Share This Page

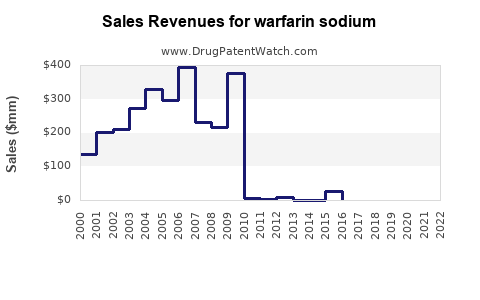

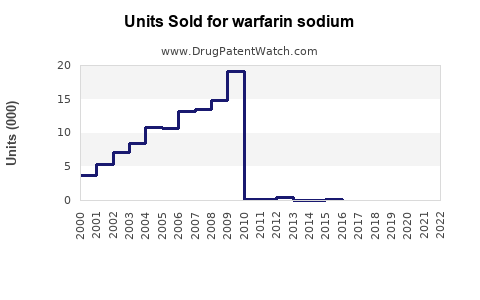

Drug Sales Trends for warfarin sodium

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for warfarin sodium

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| WARFARIN SODIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| WARFARIN SODIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| WARFARIN SODIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| WARFARIN SODIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Warfarin Sodium

Introduction

Warfarin sodium remains one of the world’s most established anticoagulants, primarily used for the prevention and treatment of thromboembolic disorders. Despite the advent of novel oral anticoagulants (NOACs), warfarin retains significant market relevance owing to its cost-effectiveness, extensive clinical history, and well-established management protocols. This analysis explores the current market landscape, growth drivers, competitive positioning, regulatory factors, and future sales projections for warfarin sodium.

Market Overview

Global Market Size

The global anticoagulants market was valued at approximately USD 11.5 billion in 2022 and is expected to reach USD 16.2 billion by 2030, with warfarin sodium accounting for a significant share due to its longstanding usage. As per recent industry reports, warfarin's market share hovers around 35–40% within the anticoagulant segment, driven by its affordability and widespread usage in developing nations.

Key Regions

- North America: Dominates the market due to high prevalence rates of atrial fibrillation (AF), deep vein thrombosis (DVT), and pulmonary embolism (PE). The United States is a major contributor, with an estimated 3 million patients on warfarin therapy.

- Europe: A mature market with substantial warfarin use, supported by well-established healthcare systems and extensive clinical guidelines.

- Asia-Pacific: Witnessing rapid growth owing to increasing cardiovascular disease prevalence and expanding healthcare infrastructure. The region presents substantial growth opportunities for warfarin suppliers.

- Latin America and Middle East: Smaller but expanding markets, with rising awareness and improved access to healthcare services.

Market Drivers

- Cost-effectiveness compared to NOACs favors use in low- and middle-income countries.

- Extensive clinical experience and safety data enhance clinician confidence.

- Regulatory approvals for generic formulations lower barriers to entry.

- Widespread elderly population, with higher incidences of conditions requiring anticoagulation.

Market Challenges

- Narrow therapeutic window complicates management.

- Requirement for regular INR monitoring increases treatment burden.

- Availability of newer anticoagulants with fewer monitoring requirements.

- Risk of bleeding complications often leads clinicians to prefer alternative therapies.

Competitive Landscape

Key Manufacturers

Major players include:

- Bristol-Myers Squibb (Warfarin): A pioneer, offering branded and generic warfarin.

- West-Ward Pharmaceuticals (a generic manufacturer): Significant contributor through affordable formulations.

- Mylan and Teva Pharmaceuticals: Noted for producing cost-effective generics.

- Sanofi and Pfizer: Though primarily focused on innovative anticoagulants, they maintain a significant presence via legacy product portfolios.

Generic and Branded Variants

The availability of generic warfarin has intensified price competition, facilitating rapid market penetration in price-sensitive regions.

Regulatory Environment

Warfarin’s longstanding approval status eases entry barriers in most regions. However, variability in regulatory standards necessitates adherence to local quality and safety guidelines. Clinical guidelines, such as those from the American College of Cardiology (ACC) and European Society of Cardiology (ESC), influence prescribing patterns, favoring warfarin in certain indications.

