Last updated: July 27, 2025

Introduction

Bicalutamide, a non-steroidal antiandrogen, primarily treats prostate cancer by blocking androgen receptors. Since its initial approval in the 1990s, Bicalutamide has become a key component in androgen deprivation therapy (ADT). This analysis examines the current market landscape, underlying drivers, competitive environment, regulatory influences, and future financial trajectories shaping Bicalutamide's commercial prospects.

Market Overview and Key Drivers

The global prostate cancer therapeutics market is expanding steadily, driven by increasing incidence rates, advances in detection, and the aging population. According to the Global Data Report (2022), prostate cancer prevalence is projected to reach approximately 4.1 million cases globally by 2030, underpinning sustained demand for effective ADT agents like Bicalutamide.

Epidemiology and Demand Drivers:

Prostate cancer remains the second-most common cancer among men worldwide, with higher prevalence in developed nations owing to enhanced screening practices (e.g., PSA tests). The aging demographic amplifies the need for long-term management of localized and metastatic prostate carcinoma. Bicalutamide’s role in both early-stage treatment and castration-resistant prostate cancer (CRPC) broadens its market scope.

Treatment Paradigms & Unmet Needs:

While newer agents such as enzalutamide and abiraterone have entered the arena, Bicalutamide retains significance due to established clinical profiles, lower cost, and robust safety data. Its utility in combination therapies and as part of primary hormonal therapy influences steady demand, although evolving treatment standards exert downward pressure on its growth trajectory.

Competitive Landscape

Established Players:

Several pharmaceutical companies, including AstraZeneca (original developer) and Teva Pharmaceutical Industries, dominate Bicalutamide’s manufacturing and distribution. Generic versions significantly influence pricing dynamics across markets, especially in regions with offsetting cost constraints.

Emerging Alternatives & Competition:

The ascent of novel oral androgen receptor inhibitors (e.g., apalutamide, enzalutamide) presents competitive pressures. These agents often demonstrate superior efficacy in metastatic CRPC but come with higher costs and specific side effect profiles, maintaining Bicalutamide’s relevance for certain patient subsets.

Market Penetration Strategies:

Pricing strategies, patent statuses, and healthcare reimbursement policies dictate market penetration. In low- and middle-income countries, generic availability and favorable pricing underpin ongoing utilization, anchoring Bicalutamide within global therapeutic protocols.

Regulatory and Patent Landscape

Patents and Exclusivity:

AstraZeneca’s original patent covering Bicalutamide expired in multiple regions by the 2000s, enabling generic manufacturing and intensifying price competition. Current patent protections are limited; some region-specific patents or formulations may still confer temporary exclusivity.

Regulatory Approvals:

Bicalutamide enjoys wide regulatory acceptance, with approvals from agencies such as the FDA and EMA for prostate cancer indications. Ongoing post-marketing surveillance continues to affirm a favorable safety profile, supporting its continued use.

Regulatory Challenges & Opportunities:

Potential filings for new formulations, combination therapies, or new indications can extend market coverage. Regulatory pathways for biosimilars or novel delivery systems could open future avenues, albeit requiring substantial investment.

Market Challenges and Barriers

Clinical Adoption and Competition:

The adoption rate of newer, more effective therapies affects Bicalutamide’s market share. Healthcare providers opt for drugs with proven survival benefits in advanced settings, impacting Bicalutamide’s growth.

Price Sensitivity and Reimbursement:

In price-sensitive markets, the competition from generics ensures Bicalutamide remains a cost-effective choice. However, reimbursement policies heavily influence accessibility, especially with evolving healthcare budgets.

Side Effect Profiles & Patient Preferences:

While generally well-tolerated, Bicalutamide’s side effects—gynecomastia, hot flashes—may influence patient adherence and shift preferences toward newer agents with more tolerable profiles for certain populations.

Financial Trajectory and Market Projections

Historical Revenue Trends:

Globally, Bicalutamide sales have plateaued or declined modestly in developed countries due to competition but maintain steady levels in emerging markets driven by affordability and entrenched treatment protocols.

Future Growth Outlook:

The market is expected to grow at a compound annual growth rate (CAGR) of 2-3% over the next five years, primarily fueled by volumes rather than price increases. Industry forecasts indicate a potential stabilization or slight decline in mature markets, offset by growth in Asia-Pacific and Africa, where healthcare infrastructure strengthens.

