Last updated: July 28, 2025

Introduction

Icosapent Ethyl (brand name Vascepa) is a purified, ethyl ester form of eicosapentaenoic acid (EPA), a marine-derived omega-3 fatty acid. Approved by the U.S. Food and Drug Administration (FDA) in 2012, its primary indication is for reducing triglyceride levels in adults with severe hypertriglyceridemia. Subsequently, the drug gained a substantial market foothold following pivotal clinical trials indicating cardiovascular benefits, notably the REDUCE-IT study (2018), which demonstrated a significant reduction in major adverse cardiovascular events (MACE). Given its evolving indications and competitive landscape, understanding Icosapent Ethyl’s market dynamics and pricing trajectory is critical for stakeholders.

Market Landscape Overview

Therapeutic Area and Demand Drivers

Icosapent Ethyl operates within the broader lipid-modifying therapies market, estimated to reach USD 25 billion globally by 2026 (per Grand View Research). The triglyceride-lowering segment is particularly attractive, driven by rising prevalence of dyslipidemia and cardiovascular disease (CVD). The REDUCE-IT trial’s results have expanded the drug's utilization beyond hypertriglyceridemia to secondary CVD prevention, aligning with increasing cardiovascular risk management protocols.

Key demand drivers include:

- Rising prevalence of CVD: Globally, over 18 million deaths annually are attributable to cardiovascular causes, emphasizing the need for effective lipid management.

- Expanded indications: The FDA’s 2019 approval of Icosapent Ethyl for cardiovascular risk reduction in high-risk patients amplifies potential patient populations.

- Guideline endorsements: Major guidelines (e.g., American Heart Association) increasingly recommend omega-3 fatty acids, particularly EPA formulations, for specific lipid profiles.

- Reimbursement landscape: Payer coverage substantially influences market penetration, with most major insurers covering Vascepa with or without prior authorization.

Competitive Landscape

Icosapent Ethyl faces competition from:

- Generic omega-3 fatty acid formulations: Over-the-counter supplements and prescription options like Lovaza (omega-3-acid ethyl esters) and Vascepa generics.

- Other lipid-lowering agents: PCSK9 inhibitors, fibrates, and statins.

- Emerging therapies: Novel lipid modulators and anti-inflammatory agents targeting residual cardiovascular risk.

Market position is bolstered by its clinical efficacy (notably in REDUCE-IT) and the dedicated label for cardiovascular risk reduction, setting it apart from less targeted omega-3 formulations.

Market Performance and Pricing Analysis

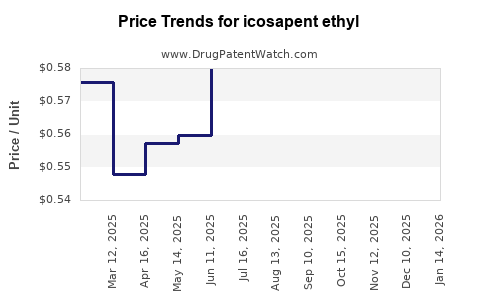

Historical Pricing Trends

Initially launched with a premium pricing strategy, Vascepa’s wholesale price hovered around USD 200 per month for a typical prescription regimen. Explanation for such pricing involved the drug’s clinical benefits, patent exclusivity, and brand positioning.

Post-approval of generics in 2020, pricing saw notable pressure:

- Branded Vascepa: Maintained premiums around USD 220–250/month due to clinical branding and prescriber familiarity.

- Generic counterparts: Entered the market at approximately USD 130–150/month, reducing overall consumer costs and impacting branded sales volume.

Market Penetration and Revenue Trends

In 2021, Vascepa’s sales revenue was approximately USD 1.1 billion, a decline from peak years influenced by:

- Patent challenges and litigation ("Vascepa patent saga").

- The rise of generic alternatives.

- Market saturation in certain indications.

Despite this, recent FDA regulatory actions have aimed to extend exclusivity:

- The USPTO granted a new patent (2020) preserving exclusivity till 2030, mitigating patent expiry risks in the near term.

- Physician acceptance, fueled by updated guidelines and prominent clinical trial data, sustains demand.

Projected Market Growth

Market projections, considering demographic, clinical, and regulatory factors, suggest:

- A compound annual growth rate (CAGR) of approximately 8–10% in the lipid-modifying segment over the next five years.

