Last updated: July 27, 2025

Introduction

Guaifenesin, a widely utilized expectorant, plays a pivotal role in alleviating coughs and chest congestion associated with respiratory illnesses. Recognized for its longstanding presence in over-the-counter (OTC) formulations, guaifenesin’s market trajectory and financial outlook hinge on regulatory trends, healthcare demand, patent lifecycle, and evolving consumer preferences. This analysis explores these dimensions to provide a comprehensive understanding of its current positioning and future prospects within the pharmaceutical landscape.

Pharmaceutical Market Overview

Guaifenesin, chemically known as 3-(2-methoxyphenoxy)-1,2-propanediol, was approved by the FDA in the early 1950s as an OTC medication. Its safety profile, efficacy, and low production costs have facilitated widespread adoption [1]. Globally, the expectorant market, valued at approximately USD 2 billion in 2022, features guaifenesin as a primary component in cough and cold remedies, contributing significantly to its revenue share [2].

The drug’s primary use cases are symptomatic relief in upper respiratory tract infections, including seasonal influenza, the common cold, and chronic bronchitis. In developed economies, the demand for guaifenesin remains relatively steady, buttressed by consumer preference for OTC remedies over prescription drugs. Emerging markets, however, exhibit potential for expansion due to rising healthcare awareness and disposable income levels.

Market Drivers

1. Rising Incidence of Respiratory Illnesses

The prevalence of respiratory conditions, notably during seasonal peaks, sustains demand for expectorants like guaifenesin. The COVID-19 pandemic underscored the importance of symptomatic treatments, further emphasizing the need for OTC expectorants [3].

2. Demand for OTC Medications

Consumers prefer accessible, non-prescription options, driving sales of multi-symptom relief formulations containing guaifenesin. The trend towards self-medication, particularly for minor ailments, bolsters sales volumes.

3. Aging Population and Chronic Respiratory Diseases

Global demographic shifts toward an older population increase the prevalence of chronic respiratory diseases. Guaifenesin’s safety for long-term use positions it favorably in managing ongoing respiratory symptoms [4].

4. Technological Developments

Formulation innovations, including combination products with antihistamines or decongestants, enhance product efficacy and consumer appeal [5].

Market Challenges and Constraints

1. Patent Expiry and Generic Competition

While initial formulations benefited from patent exclusivity, most guaifenesin products entered the generic market decades ago, intensifying price competition and constraining margins [6].

2. Regulatory Scrutiny and Reformulation

Regulatory agencies, including the FDA, periodically reassess OTC medications for safety and efficacy. Regulatory actions or reformulations can impact market stability [7]. Notably, some concerns have been voiced regarding the efficacy of single-agent guaifenesin at marketed doses, potentially influencing marketing and labeling regulations.

3. Market Saturation

The mature status of the OTC expectorant segment limits growth potential, necessitating innovation or expansion into new geographies.

4. Consumer Preference for Natural and Plant-Based Remedies

A growing shift towards natural remedies could reduce reliance on traditional synthetic expectorants, influencing future demand patterns [8].

Financial Trajectory

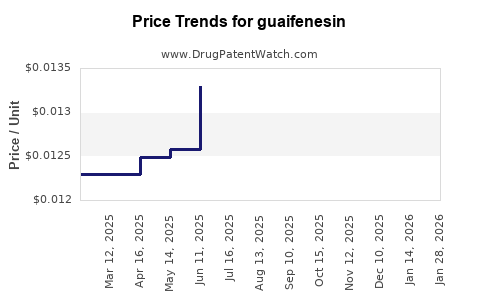

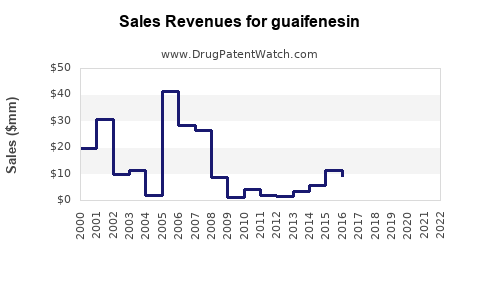

Historical Revenue Trends

Over the past decade, guaifenesin’s revenues have demonstrated modest growth, primarily driven by volume rather than price increases. Leading OTC manufacturers report annual sales ranging from USD 500 million to over USD 1 billion globally, with North America representing the largest regional market [9].

Future Revenue Projections

Analysts project a compound annual growth rate (CAGR) of approximately 3-4% for the expectorant segment through 2028, driven by steady demand and product diversification strategies. Emerging markets are expected to contribute increasingly to revenues, with CAGR estimates of 5-6% based on healthcare infrastructure improvements [2].

Innovation and Product Diversification

Companies investing in reformulated products, combination therapies, or novel delivery mechanisms could unlock new revenue streams. Additionally, patent protections on specific formulations or delivery technologies can create short-term market advantages, though the landscape is largely commoditized.

Impact of Regulatory Policies

Increasing regulatory stringency or reformulation requirements could entail R&D costs, impacting profit margins. Conversely, simplified regulatory pathways for line extensions or combination products may stimulate growth.