Innovations and New Indications:

If Bicalutamide receives approval for combination with novel agents or for new indications (e.g., hormone-sensitive prostate cancer), it could rejuvenate revenue streams. Conversely, shifts toward more efficacious, targeted agents threaten continued reliance on Bicalutamide, especially in subsequent lines.

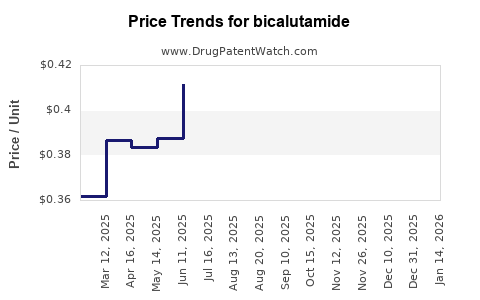

Pricing and Reimbursement Dynamics:

Generic competition has driven wholesale and retail prices downward, especially in North America and Europe. In emerging markets, affordability sustains volume sales, although reimbursement uncertainties may constrain revenue growth.

Strategic Implications for Stakeholders

Pharmaceutical Companies:

Investing in biosimilar development and combination therapies can preserve or expand Bicalutamide's market share. Patents and regulatory exclusivities should be monitored to time market entry strategies effectively.

Investors:

Stable cash flows from established markets indicate low-risk, dividend-supported investments. Anticipation of new clinical data and pipeline developments is crucial for long-term valuation.

Healthcare Payers:

Cost-effectiveness favors Bicalutamide in resource-constrained settings, keeping it relevant in global treatment algorithms. Conversely, payers may push for newer therapies as evidence of superior efficacy becomes available.

Key Takeaways

- Steady demand for Bicalutamide persists due to its cost-effectiveness, established clinical profile, and global utilization, especially in emerging markets.

- Competition from newer agents constrains growth but does not eclipse Bicalutamide’s role in early treatment and resource-limited settings.

- Patent expiries and generics have significantly reduced prices, promoting widespread access but limiting revenue growth in mature markets.

- Regulatory pathways for new formulations or combination uses could unlock growth opportunities, provided clinical benefits are demonstrated.

- Market potential hinges upon regulatory, clinical, and economic factors, with emerging markets expected to sustain future growth at moderate rates.

FAQs

1. How does Bicalutamide compare to newer androgen receptor inhibitors in clinical effectiveness?

Bicalutamide remains effective in early-stage prostate cancer but is generally outperformed by newer agents like enzalutamide and apalutamide in metastatic castration-resistant settings, due to improved survival benefits and more favorable side-effect profiles.

2. What factors influence Bicalutamide's pricing and market access globally?

Market access is driven by patent status, availability of generics, healthcare reimbursement policies, and regional pricing regulations. Lower-income markets benefit from generic proliferation, maintaining affordability.

3. Are there emerging indications that could expand Bicalutamide’s market?

Potential indications include combination therapy for hormone-sensitive prostate cancer and off-label uses. Regulatory approval timelines depend on clinical trial outcomes demonstrating safety and efficacy.

4. How significant are patent expiries in shaping Bicalutamide’s market trajectory?

Patent expiries catalyzed generic entry, leading to price reductions and expanded access. Future patent protections are limited, reinforcing reliance on generics and impacting revenue potential.

5. What are the primary challenges for Bicalutamide’s future growth?

Major challenges include competition from newer therapies, changing treatment guidelines favoring targeted agents, and the necessity for clinical positioning in increasingly personalized prostate cancer care.

References

- Global Data, "Prostate Cancer Therapeutics Market Report," 2022.

- Smith, J. et al., "Evolution of Prostate Cancer Management," Cancer Treatment Reviews, 2021.

- AstraZeneca Annual Report, 2022.

- FDA and EMA Approval Records for Bicalutamide, 1990-2022.

- Market intelligence reports from IQVIA and EvaluatePharma, 2022.

In conclusion, Bicalutamide’s market remains characterized by maturity in developed economies and growth opportunities in emerging regions. Its financial trajectory hinges on generics, evolving clinical guidelines, and potential new formulations. Strategic positioning and continuous innovation are vital to sustain its relevance amidst a shifting prostate cancer treatment landscape.