstanding history, the drug’s market trajectory is shaped by a confluence of clinical efficacy, regulatory frameworks, emerging therapies, and economic factors.

This analysis provides a comprehensive review of the current market dynamics and forecasts the financial trajectory for quinidine sulfate, emphasizing key drivers and barriers influencing its global demand and supply.

Historical Context and Current Clinical Position

Developed in the early 20th century, quinidine sulfate derives from the cinchona tree's alkaloids. It gained prominence as an effective treatment for atrial and ventricular arrhythmias, especially before the advent of more advanced agents (as detailed by the American Heart Association).

Despite its historical significance, quinidine's use has waned in Western markets, primarily due to safety concerns, including proarrhythmic risks and drug interactions, which have favored newer classes of anti-arrhythmics like amiodarone and lidocaine. Nonetheless, it retains some relevance in low-resource settings and for specific indications such as malaria prophylaxis and certain arrhythmias resistant to other treatments.

Market Dynamics

1. Demand and Usage Trends

Global demand for quinidine sulfate has declined over the past decade, driven mainly by:

-

Shift Towards Safer Alternatives: The advent of novel anti-arrhythmic drugs with improved safety profiles has limited quinidine's use. For example, amiodarone’s favorable efficacy and tolerability profile outcompete quinidine for many indications.

-

Regulatory Restrictions: In several regions, stringent regulations and safety warnings have curtailed its prescription rates. The FDA's black box warning regarding the risk of arrhythmias has further limited formal use in the US market.

-

Limited Therapeutic Indications: The narrow scope of approved indications restricts its market expansion opportunities.

2. Geographical and Demographic Factors

-

Emerging Markets: Countries with limited access to advanced anti-arrhythmics, such as parts of Africa and Southeast Asia, continue to use quinidine sulfate, often in combination with other therapies for malaria and arrhythmias.

-

Aging Population: The global rise in cardiovascular diseases among aging populations sustains some demand, although largely for newer agents.

-

Manufacturing Concentration: Major producers include India, China, and Argentina, where cost-effective manufacturing sustains supply despite declining demand.

3. Regulatory and Patent Landscape

-

Patent Expiry: Quinidine sulfate is generics-driven, with no active patents. The market’s price competition results in low margins but assures continued supply.

-

Regulation Variability: Different regulatory regimes influence market access; some countries have restrictions or require special import licenses, affecting distribution.

4. Competitive Landscape

-

Emerging Therapies: The proliferation of targeted anti-arrhythmics and interventional procedures limits quinidine's position primarily to niche applications.

-

Alternative Indications: Off-label use in conditions like malaria changes demand dynamics but remains unregulated in certain markets.

5. Manufacturing and Supply Chain Factors

-

Supply Chain Stability: Manufacturers in emerging economies benefit from cost efficiency, but geopolitical factors and raw material availability can influence production stability.

-

Quality and Safety Standards: Increasing emphasis on Good Manufacturing Practices (GMP) elevates production costs but enhances product reputation where used.

Economic and Financial Projection

1. Market Size and Revenue Forecast

The global quinidine sulfate market is modest, with estimates around USD 10-15 million annually, predominantly driven by emerging markets. A compound annual growth rate (CAGR) of approximately -1.5% to -2% over the next five years reflects its declining demand pattern.

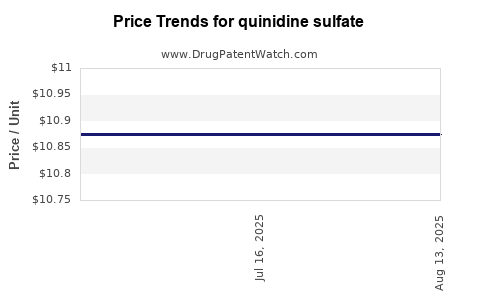

2. Price Trends

Prices remain low due to generic competition. However, shortages or supply disruptions could temporarily inflate prices in niche markets.

3. Investment Considerations

-

R&D and Innovation: Given its limited pipeline, substantial investment into innovation is unlikely, reinforcing its status as a mature, low-growth product.

-

Regulatory Risks: Changes in safety regulations or classification (e.g., reclassification as a controlled substance) could impose additional costs.

4. Market Drivers and Restraints

| Drivers |

Restraints |

| Growing prevalence of arrhythmias among aging populations |

Safety concerns limiting clinical use |

| Demand in developing countries for generic, low-cost solutions |

Competition from newer, safer anti-arrhythmics |

| Off-label applications such as malaria prophylaxis |

Regulatory restrictions and safety warnings |

5. Future Outlook

The financial trajectory for quinidine sulfate is predominantly horizontal or declining. Marginal growth may occur in specific geographies, buoyed by low-cost manufacturing and limited regulatory barriers. Nevertheless, the overarching trend suggests a gradual market contraction, with most revenues stemming from existing stockpiles and off-label uses.

Regulatory and Market Entry Considerations

Market entrants or stakeholders assessing opportunities should account for:

-

Regional Regulatory Environment: Varied acceptance levels necessitate tailored compliance strategies.

-

Pricing and Reimbursement Policies: Low price points hinder profitability unless targeting specific niche markets.

-

Supply Chain Considerations: Ensuring raw material procurement and manufacturing compliance are vital for market stability.

Concluding Remarks

Quinidine sulfate's market outlook reflects a classic case of a legacy drug with niche viability amid an evolving therapeutic landscape. While declining in developed markets due to safety and efficacy concerns, it persists in resource-constrained regions and specific indications.

Stakeholders should view quinidine sulfate as a low-growth, low-margin product with strategic importance primarily in emerging markets or specialized applications rather than as a large-scale commercial opportunity.

Key Takeaways

- Demand decline is driven by safer, more effective anti-arrhythmics and stringent safety regulations.

- Emerging markets sustain some demand due to affordability and limited alternatives.

- Market size is modest (~USD 10-15 million annually) with a projected negative CAGR.

- Supply chains are concentrated in India, China, and Latin America, benefiting from low-cost manufacturing.

- Future opportunities are limited; focus should remain on niche applications and geographic markets with fewer regulatory restrictions.

FAQs

1. Why is quinidine sulfate used less frequently in developed markets?

Due to safety concerns like proarrhythmic effects, regulatory warnings, and the availability of newer, safer alternatives such as amiodarone, quinidine sulfate's use has substantially declined in developed regions.

2. What are the primary global markets for quinidine sulfate?

Emerging markets in Africa, Southeast Asia, and parts of Latin America dominate consumption, mainly for low-cost treatment options and specific indications like malaria prophylaxis.

3. How do regulatory differences influence quinidine sulfate’s market?

Markets with strict safety regulations or classification as a controlled substance restrict access, reducing market size. Conversely, countries with lax regulations or demand for affordable generics sustain its use.

4. What are the main factors affecting the financial health of quinidine sulfate manufacturers?

Price competition due to generics, supply chain stability, manufacturing costs, and regulatory compliance significantly impact profitability. Shortages or regulatory changes can introduce volatility.

5. Is there potential for innovation or new indications for quinidine sulfate?

Limited. The drug's outdated safety profile and the emergence of superior therapies diminish the prospects for significant R&D investments or new indications.

Sources:

[1] American Heart Association. “Anti-arrhythmic Drugs.”

[2] GlobalData. “Pharmaceutical Market Analysis.”

[3] U.S. Food and Drug Administration (FDA). “Drug Safety Communications.”

[4] MarketWatch. “Generic Drug Market Trends.”

[5] World Health Organization. “Malaria Control Strategies.”