Last updated: July 28, 2025

Introduction

Tinidazole is a potent nitroimidazole derivative extensively used for treating protozoal infections and certain bacterial infections. Approved primarily for trichomoniasis, amebiasis, and bacterial vaginosis, its pharmacological profile offers an alternative to metronidazole, often with advantages like shorter treatment duration and fewer side effects. The evolving landscape surrounding Tinidazole involves shifting clinical applications, regulatory considerations, and competitive market forces. An in-depth analysis of market dynamics and financial prospects is essential for stakeholders aiming to capitalize on this therapeutic agent.

Pharmacological Profile and Therapeutic Applications

Developed by pharmaceutical companies specializing in anti-infectives, Tinidazole demonstrates broad-spectrum efficacy against anaerobic bacteria and protozoa. Its mechanism involves disrupting DNA synthesis in pathogens, leading to cell death. Approved in various regions, including the US and Europe, for indications such as:

- Trichomoniasis

- Amebiasis

- Bacterial vaginosis

- Giardiasis

Additional off-label uses include treatment of Helicobacter pylori eradication protocols. The drug’s tolerability, with fewer gastrointestinal side effects compared to metronidazole, positions it favorably in clinical settings.

Market Drivers

1. Rising Incidence of Protozoal Infections

Global increases in parasitic infections, fueled by international travel and poor sanitation, propel demand for effective anti-protozoal agents like Tinidazole. Regions such as South Asia, Africa, and Latin America report high infection burdens, contributing significantly to local markets.

2. Growing Awareness and Improved Diagnostics

Enhanced disease detection and awareness campaigns have increased diagnosis rates of protozoal infections, subsequently escalating Tinidazole prescriptions. Laboratory advancements facilitate rapid identification, supporting timely treatment and bolstering drug sales.

3. Favorable Pharmacokinetics and Tolerability

Compared with older agents, Tinidazole’s shorter course regimens and minimal adverse effects appeal to clinicians and patients, fostering higher acceptance and adherence.

4. Expansion into New Therapeutic Areas

Research exploring Tinidazole's efficacy in managing resistant infections and potential off-label applications broadens its market scope. Clinical trials investigating its utility against Helicobacter pylori and other resistant strains may unlock additional demand.

Market Challenges

1. Regulatory and Patent Landscape

While Tinidazole is off-patent in many jurisdictions, some formulations remain proprietary. Regulatory hurdles, particularly in approvals for new indications or formulations, can delay market expansion.

2. Competition from Alternative Agents

Metronidazole remains the market leader due to its longstanding presence and low cost. Newer agents with better safety profiles or enhanced efficacy, such as secnidazole and ornidazole, compete directly with Tinidazole.

3. Resistance Concerns

Emerging resistance among protozoa and anaerobic bacteria threatens long-term efficacy, prompting cautious prescribing and limiting market growth potential.

4. Limited Commercial Infrastructure

In many low-resource settings where demand is highest, infrastructure deficits hinder widespread distribution and availability of Tinidazole.

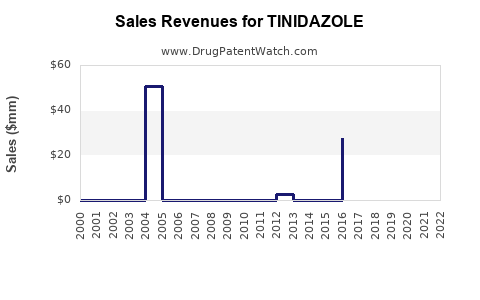

Market Size and Forecast

Current Market Overview

The global anti-infective market for protozoal agents was valued at approximately USD 2.7 billion in 2022, with Tinidazole accounting for an estimated 15-20% share. The Asia-Pacific region dominates, representing around 50% of the consumption, driven by high disease prevalence and increased healthcare access.

Projected Growth Trajectory

Based on epidemiological trends and increased adoption, the Tinidazole market is poised for compounded annual growth rates (CAGR) of 5-7% over the next five years. The expansion is primarily driven by:

- Increased use in developing economies

- Rising research into novel indications

- Efforts to replace older drugs with more tolerable agents

Global sales are projected to reach USD 600-700 million by 2028, contingent on regulatory approvals for new indications and formulation improvements.

Regional Outlook

- Asia-Pacific: Leading growth, fueled by high infection rates and developing healthcare infrastructure.

- North America & Europe: Moderate growth, primarily driven by off-label use and research initiatives.

- Latin America & Africa: Emerging markets with substantial demand, though growth constrained by infrastructure and regulatory barriers.

