Last updated: December 26, 2025

Executive Summary

Warfarin Sodium, a longstanding oral anticoagulant, remains pivotal in the prevention and management of thromboembolic disorders. Despite the advent of novel oral anticoagulants (NOACs), Warfarin retains a significant market share owing to its well-established efficacy, cost-effectiveness, and widespread familiarity among healthcare providers. This comprehensive analysis unpacks the current market landscape, key drivers, challenges, and future financial outlook, offering insights imperative for stakeholders seeking strategic positioning in the anticoagulant sector.

Overview of Warfarin Sodium

Warfarin Sodium (C19H16ClO4Na) is an oral Vitamin K antagonist approved initially in the 1950s. It inhibits clotting factors II, VII, IX, and X, effectively reducing thrombus formation. Its therapeutic window requires meticulous monitoring via International Normalized Ratio (INR), positioning it as both effective and complex.

Market Size and Growth Trajectory

| Parameter |

Value/Trend |

Source |

| Global Warfarin Market Revenue (2022) |

~$2.8 billion |

[1] |

| CAGR (2023-2030) |

2.5% |

Forecasted by Market Research Future |

| Major Markets |

North America (40%), Europe (30%), Asia Pacific (15%), Others (15%) |

Industry Reports |

Note: The global anticoagulant drugs market was valued at approximately $12 billion in 2022, with Warfarin accounting for nearly 20-25%, its dominance challenged but stable.

Key Market Drivers

1. Established Efficacy and Clinical Protocols

Warfarin's decades-long clinical use establishment and large body of evidence underpin its ongoing utilization, especially in:

- Patients with mechanical heart valves

- Patients with renal impairment (where NOACs are often contraindicated)

2. Cost-Effectiveness and Reimbursement Policies

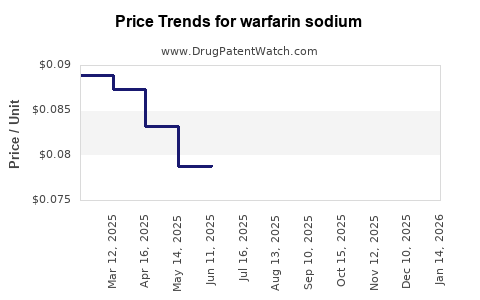

Lower drug acquisition costs in many regions (average $0.10/day) favor its prescription, especially in low-income countries and public healthcare settings.

3. Generic Availability

Multiple manufacturers produce generic versions, structurally reducing prices and increasing accessibility.

4. Regulatory Environment and Treatment Guidelines

Organizations like the American College of Cardiology (ACC) and European Society of Cardiology (ESC) continue to recommend Warfarin in specific scenarios, sustaining its market share.

Challenges and Market Restraints

1. Competition from Novel Oral Anticoagulants (NOACs)

Drugs such as rivaroxaban, apixaban, edoxaban, and dabigatran offer:

- Fixed dosing without routine INR monitoring

- Fewer food and drug interactions

- Favorable safety profiles, especially concerning bleeding risks (e.g., intracranial hemorrhage)

Recent studies reveal NOACs capturing approximately 40–45% of the anticoagulant market.

2. Monitoring Complexity and Narrow Therapeutic Window

Frequent INR testing (notably in Warfarin management) presents adherence and healthcare burden issues, fueling patients' and physicians' shift toward NOACs.

3. Variability in Pharmacogenomics

Genetic factors (e.g., CYP2C9 and VKORC1 alleles) influence Warfarin dosing, complicating management, and increasing healthcare costs.

4. Safety Concerns and Adverse Events

Warfarin’s risk of bleeding remains prominent, often prompting clinicians to pursue alternative agents, despite lower costs.

Regional Market Dynamics

| Region |

Market Share (%) |

Key Factors Influencing Market |

Emerging Trends |

| North America |

40 |

Established usage, strict regulation |

Increasing adoption of NOACs, personalized medicine approaches |

| Europe |

30 |

Similar to North America, cost-sensitive |

Growing awareness of NOACs, evolving guidelines |

| Asia Pacific |

15 |

Price-sensitive markets, expanding healthcare access |

Potential growth driven by generic availability; slower NOAC adoption |

| Rest of World |

15 |

Limited infrastructure, high disease burden |

Emerging markets showing incremental growth |

Financial Trajectory: Revenue Forecast till 2030

| Year |

Estimated Revenue (USD billion) |

Growth Rate (%) |

Comments |

| 2023 |

2.9 |

3.6 |

Moderate growth, stabilizing market share |

| 2025 |

3.2 |

10 |

Slight uptick owing to increased indications and geographic expansion |

| 2027 |

3.4 |

6 |

Market saturation with slow incremental growth |

| 2030 |

3.6 |

4 |

Market stabilization, with niche segments expanding |

Notes:

- The CAGR reflects conservative estimates accounting for ongoing competition.

