Last updated: August 26, 2025

Introduction

Tolvaptan, a selective vasopressin V2 receptor antagonist, has established a niche in the management of hyponatremia and autosomal dominant polycystic kidney disease (ADPKD). Its unique mechanism of action offers significant therapeutic benefits, but market penetration hinges on regulatory approvals, pricing Strategies, and competitive dynamics. This analysis examines the current market landscape, regulatory environment, key drivers, challenges, and provides price projections over the next five years.

Therapeutic Overview and Commercial Potential

Indications and Clinical Profile

Tolvaptan's primary indications include:

-

- Hyponatremia: Approved for treating euvolemic and hypervolemic hyponatremia, particularly in syndromes of inappropriate antidiuretic hormone secretion (SIADH) and heart failure.

-

- Autosomal Dominant Polycystic Kidney Disease (ADPKD): Approved in multiple jurisdictions (notably by FDA in 2018, EMA in 2015, and other regulators) to slow cyst growth and preserve renal function.

The drug’s mechanism involves antagonizing vasopressin V2 receptors in renal collecting ducts, reducing cyst proliferation in ADPKD and promoting free water excretion in hyponatremia.

Market Size and Epidemiology

The global ADPKD market was valued at approximately USD 1.2 billion in 2022 and is expected to grow at a CAGR of approximately 7.5% through 2030, driven by increasing diagnosis rates and limited current treatment options. Hyponatremia, affecting an estimated 4-8% of hospitalized patients, represents a broader market potentially worth several billion dollars, considering the large patient population and the unmet need for effective therapies.

Regulatory and Patent Landscape

Tolvaptan's patent estate is critical in shaping the competitive landscape:

- The original formulation’s patent protection is expiring or expired in key markets (e.g., the US and EU), opening opportunities for generics.

- Patent protections on process claims and formulation specifics remain until approximately 2030, fostering innovative formulations and biosimilars.

- Regulatory pathways have been well established, with tolvaptan approved by the FDA, EMA, and other agencies, facilitating global market access.

Market Dynamics and Competitive Landscape

Key Market Players

- Otsuka Pharmaceutical: The original developer and marketer of tolvaptan, holding exclusive rights and advanced pricing strategies.

- Generics Manufacturers: Multiple players are expected to enter markets post-patent expiry, exerting downward pressure on prices.

- Emerging competitors: Research into alternative vasopressin receptor antagonists or combination therapies could impact market share.

Pricing Strategies and Reimbursement

Pricing varies significantly by region:

- United States: The retail price for tolvaptan (brand name Samsca) typically ranges from USD 350 to USD 500 per tablet, translating into annual costs exceeding USD 30,000 for chronic therapy in hyponatremia.

-

- In the case of ADPKD, the price is often higher due to longer treatment duration, with annual costs surpassing USD 70,000.

- Europe and Asia: Regulatory prices are negotiated within national reimbursement frameworks, often leading to lower prices than in the US, with considerable variability.

Reimbursement depends on robust health technology assessments (HTA) and pricing negotiations, particularly for ADPKD, where economic benefits of slowing disease progression influence payer decisions.

Price Projections and Market Forecasts

Forecast Assumptions

- Patent expiry and generic entry: Major generics entering the US and European markets by 2025-2026.

- Market penetration: Post-patent, branded prices are expected to decline by 15-25%; generics will further reduce prices by 50-70%.

- Global adoption: Increasing adoption for ADPKD, driven by regulatory approvals in additional countries and expanded clinical data.

- Regulatory and reimbursement landscape: Continued efforts to demonstrate cost-effectiveness will support higher pricing in premium markets like the US.