Financial Considerations

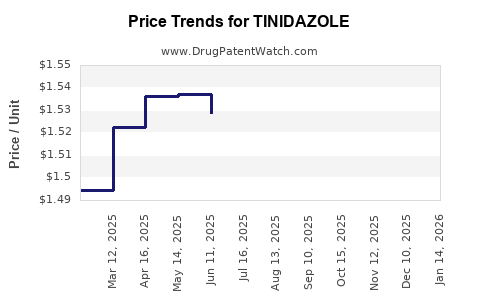

Pricing Dynamics

As a generic medication in many regions, Tinidazole’s price remains competitive, with costs ranging from USD 0.10 to 0.50 per tablet. Pricing pressures from manufacturers and procurement agencies influence profit margins, emphasizing the importance of efficient supply chains.

Research & Development (R&D)

Investment conflicts exist between incremental formulation improvements and development of novel therapeutics to combat resistance. Licensing agreements and strategic partnerships are critical for market expansion.

Regulatory Environment

Stringent regulations in the US, EU, and Japan necessitate robust clinical data to obtain or extend approvals. Off-label uses have limited reimbursement potential, affecting overall revenue streams.

Supply Chain & Distribution

To capitalize on growth, manufacturers need robust distribution frameworks, especially in emerging markets. Local partnerships and generic manufacturing capacity significantly influence profitability.

Strategic Opportunities

- Formulation Innovations: Developing fixed-dose combinations or formulations suitable for children to enhance compliance and market penetration.

- New Indications: Advancing clinical trials for resistant infections can open higher-value markets.

- Market Penetration in Developing Countries: Tailoring distribution strategies to increase access in underserved regions unlocks significant incremental revenue.

- Partnerships: Collaborations with government health programs or NGOs can facilitate large-volume procurement, stabilizing revenues.

Competitive Landscape

Leading generic manufacturers include Pfizer, Teva, and Mylan, which dominate supply in developed markets. Niche biotech firms exploring novel derivatives or delivery systems pose emerging competitive threats. Addressing resistance patterns and optimizing formulations can sustain competitive advantages.

Regulatory and Patent Outlook

- Patent Status: Largely expired in most regions, allowing generic proliferation.

- Regulatory Approvals: Ongoing applications for expanded indications and formulations can alter the market landscape.

- Quality Standards: Conformance to international standards (e.g., WHO prequalification) remains key for market access, especially in low-income countries.

Key Market Trends

- Increasing use of Tinidazole in combination therapies for resistant infections.

- Shift toward patient-friendly formulations with improved dosing regimens.

- Growing emphasis on affordability and accessibility in low-resource settings.

- Enhanced focus on clinical trials demonstrating efficacy against emerging protozoal pathogens.

Conclusion

The market for Tinidazole presents tangible growth opportunities driven by epidemiological trends, clinical advantages, and expanding indications. Strategic positioning in emerging markets, continuous R&D, and adherence to regulatory standards will be critical to maximizing financial returns. While competition from existing agents remains intense, innovations and targeted distribution can secure a sustainable market share.

Key Takeaways

- Growth Prospects: The global Tinidazole market is projected to grow at a CAGR of 5-7%, reaching approximately USD 600-700 million by 2028.

- Market Drivers: Rising protozoal infections, enhanced diagnostics, and patient-friendly formulations underpin growth.

- Challenges: Resistance development, regulatory barriers, and competition from older agents pose hurdles.

- Strategic Focus: Innovation in formulations, expansion into new indications, and targeted penetration in emerging markets can drive profitability.

- Regulatory Consideration: Expired patents enhance generic competition, but regulatory approval for new uses remains pivotal.

FAQs

Q1: What are the main therapeutic indications for Tinidazole?

A1: Tinidazole is primarily used for treating trichomoniasis, amoebiasis, bacterial vaginosis, and giardiasis. Emerging research explores additional uses such as Helicobacter pylori eradication.

Q2: How does Tinidazole compare to metronidazole?

A2: Tinidazole offers shorter treatment courses and fewer side effects, with similar or superior efficacy, making it an attractive alternative in clinical practice.

Q3: What are the key competitive factors in the Tinidazole market?

A3: Price competitiveness, formulation options, regulatory approvals, resistance management, and distribution infrastructure are critical for market success.

Q4: What regions offer the most growth potential for Tinidazole?

A4: Asia-Pacific leads due to high infection prevalence, followed by Latin America and Africa, which are expanding markets constrained mainly by infrastructure and regulatory hurdles.

Q5: What are the future opportunities for investment in Tinidazole?

A5: Opportunities include developing patient-centric formulations, pursuing new indications via clinical trials, and establishing strategic partnerships to penetrate low-resource markets.

References

[1] Market Research Future Reports, 2022. Global Anti-Infective Market Size & Share.

[2] World Health Organization, 2021. Neglected Tropical Diseases: Protozoal Infections.

[3] PharmaData Insights, 2022. Competitive Landscape of Nitroimidazole Drugs.

[4] GlobalData Reports, 2022. Emerging Trends in Infectious Disease Therapies.