- The cardiovascular risk reduction indication expanding patient pools to include high-risk secondary prevention populations.

- Potential for market share gain through further guideline integrations and physician education.

Regulatory and Patent Outlook

Patent protections and regulatory exclusivity are pivotal:

- Pending patent litigation remains a concern; however, recent patent grants support a protected period until 2030.

- The recent rejection of some generics by the U.S. Patent and Trademark Office (USPTO) delays erosion of brand exclusivity.

- Additionally, market entrants will need to navigate existing legal and regulatory hurdles, including clinical data requirements for new formulations.

Price Projections

Based on current trends, the following pricing outlook can be articulated:

- 2023–2024: Continued price stability for branded Vascepa at USD 220–250/month. Generic formulations likely stabilize at USD 130–150/month.

- 2025–2027: Potential gradual reduction of branded prices to USD 200–220/month due to market competition and payer negotiations, but some stability is expected given clinical and patent protections.

- Post-2028: When patent protections potentially lapse, generic competition could lead to prices dropping to USD 100–130/month.

- Premium market segment (specialized indications): May sustain higher pricing levels due to clinical differentiation, especially in secondary CVD prevention indications.

Overall, despite patent challenges, strong clinical data and guideline support underpin a resilient valuation position. Price reductions may be modest, ensuring revenue streams remain at a robust level, especially if the indication spectrum expands.

Emerging Trends and Opportunities

- Combination therapies: Partnering with other lipid-lowering agents could open new markets.

- Expanded indications: Future approvals for conditions like non-alcoholic fatty liver disease (NAFLD) or other metabolic disorders may further propel demand.

- Market segmentation: Tailoring formulations (e.g., once-daily, combination pills) may optimize adherence and expansion.

Key Challenges

- The entry of generic competitors and legal disputes over patent rights remain primary hurdles.

- Payer negotiations and formulary placements influence price and volume.

- Competition from new modalities targeting residual cardiovascular risk may erode share.

Conclusion

Icosapent Ethyl’s market remains promising, buoyed by clinical evidence and expanding indications. While patent disputes and generic competition exert downward pressure on prices, strategic patent protections and clinical positioning can sustain revenue streams. Price projections indicate stability in the short term with potential declines aligned with patent expiries in subsequent years.

Key Takeaways

- Icosapent Ethyl stands at a pivotal intersection of lipid management and cardiovascular risk reduction, with a substantial and growing market.

- Pricing strategies will need to adapt to patent protections, generic competition, and clinical guideline updates.

- Industry stakeholders should monitor legal developments and expanded indications to optimize market approach.

- Payers' evolving reimbursement policies influence market access and pricing, necessitating proactive engagement.

- Long-term value hinges on continued clinical validation and innovation to sustain competitive advantage.

FAQs

1. How does Icosapent Ethyl differentiate itself from other omega-3 fatty acid formulations?

It is a purified EPA derivative with proven cardiovascular benefits in high-risk patients, supported by the REDUCE-IT trial, unlike over-the-counter omega-3 supplements or less targeted prescription formulations.

2. What impact will patent challenges have on Vascepa’s pricing and market share?

Patent disputes may lead to eventual generic entry, prompting significant price reductions. However, recent patent grants and exclusivity protections could delay generic competition until at least 2030, stabilizing prices in the near term.

3. Are there upcoming regulatory changes that could affect Icosapent Ethyl’s market?

Regulatory agencies are closely monitoring cardiovascular outcomes and may approve additional indications. Conversely, patent expirations and legal decisions could influence market dynamics.

4. What is the outlook for Icosapent Ethyl in terms of revenue growth?

While revenue growth faces headwinds from generic competition, expanding indications, guideline endorsements, and clinical benefits could sustain moderate growth at around 8–10% CAGR over the next five years.

5. How should pharmaceutical companies approach pricing strategies for Icosapent Ethyl moving forward?

Strategies should consider patent protection timelines, reimbursement landscape, competitive positioning, and clinical value propositions, balancing premium pricing with payer negotiations to maximize revenue.

Sources:

[1] Grand View Research. Omega-3 Fatty Acids Market Analysis, 2022.

[2] U.S. Food and Drug Administration. FDA approves Vascepa to reduce cardiovascular risk.

[3] REDUCE-IT Trial Publications.

[4] IQVIA. Prescription Data and Market Trends, 2022.

[5] USPTO Patent Gazette, 2020.