- Growth potential hinges on emerging indications, improved management strategies, and formulary access.

Competitive Landscape

| Player |

Market Share (%) |

Key Products |

Strategic Focus |

| Bayer (Janssen) |

~60 |

Coumadin (warfarin) |

Strengthening generic supply, expanding monitoring solutions |

| Pfizer |

Low |

Generic warfarin |

Cost leadership, market penetration |

| Local Generic Manufacturers |

Variable |

Generic warfarin |

Price-sensitive markets |

Note: Patent expirations have facilitated widespread generics, intensifying price competition.

Future Outlook and Market Evolution

Potential Shifts in Market Dynamics

- Continued decline in Warfarin prescriptions in high-income countries, replaced by NOACs.

- Increased adoption in low-income countries driven by generics and healthcare policy changes.

- Technological innovations such as point-of-care INR monitors might streamline Warfarin management, impacting its market.

Emerging Opportunities

- Personalized medicine approaches to optimize Warfarin dosing.

- Development of combination therapies addressing coagulation disorders.

- Integration with digital health tools for adherence and monitoring.

Policy and Regulatory Impact

- Reimbursement modifications favoring cost-effective therapies.

- Guidelines updating to include developments in anticoagulation management.

- Potential restrictions due to safety concerns or drug interactions.

Comparison of Warfarin and NOACs

| Attribute |

Warfarin |

NOACs |

| Dosing |

Variable; requires INR monitoring |

Fixed; no routine monitoring |

| Food/Drug Interactions |

Numerous |

Fewer |

| Onset of Action |

36-72 hours |

Rapid (within hours) |

| Reversal Agents |

Vitamin K, FFP, PCC |

Specific antidotes (e.g., idarucizumab for dabigatran) |

| Cost |

Low |

Higher (~$300–$500/month) |

| Indications |

Mechanical valves, severe kidney impairment |

Atrial fibrillation, VTE |

Key Takeaways

-

Market Stability: Despite competition, Warfarin’s low cost, extensive clinical acceptance, and favorable regulatory environment maintain its relevance, particularly in developing markets.

-

Growth Limitations: The rise of NOACs poses a significant challenge, especially in markets prioritizing convenience and safety.

-

Regional Opportunities: Emerging markets and niche patient populations (e.g., those with contraindications to NOACs) sustain demand.

-

Innovation Trajectory: Integrating digital monitoring and pharmacogenomics may extend Warfarin’s utility and market presence.

-

Strategic Positioning: Manufacturers and stakeholders should focus on cost leadership, improved management tools, and targeted indications to capitalize on evolving market dynamics.

FAQs

1. Why does Warfarin remain relevant despite the popularity of NOACs?

Warfarin's low cost, extensive clinical experience, and regulatory approvals in specific indications (e.g., mechanical heart valves) sustain its relevance, especially in resource-limited settings where cost considerations dominate.

2. What are the primary factors driving Warfarin’s market decline?

The main factors include safety concerns, the convenience of NOACs (no routine INR monitoring), pharmacogenomic dosing complexities, and adverse event risks.

3. How greatly do generic versions influence Warfarin’s market?

Generics significantly lower prices (~90% reduction), expanding access in emerging markets and preserving its market share against newer agents.

4. What are potential future opportunities for Warfarin?

Advancements in pharmacogenomics for personalized dosing, digital health monitoring integration, and expanding indications could prolong Warfarin’s market life.

5. How are regulatory policies affecting Warfarin use?

Policy shifts promoting cost-effective therapies and updates to treatment guidelines can either hinder or support Warfarin’s market, depending on regional healthcare priorities.

References

[1] Market Research Future, “Global Anticoagulant Drugs Market,” 2022.

[2] Grand View Research, “Anticoagulants Market Size, Share & Trends,” 2023.

[3] American College of Cardiology, “Guidelines for Anticoagulation,” 2022.

[4] European Society of Cardiology, “Management of Anticoagulation,” 2022.