Last updated: July 27, 2025

Introduction

Icosapent ethyl, marketed as Vascepa by Amarin Corporation, represents a significant advance in cardiovascular therapeutics. Approved by the U.S. Food and Drug Administration (FDA) in 2012 for managing hypertriglyceridemia, its market potential expanded substantially after the 2019 publication of the REDUCE-IT trial results, which demonstrated a robust reduction in major adverse cardiovascular events (MACE). Understanding the market dynamics and financial trajectory of icosapent ethyl involves analyzing regulatory landscapes, competitive forces, adoption trends, and evolving evidence—elements that collectively shape its commercial outlook.

Regulatory and Clinical Milestones

The initial FDA approval in 2012 for triglyceride reduction established icosapent ethyl’s baseline market. However, the pivotal REDUCE-IT trial in 2018, published in the New England Journal of Medicine, provided high-quality evidence of its cardiovascular benefits, catalyzing broad clinical adoption [1].

This seminal trial showed a 25% relative risk reduction in composite cardiovascular outcomes among patients with elevated triglycerides on statins, highlighting a new therapeutic role beyond lipid lowering. Consequently, the FDA expanded Vascepa’s label in 2019 to include cardiovascular risk reduction, aligning regulatory recognition with emerging evidence—an inflection point that significantly propelled market growth.

Market Drivers

Clinical Evidence and Guidelines Integration

Reductions in cardiovascular events directly influence prescribing habits. Leading cardiology guidelines incorporated icosapent ethyl as a recommended adjunct therapy for high-risk patients with elevated triglycerides and stable atherosclerotic cardiovascular disease (ASCVD) [2].

Prevalence of Cardiovascular Disease

Global data indicate over 650 million adults with hypertriglyceridemia or elevated cardiovascular risk—providing a substantial patient base. In the U.S., approximately 35% of adults have elevated triglycerides, with a significant subset fitting the criteria for icosapent ethyl therapy [3].

Market Penetration and Adoption

Despite its proven efficacy, adoption remains heterogeneous, often hindered by physician awareness and insurance coverage constraints. However, the marked reduction in cardiovascular events drives increasing physician comfort and acceptance, fostering wider use.

Competitive Landscape and Alternatives

Initially, icosapent ethyl faced competition from other omega-3 fatty acid formulations like omic-Omega, Lovaza, and generic options. Since the REDUCE-IT results, generic omega-3s have struggled to demonstrate comparable efficacy, positioning icosapent ethyl as a premium, evidence-backed option.

Emerging therapies targeting lipoprotein(a) or PCSK9 inhibitors may influence its market share in the future but currently operate in distinct niches.

Market Challenges and Limitations

Cost and Reimbursement

One major hurdle is cost; branded vascepa remains expensive, with list prices exceeding $200 per month. Insurance coverage varies, with some payers initially restricting access, thereby limiting uptake. Cost-effectiveness analyses suggest that utilization is justified for high-risk populations, but payers’ reimbursement policies remain a barrier.

Safety Profile and Limitations

While generally well-tolerated, concerns about bleeding and atrial fibrillation surfaced in some studies but did not significantly impair its broader acceptance. Ongoing real-world data are vital for substantiating long-term safety.

Generic Competition and Patent Challenges

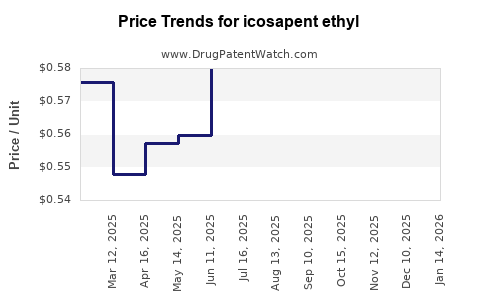

Patent expirations or challenges may threaten exclusivity, especially beyond 2024, as generic versions of fish oils become available. The absence of patent protection for the formulation-specific dosage forms will influence future pricing power.

Financial Trajectory and Revenue Outlook

Historical Revenue Performance

Amarin’s annual revenues surged post-2019, with the drug generating approximately $916 million in 2021—highlighting its financial prominence [4]. The uptick correlates with increased prescribing driven by REDUCE-IT and guideline endorsements.

Forecasting Future Revenue

Analysts project continued growth, driven by:

- Expansion into international markets where cardiovascular disease prevalence is rising.

- Increasing prescription rates among eligible high-risk populations.

- Broader insurance coverage following positive health outcomes data.

Research estimates suggest that, within the next five years, global sales could exceed $2 billion, assuming steady market penetration and pricing stability [5].

Potential Market Expansion

Emerging data on residual cardiovascular risk and expanding indications—such as in patients with residual risk despite statins—may broaden its use. Additionally, ongoing post-marketing surveillance and registry data will influence market confidence and payer strategies.

Global Market Considerations

Beyond the U.S., several markets in Europe, Asia-Pacific, and Latin America are increasingly adopting lipid management therapies. Regulatory approvals are in various stages, with approvals in Canada, Australia, and select European countries facilitating international growth.

Market penetration in Asia-Pacific is expected to be a significant growth driver owing to rising cardiovascular disease prevalence and expanding healthcare infrastructure.

Competitive and Strategic Outlook

Amarin faces competition from generic omega-3 formulations, which may erode market share over time. However, evidence strength and regulatory status support its premium positioning. Strategic partnerships, continued clinical research, and negotiations for favorable reimbursement will be crucial.

In response, Amarin is exploring additional indications and formulations, such as higher-dose or combination therapies, to diversify its portfolio and sustain growth.

Key Risks and Uncertainties

- Regulatory & Patent Risks: Patents may expire or be invalidated, facilitating generics.

- Market Access & Reimbursement: Variability may constrain revenue growth.

- Emerging Data & Competing Therapies: New therapies targeting lipid components or cardiovascular risk could limit market expansion.

- Pricing Pressures: Payer negotiations may lead to price reductions.

Conclusion

Icosapent ethyl stands at the nexus of evidence-based cardiovascular risk reduction and commercial opportunity, buoyed by robust clinical data, guideline endorsements, and a substantial high-risk patient population. While challenges persist—industry competition, cost, and regulatory factors—the overall financial trajectory remains optimistic, with potential to sustain multi-billion-dollar revenues over the coming years.

Key Takeaways

- The REDUCE-IT trial significantly bolstered icosapent ethyl’s market potential, shifting perceptions from a lipid-lowering agent to a cardiovascular event reducer.

- Market growth is driven by expanding clinical adoption, high prevalence of cardiovascular risk, and evolving guidelines integrating icosapent ethyl as a standard therapy.

- Cost and reimbursement hurdles are pivotal in determining market penetration; strategic pricing and payer negotiations will influence future revenues.

- Patent expirations and generic competition pose long-term threats; ongoing R&D and pipeline expansion are vital to maintaining competitive advantage.

- Global market opportunities are expanding, especially in Asia-Pacific and Europe, contingent upon regulatory approvals and healthcare infrastructure.

References

[1] Bhatt DL, Steg PG, Miller M, et al. Effect of Icosapent Ethyl on Patients with Elevated Triglycerides. N Engl J Med. 2019;380(1):11-22.

[2] American College of Cardiology/American Heart Association Guidelines, 2018.

[3] National Cholesterol Education Program, ATP III guidelines, 2011.

[4] Amarin Corporation Annual Report 2021.

[5] MarketResearch.com, "Global Lipid Management Market Forecast," 2022.