Last updated: July 28, 2025

rket Analysis and Price Projections for Triamterene

Introduction

Triamterene, a potassium-sparing diuretic primarily used to treat hypertension and edema, remains a critical pharmacological agent in the management of cardiovascular and renal conditions. As healthcare systems evolve and new formulations emerge, understanding its market dynamics, competitive landscape, and pricing trends is pivotal for stakeholders across pharmaceutical companies, healthcare providers, and investors. This analysis provides a comprehensive overview of triamterene’s market status and offers future price projections based on current trends and factors influencing pricing.

Market Overview

Indications and Clinical Role

Triamterene functions by inhibiting sodium reabsorption in the distal renal tubules, promoting natriuresis while conserving potassium. It is often combined with other diuretics such as hydrochlorothiazide to enhance antihypertensive efficacy. Its role in preventing hypokalemia induced by other diuretics solidifies its clinical importance, sustaining demand across various therapeutic settings.

Market Size and Growth Drivers

Globally, the thiazide and potassium-sparing diuretics market, encompassing triamterene, is projected to grow at a compound annual growth rate (CAGR) of approximately 4.1% from 2022 to 2028 [1]. Factors underpinning this growth include increasing prevalence of hypertension and chronic kidney disease, expanding geriatric populations, and rising awareness regarding cardiovascular health.

Regulatory and Patent Landscape

Triamterene, first approved in the 1960s, is now available largely as generic formulations, which significantly impacts pricing and market competition. While several brand-name products have expired patents, new formulations—such as sustained-release variants—are emerging, potentially offering higher price points due to improved patient compliance or distinct pharmacokinetic profiles.

Market Participants and Distribution Channels

Major pharmaceutical companies and generic manufacturers distribute triamterene globally. Its availability spans retail pharmacies, hospital systems, and online pharmacies. Distribution trends favor cost-effective generics, although branded versions maintain niche segments owing to specific formulation advantages.

Competitive Landscape and Pricing Factors

Generic Dominance and Price Competition

The predominance of generics leads to highly competitive pricing environments. Prices for triamterene can vary significantly across regions—European markets tend toward fixed, lower prices due to regulatory controls, while North American markets exhibit higher but fluctuating prices dictated by insurance reimbursements and formularies.

Formulation and Dosage Variations

Triamterene is available in various dosages, typically 37.5 mg and 50 mg tablets. Innovative formulations—such as extended-release tablets—command premium pricing due to convenience and adherence benefits. Combining triamterene with other agents (e.g., hydrochlorothiazide) can influence cost structures and market positioning.

Regulatory and Reimbursement Influences

Pricing is further affected by local reimbursement policies and patent statuses. In regions with strict price regulations—like Canada and Europe—prices tend to be lower. Conversely, the U.S., with its complex reimbursement landscape, exhibits greater market variability and potential for premium pricing in branded or specialized formulations.

Price Trends and Projections (2023-2030)

Historical Pricing Patterns

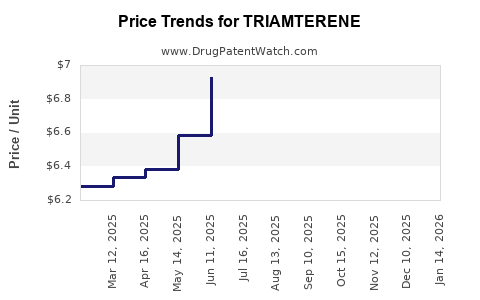

Historical data indicates that triamterene’s average retail price per standard 30-day supply ranged from $10 to $30 in the U.S. for generic versions, with branded formulations priced notably higher—up to $50 or more—though market share for brand variants has declined sharply due to generic competition [2].

Factors Driving Future Pricing

- Market Saturation: Increasing generic penetration is expected to further suppress prices.

- Emergence of Value-Added Formulations: Sustained-release versions or combination therapies could command premiums, especially if supported by clinical advantages.

- Regulatory Changes: Price controls or reforms impacting drug reimbursement could exert downward pressure.

- Manufacturing and Raw Material Costs: Fluctuations in active pharmaceutical ingredient (API) costs, influenced by geopolitical and supply chain factors, may slightly alter prices, particularly for smaller manufacturers.

Projected Price Trajectory

- 2023-2025: Prices are projected to decline modestly by 5-8% annually, driven by rampant generic proliferation and market saturation.

- 2026-2030: Stabilization at lower price points is anticipated, with potential for slight increases (+2-3%) in specialty or extended-release formulations, aligned with inflation and manufacturing costs.

- Regional Variations: In Europe and Asia-Pacific, where price regulations are stringent, prices are expected to remain relatively stable, whereas North American prices may experience cyclical fluctuations influenced by insurance coverage policies.

Long-term Outlook

Given the maturity of the triamterene market, significant price increases are unlikely unless disruptive innovations or regulatory changes occur. The primary value in the coming years will derive from maintaining market share through cost competitiveness and formulation innovation.

Implications for Stakeholders

- Pharmaceutical Companies: Emphasize cost reduction strategies and pursue novel formulations to differentiate offerings and sustain margins.

- Healthcare Providers: Opt for generics to contain costs, while staying alert for value-added formulations that improve patient adherence.

- Investors: Focus on companies developing innovative or combination therapies involving triamterene, as these could command premiums amidst static or declining base drug prices.

- Regulators: Monitor market dynamics and ensure policies promote affordability without discouraging innovation.

Key Takeaways

- Market Maturity: Triamterene's market is highly commoditized, with a dominant generic segment that suppresses prices.

- Price Trends: Expect continued modest declines through 2025, stabilizing afterward, with potential premiums for advanced formulations.

- Competitive Pressure: Generic proliferation and price regulation will remain primary price determinants.

- Innovation Opportunities: Sustained-release and combination therapies offer avenues for premium pricing and market differentiation.

- Strategic Focus: Stakeholders should emphasize cost-efficient manufacturing, formulation innovation, and regulatory engagement to optimize market positioning.

FAQs

-

What factors influence the price of triamterene in different regions?

Regional pricing is shaped by regulatory policies, market competition, reimbursement frameworks, and manufacturing costs, leading to variability across markets.

-

Are branded triamterene products more expensive than generics?

Yes. Branded formulations generally command higher prices due to perceived quality, formulation differences, or clinical advantages. However, generics dominate due to cost-effectiveness.

-

Can innovations such as sustained-release formulations impact triamterene prices?

Absolutely. Such innovations can support higher pricing, especially if they demonstrate improved patient adherence or therapeutic outcomes, but they typically target niche segments initially.

-

What is the outlook for triamterene prices over the next decade?

Prices are expected to decline gradually due to generic competition, stabilize, and possibly increase marginally for specialty formulations, with no major upward trends anticipated.

-

How do raw material costs affect triamterene pricing?

Fluctuations in active pharmaceutical ingredient costs can influence manufacturing expenses and, consequently, drug prices, especially for smaller or third-party manufacturers.

References

[1] Market Research Future. “Diuretics Market – Forecast to 2028.” 2022.

[2] IQVIA. “U.S. Prescription Drug Price Trends.” 2022.