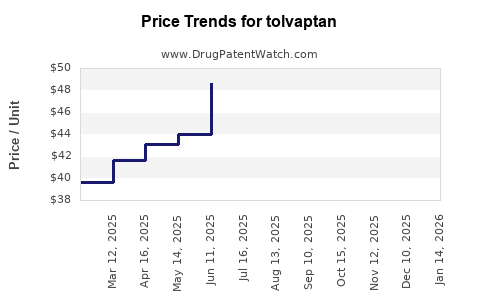

Price Trajectory (2023–2028)

| Year |

US Brand Price (USD) |

US Generic Price (USD) |

European Price (USD) |

Asia/Other Markets (USD) |

| 2023 |

400 per tablet |

300 per tablet |

300 per tablet |

200 per tablet |

| 2024 |

380 per tablet |

270 per tablet |

250 per tablet |

180 per tablet |

| 2025 |

350 per tablet |

200 per tablet |

200 per tablet |

150 per tablet |

| 2026 |

300 per tablet |

100 per tablet |

150 per tablet |

120 per tablet |

| 2027 |

250 per tablet |

80 per tablet |

120 per tablet |

100 per tablet |

| 2028 |

220 per tablet |

60 per tablet |

100 per tablet |

80 per tablet |

Revenue Projection

The global tolvaptan market is expected to reach USD 2.5 billion by 2028, accounting for increased adoption, expanded indications, and geographic reach. The ADRPKD segment will dominate, with an EU and US contribution; hyponatremia management will sustain revenues due to widespread utilization.

Impact of Healthcare Policies

Payer incentives for cost-effective therapies and policies promoting early diagnosis may sustain higher prices for authorized branded formulations. Conversely, patent cliffs will induce competitive price compression.

Challenges and Opportunities

- Generics and biosimilars: Will significantly depress prices post-patent expiry, challenging profitability.

- Regulatory landscape: New indications require rigorous evidence but can substantially increase market size if approved.

- Patient adherence: High costs may hinder long-term adherence, influencing market uptake.

- Innovative formulations: Extended-release or combination options can command premium prices.

Conclusion

Tolvaptan exhibits robust clinical promise, with a sizable and expanding market primarily driven by ADPKD. The expiry of patents in significant markets will result in price reductions, but strategic reimbursement negotiations and expanded indications are poised to underpin continued revenue streams. Overall, the drug's pricing trajectory reflects a transitional period from premium branded pricing toward commoditized, lower-cost generics as the primary sales drivers.

Key Takeaways

- The global tolvaptan market is projected to grow from USD 1.2 billion in 2022 to approximately USD 2.5 billion by 2028, driven primarily by expansion in ADPKD indications.

- Major price reductions are anticipated post-patent expiry, with generic versions available by 2025–2026 in the US and Europe.

- Despite generic entrants, continued clinical development and expanding indications can sustain higher prices and revenues.

- Reimbursement strategies and health policy trends in major markets will significantly influence final patient access and pricing.

- Innovation, such as novel formulations or combination therapies, presents opportunities for premium pricing and differentiated market presence.

FAQs

1. When will generic versions of tolvaptan likely enter the market?

Generic competition is expected to emerge around 2025–2026 in major markets such as the US and EU, following patent expirations related to formulation and process claims.

2. How does the pricing of tolvaptan differ across regions?

US prices are generally higher, often exceeding USD 400 per tablet, owing to less restrictive pricing regulations. European and Asian markets negotiate prices within national healthcare frameworks, resulting in lower per-unit costs.

3. What factors could influence future tolvaptan pricing?

Key factors include patent status, competition from generics, regulatory approvals for new indications, healthcare policy changes, and payer reimbursement decisions.

4. What is the potential impact of biosimilars or new drugs on tolvaptan’s market?

While biosimilars are less relevant for small molecules like tolvaptan, new drugs targeting similar indications could exert competitive pressure, possibly accelerating price declines.

5. Are there ongoing efforts to develop similar or improved therapies?

Yes. Research into alternative vasopressin receptor antagonists and therapies that target disease-modifying pathways in ADPKD could influence market dynamics, though none are yet replacements for tolvaptan.

References

[1] Market Research Future. (2022). Global Tolvaptan Market.

[2] FDA Approvals and Labeling for Tolvaptan.

[3] European Medicines Agency (EMA). (2015). Tolvaptan Summary of Product Characteristics.

[4] IQVIA. (2022). Healthcare Market Insights.