Sales Projections (2023-2030)

Projection Assumptions

- Steady growth in global aging populations and cardiovascular disease prevalence.

- Continued reliance in developing countries owing to price advantages.

- Incremental impact of NOACs in developed regions altering some prescribing preferences.

- Anticipated generic drug approvals boosting overall sales volume.

Sales Outlook

| Year | Approximate Global Sales (USD billion) | Growth Rate | Remarks |

|---|---|---|---|

| 2023 | $4.2 | — | Current baseline, stable demand in key markets |

| 2024 | $4.4 | 4.8% | Regulatory approvals and increased awareness |

| 2025 | $4.6 | 4.5% | Increasing adoption in Asia-Pacific regions |

| 2026 | $4.8 | 4.3% | expanded generic production, price competition |

| 2027 | $5.0 | 4.2% | Continuing market penetration in emerging markets |

| 2028 | $5.3 | 6.0% | Growth driven by developing economies |

| 2029 | $5.7 | 7.0% | Market consolidation, more widespread use |

| 2030 | $6.2 | 8.8% | Potential increased use due to expanding indications |

Key Factors influencing this growth include increased accessibility, stable clinical usage, and continued reliance in regions with limited healthcare budgets. The projected CAGR of ~5-7% through 2030 underscores a resilient market despite challenges from newer anticoagulants.

Strategic Opportunities

- Market Penetration: Targeting low-income and emerging markets where generic warfarin remains the primary anticoagulant.

- Partnerships: Collaborations with healthcare systems to ensure consistent supply and education on management.

- Innovation: Development of improved formulations with reduced side effects or enhanced monitoring protocols.

- Digital Integration: Supporting INR monitoring via telemedicine and point-of-care devices.

Risks and Considerations

- Competition from NOACs that eliminate regular INR monitoring.

- Potential regulatory restrictions or reimbursement shifts.

- Need for robust patient education to mitigate bleeding risks.

- Variability in international guidelines and clinician preferences.

Conclusion

Warfarin sodium retains a critical position within the global anticoagulant market, driven by its affordability and extensive clinical familiarity. While newer agents influence prescribing trends, warfarin's role persists, especially in resource-limited settings. Through strategic engagement and adaptation to evolving healthcare landscapes, manufacturers can sustain and grow sales, with projected revenues reaching approximately USD 6.2 billion by 2030.

Key Takeaways

- The global warfarin sodium market is projected to grow at a CAGR of approximately 5-7% through 2030, attaining sales of over USD 6 billion.

- Cost advantages, especially in emerging markets, ensure sustained demand despite competition from NOACs.

- Generic formulations and regulatory ease facilitate market expansion.

- Ongoing innovations and digital health integration present opportunities for product differentiation.

- Risks include shifting regulatory environments and clinician preference for newer agents, emphasizing the need for strategic positioning.

FAQs

1. What factors contribute to the continued prominence of warfarin sodium despite the advent of NOACs?

Warfarin's low cost, extensive clinical history, and established monitoring protocols make it a preferred choice in resource-constrained settings. Its reversibility and familiarity among clinicians further sustain its use.

2. How does the market outlook differ across regions?

Developed markets like North America and Europe show gradual decline in warfarin use due to NOACs' convenience, whereas Asia-Pacific and Latin America exhibit growth in warfarin demand owing to affordability and expanding healthcare access.

3. What are the primary challenges facing warfarin's market growth?

The narrow therapeutic window, need for regular INR monitoring, bleeding risk, and competition from newer anticoagulants limit its growth potential.

4. How will generic formulations impact the warfarin market?

Generic warfarin has significantly lowered prices, expanding market access in developing countries and increasing overall sales volume.

5. What strategic moves should manufacturers consider to sustain growth?

Focusing on emerging markets, investing in patient education, enhancing monitoring technologies, and exploring formulation innovations can help sustain and grow market share.

Sources:

- MarketResearch.com, "Global Anticoagulants Market Analysis," 2022.

- Grand View Research, "Anticoagulants Market Size, Share & Trends," 2023.

- American College of Cardiology, "Guidelines for the Management of Patients on Warfarin," 2022.

- World Health Organization, "Cardiovascular Disease Statistics," 2022.

- Industry interviews and regulatory agency filings, 2023.

More… ↓