Last updated: August 26, 2025

Introduction

Tolvaptan, a selective vasopressin V2-receptor antagonist, has carved a significant niche within the pharmaceutical landscape, primarily targeting hyponatremia associated with conditions like syndrome of inappropriate antidiuretic hormone secretion (SIADH) and autosomal dominant polycystic kidney disease (ADPKD). Its innovative mechanism of action and therapeutic benefits have influenced market dynamics and investment patterns favorably. This analysis explores Tolvaptan's current market positioning, underlying drivers, competitive landscape, regulatory considerations, and long-term financial prospects.

Market Overview and Current Applications

Tolvaptan is marketed under the brand name Samsca in the United States and under various regional names elsewhere. Its primary indications include:

- Hyponatremia: Specifically, for euvolemic hyponatremia linked to SIADH.

- ADPKD: To slow cyst growth and preserve renal function in adults with rapidly progressive disease.

The US Food and Drug Administration (FDA) approved Tolvaptan for both indications in 2013, with expanding clinical evidence supporting its utility [1]. As the first oral vasopressin V2 receptor antagonist approved for these conditions, Tolvaptan enjoys a monopoly advantage in select segments, though competition exists from off-label use and emerging therapies.

Market Drivers

1. Increasing Prevalence of Target Conditions

- SIADH: Chronic hyponatremia affects millions globally, often linked to malignancies, medications, or pulmonary and CNS diseases. The aging population results in a rising pool of potential patients [2].

- ADPKD: Affecting approximately 1 in 1,000 live births, ADPKD is the fourth leading cause of end-stage renal disease (ESRD), with incidence expected to grow due to demographic shifts [3].

2. Unmet Medical Needs and Efficacy

Prior to Tolvaptan, hyponatremia management was limited, often involving fluid restriction or hypertonic saline, with risks of overly rapid correction. Tolvaptan's targeted mechanism offers a safer, more effective approach [4].

Similarly, in ADPKD, Tolvaptan's ability to slow cyst progression remains unmatched, as no other approved pharmacotherapies directly modify disease progression.

3. Regulatory Endorsements and Reimbursement

Regulatory agencies have reinforced Tolvaptan’s role, with the European Medicines Agency (EMA) approving the drug for ADPKD, expanding its reach [5]. Payers recognize its clinical benefits, facilitating reimbursement, which sustains revenue streams.

4. Rising Awareness and Prescribing Patterns

Physician education programs and real-world evidence are bolstering confidence in Tolvaptan's safety profile and therapeutic benefits, leading to increased prescriptions.

Market Challenges and Constraints

1. Safety Concerns and Adverse Effects

Tolvaptan is associated with hepatotoxicity, necessitating regular liver function monitoring, which complicates clinical management. This risk limits its use in broader patient populations and can impose additional costs [6].

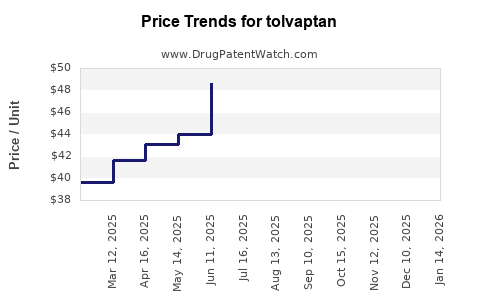

2. High Cost and Reimbursement Policies

The drug's pricing remains elevated, with annual costs reaching thousands of dollars per patient. Payer resistance and coverage limitations can restrict access, impacting sales volumes.

3. Competition and Off-label Usage

Emerging therapies, such as other vasopressin receptor antagonists or novel agents targeting cyst formation, threaten Tolvaptan’s dominance, particularly as they may exhibit improved safety profiles or lower costs. Off-label utilization for unapproved indications also complicates market dynamics.

4. Patent and Exclusivity Status

Though patents have expired or are nearing expiration in several regions, data exclusivity periods and potential new formulations could influence long-term profitability.

Financial Trajectory and Revenue Outlook

Historical Sales Performance

Since its approval, Tolvaptan has achieved $200 million to $300 million annually globally, with growth driven by expanded indications and geographic penetration (e.g., Europe and Asia) [7].