Competitive Landscape

The competitive environment is characterized by numerous generic manufacturers positioned globally. Key players include Johnson & Johnson, Perrigo, and Glenmark Pharmaceuticals, among others. Market entry barriers are moderately low due to the patent expirations, fostering intense price competition and cooperative marketing strategies aimed at consumer loyalty.

Strategic alliances, acquisitions, and investments in marketing are crucial for maintaining market share. Technological advancements, such as sustained-release formulations or natural extraction-based products, are emerging trends.

Regulatory and Legal Dynamics

Regulatory agencies continuously evaluate the safety, efficacy, and labeling of OTC drugs. In 2018, the FDA issued guidelines questioning the sufficiency of evidence supporting some expectorants' claims but has maintained the status of guaifenesin as generally recognized as safe (GRAS) [7].

Patent expirations and ongoing legal challenges in various jurisdictions necessitate vigilant IP management and compliance strategies. Companies investing in innovative delivery systems or combination therapies may seek patent protections, influencing their financial trajectory.

Global Market Outlook

Asia-Pacific presents promising growth opportunities due to increasing healthcare access, urbanization, and demand for OTC products. The regional CAGR is projected at 6%, driven by expanding middle-class populations and improved distribution networks.

Europe and North America, while mature markets, are expected to see moderate growth aligned with population aging and chronic respiratory disease prevalence. Regulatory harmonization and import-export dynamics will influence regional sales.

Emerging Trends and Opportunities

-

Natural and Herbal Formulations: Increasing consumer interest in natural expectorants may incentivize companies to develop plant-based guaifenesin alternatives, potentially commanding premium pricing and shelf space in specialty outlets.

-

Combination Therapy: Incorporating guaifenesin into multi-symptom cold remedies or respiratory health supplements can expand market reach.

-

Digital and e-Commerce Platforms: Leveraging online sales channels enhances consumer access, especially in emerging markets.

-

Personalized Medicine: Tailoring formulations to specific demographic groups or disease profiles may unlock additional revenue streams.

Conclusion

Guaifenesin remains a cornerstone expectorant within the OTC respiratory treatment market, supported by a resilient demand base and steady regio-specific growth. While patent expirations and market saturation pose challenges, ongoing innovations in formulation and expanding consumer markets underpin a cautiously optimistic financial trajectory. Strategic investments in product diversification, regulatory compliance, and emerging markets will be pivotal to sustain and enhance profitability in the evolving pharmaceutical landscape.

Key Takeaways

-

Steady Demand: The primary drivers—respiratory illness prevalence, OTC preference, aging population—ensure consistent demand for guaifenesin.

-

Market Saturation and Competition: Patent expirations have led to intense generic competition, constraining margins but maintaining volume-based revenues.

-

Emerging Markets Growth: Asia-Pacific and other rapidly developing regions offer significant growth prospects, driven by healthcare expansion.

-

Innovation Opportunities: Natural formulations, combination products, and digital channels represent avenues for market expansion and revenue growth.

-

Regulatory Landscape: Vigilant compliance and adaptive formulation strategies are essential amid evolving safety and efficacy scrutiny.

FAQs

1. What is the market outlook for guaifenesin over the next five years?

The outlook indicates a CAGR of approximately 3-4%, supported by stable demand in mature markets and accelerated growth in emerging regions, especially as consumers favor OTC remedies and innovative formulations.

2. How do patent expiries affect guaifenesin’s market revenue?

Patent expiries have led to widespread generic competition, reducing prices and profit margins. Companies focusing on product differentiation through formulation innovation or branding can mitigate revenue erosion.

3. Are there any regulatory concerns impacting guaifenesin's market?

Regulatory agencies periodically review OTC expectorants. While guaifenesin remains generally recognized as safe, claims and labeling are subject to scrutiny, and reformulation requirements may incur additional costs.

4. What emerging trends could influence guaifenesin’s financial trajectory?

Natural remedies, combination therapies, and digital marketing channels are key trends. Additionally, expanding into underpenetrated markets with improved distribution can substantially boost revenues.

5. What are the key opportunities for companies in the guaifenesin market?

Investing in innovative formulations, tapping into emerging markets, developing combination products, and leveraging digital platforms are strategic avenues for growth.

References

[1] U.S. Food and Drug Administration (FDA). "Guaifenesin – Drug Approval." 1950s.

[2] MarketsandMarkets. "Expectorants and Mucolytics Market." 2022.

[3] World Health Organization (WHO). "Global Burden of Respiratory Diseases." 2021.

[4] National Institutes of Health (NIH). "Chronic Respiratory Diseases in Aging Populations." 2020.

[5] PharmTech. "Formulation Innovations in OTC Expectants," 2021.

[6] FDA. "OTC Drug Review." 2018.

[7] U.S. FDA. "Guidance on Over-the-Counter Expectants." 2018.

[8] Euromonitor International. "Consumer Trends towards Natural Remedies," 2022.

[9] IQVIA. "Global OTC Market Reports." 2022.