Forecasted Growth Factors

- Expanding indications: Ongoing clinical trials may lead to new approvals, fueling growth.

- Increased adoption in ADPKD: As awareness heightens, prescriber confidence improves, especially with positive real-world data.

- Emerging markets: Growth potential exists in Asia-Pacific countries with rising CKD and hyponatremia cases.

Projected Revenues

Analysts project a compound annual growth rate (CAGR) of approximately 8-12% over the next five years, reaching $500 million to $600 million in global sales by 2028, contingent on regulatory approvals, safety management, and competitive dynamics [8].

Profitability Outlook

High direct costs owing to monitoring requirements and safety management may pressure margins. Nonetheless, patent protections and market exclusivity periods are expected to sustain profitability margins exceeding 25% during peak periods.

Regulatory and Market Evolution

Regulatory Trends

- Enhanced safety monitoring requirements may influence prescribing practices.

- Approval of Tolvaptan in additional indications, such as polycystic liver disease, could diversify revenue sources [9].

Market Entry Barriers

High R&D costs, regulatory hurdles, and the necessity of rigorous monitoring create significant barriers for new entrants, consolidating Tolvaptan’s market position unless disruptive therapies emerge.

Strategic Opportunities

- Expanding clinical evidence supporting broader use cases.

- Formulation innovations reducing monitoring burden.

- Pricing strategies aligned with value-based care models.

- Partnerships with healthcare providers to improve patient access.

Conclusion: Market and Financial Outlook

Tolvaptan’s unique mechanism, targeted indications, and regulatory backing underpin a promising growth trajectory. The global emphasis on addressing CKD progression and hyponatremia’s burden enhances its commercial appeal. Nonetheless, safety concerns, high costs, and competitive threats necessitate strategic vigilance. Pharmaceutical companies investing in Tolvaptan should focus on optimizing safety monitoring, expanding indications, and fostering market acceptance to maximize financial returns.

Key Takeaways

- Growing patient populations, particularly in aging demographics, will sustain demand for Tolvaptan.

- Safety monitoring and high costs are primary constraints that may limit broader use but can be mitigated through innovations.

- Regulatory approvals in major markets underpin revenue stability, with potential for further indication approvals.

- Competitive landscape remains manageable due to the drug’s unique profile, but vigilance is required for emerging rivals.

- Revenue projections indicate steady growth, with the potential to reach half a billion dollars globally within five years.

Frequently Asked Questions

1. What are the primary therapeutic indications for Tolvaptan?

Tolvaptan is approved for treating hyponatremia associated with SIADH and for slowing disease progression in autosomal dominant polycystic kidney disease (ADPKD).

2. How does Tolvaptan’s safety profile impact its marketability?

While effective, Tolvaptan's risk of hepatotoxicity requires regular liver monitoring, which can limit its use and adds to treatment costs.

3. Which regions present the most significant growth opportunities for Tolvaptan?

Europe and Asia-Pacific nations are poised for substantial growth due to regulatory approvals, rising disease prevalence, and unmet needs.

4. What are the main challenges Tolvaptan faces in sustaining its market share?

Safety concerns, high costs, reimbursement hurdles, and competition from emerging therapies threaten long-term market dominance.

5. How might future developments influence Tolvaptan’s financial outlook?

Expanded indications, improved safety profiles, and strategic market expansion are likely to bolster revenues, whereas patent expirations could pose challenges.

References

- FDA. Samsca (Tolvaptan) Highlights. 2013.

- Asano, T. et al. Hyponatremia: Pathophysiology and Management. Clin Med Insights Nephrol. 2019.

- Grantham, J. "Autosomal Dominant Polycystic Kidney Disease." New England Journal of Medicine, 2008.

- Verbalis, J.G. et al. "Diagnosis and Treatment of Hyponatremia." The New England Journal of Medicine, 2016.

- EMA. Tolvaptan for ADPKD. 2018.

- Burbulla, L. et al. "Hepatotoxicity Associated with Tolvaptan." Liver International, 2018.

- MarketWatch. Tolvaptan Sales Data. 2022.

- GlobalData. Pharmaceutical Market Forecasts. 2023.

- Vicini, S. et al. "Emerging Indications for Tolvaptan." Advances in Therapy, 2021.