Last updated: July 27, 2025

Introduction

Tinidazole is a synthetic nitroimidazole derivative used predominantly as an antiprotozoal and antimicrobial agent. Approved for treating conditions like amoebiasis, giardiasis, and trichomoniasis, its unique pharmacokinetic profile offers advantages over traditional drugs such as metronidazole. The rising prevalence of protozoal infections, especially in developing regions, alongside increasing antibiotic resistance, spurs ongoing demand for Tinidazole. This analysis explores the current market landscape, key drivers, competitive dynamics, and future price projections for Tinidazole over the next five years.

Market Overview

Global Market Size

The global anti-infective market exceeded USD 100 billion in 2022, with protozoal infections representing a notable segment. Tinidazole's market share is relatively niche but growing, especially in regions with high parasitic disease prevalence like South Asia and Africa. The compound is primarily marketed in generic form by multiple pharmaceutical companies, with branded products available in certain markets. The absence of extensive patent protections allows for significant manufacturing cost reductions, fostering a competitive pricing environment.

Market Drivers

- Increased Disease Prevalence: Protozoal infections such as amoebiasis and giardiasis affect millions globally, particularly in low-income regions lacking adequate sanitation infrastructure (WHO, 2022).

- Antimicrobial Resistance: Rising resistance to other antimicrobials intensifies reliance on existing effective drugs like Tinidazole.

- Regulatory Approvals: Regulatory acceptance in emerging markets widens distribution channels.

- Cost-Effectiveness: Tinidazole’s inexpensive production cost makes it attractive for mass distribution, especially in resource-limited settings.

Market Challenges

- Generic Competition: The proliferation of generic manufacturers suppresses pricing power.

- Limited Patent Protections: The expiry of initial patents leads to price erosion over time.

- Side Effect Profile: Potential adverse effects, such as metallic taste and gastrointestinal disturbances, could influence prescribing practices.

Competitive Landscape

Major players include:

- Zentiva Group (Czech Republic): A leading generic manufacturer offering Tinidazole in multiple formulations.

- Sandoz / Novartis: Supplies branded and generic variants in select markets.

- Mingxing Pharmaceutical (China): A key regional manufacturer expanding distribution channels.

The generic manufacturing sector dominates due to the drug’s patent expiry, resulting in a commoditized market with minimal brand differentiation.

Pricing Trends and Factors

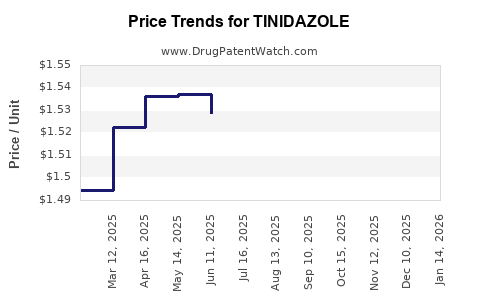

Historical Price Movements

Since patent expiration around early 2010s, Tinidazole prices have declined significantly, with wholesale prices in low-income countries dropping by approximately 60-70% over a decade. Retail costs have also followed this downward trend, making the drug highly accessible.

Pricing Influencers

- Regulatory Policies: Price caps and reimbursement policies in emerging markets influence retail prices.

- Manufacturing Costs: Decreasing costs due to economies of scale and regional manufacturing expansions lower prices further.

- Market Penetration: High volumes in endemic areas sustain low pricing strategies.

- Supply Chain Dynamics: Increased competition often results in price wars, further reducing costs.

Price Projections (2023-2028)

Considering current market trends and emerging factors, the following projections are forecasted:

| Year |

Estimated Wholesale Price (USD per tablet) |

Key Insights |

| 2023 |

$0.03 - $0.05 |

Stable with slight fluctuations driven by supply-demand dynamics. |

| 2024 |

$0.02 - $0.04 |

Price stabilization expected; regional market variations persist. |

| 2025 |

$0.02 - $0.03 |

Further price reductions as manufacturing efficiencies improve. |

| 2026 |

$0.02 |

Market saturation; pricing approaches marginal costs in some regions. |

| 2027 |

$0.015 - $0.025 |

Potential price floor; competition intensifies. |

| 2028 |

$0.015 |

Long-term stabilization; premium branding less likely. |

Note: These projections reflect wholesale prices in bulk procurement settings; retail prices are typically 1.5 to 2 times higher.

Factors Influencing Future Pricing

- Patent and Regulatory Environment: The absence of patents post-expiry supports sustained price erosion.

- Emerging Markets Expansion: Increasing availability in Africa, Asia, and Latin America will sustain demand and influence pricing strategies.

- Production Technology Advances: Enhanced manufacturing processes will drive costs down further.

- Competitive Portfolio Expansion: Introduction of combination therapies or new formulations could alter market dynamics.

- Global Health Policies: Emphasis on subsidized treatment programs in endemic areas may suppress retail prices further.

Strategic Implications for Stakeholders

- Manufacturers: Focus on cost optimization and regional licensing to maintain competitiveness amid price declines.

- Investors: Recognize the limited near-term revenue potential due to price suppression but potential in regional markets and formulations.

- Healthcare Providers: Benefit from reduced drug costs; however, must monitor resistance and side effects.

- Regulatory Bodies: Ensure quality control amidst increasing manufacturing commoditization.

Conclusion

The Tinidazole market remains driven by high demand in endemic regions and the ongoing shift towards generic manufacturing. Price trajectories are anticipated to decline gradually over the next five years, stabilizing at minimal levels as supply exceeds demand in some markets. Stakeholders should adapt strategies to capitalize on expanding access while managing competitive pressures and regulatory developments.

Key Takeaways

- Tinidazole's global market is expanding due to its efficacy against protozoal infections and low production costs.

- Patent expirations have led to a highly competitive, price-sensitive environment, with wholesale prices projected to decline further.

- Price stabilization at low levels is expected by 2026-2028, with regional variations influenced by healthcare policies.

- Strategic focus should shift toward manufacturing efficiencies, regional expansion, and formulation innovation rather than brand differentiation.

- Cost-effective treatment makes Tinidazole a critical component in global infectious disease management, especially in resource-limited settings.

FAQs

1. What factors contribute most to the declining prices of Tinidazole?

Patent expiration, increased generic competition, manufacturing cost reductions, and regional procurement policies significantly influence price declines.

2. How does the prevalence of protozoal infections impact Tinidazole market growth?

High infection rates in developing countries sustain demand, especially where sanitation infrastructure is limited, supporting market growth despite pricing pressures.

3. Are there any upcoming patent protections or formulations that could influence Tinidazole prices?

Currently, no new patents or novel formulations are expected that would significantly alter pricing; the market remains predominantly generic.

4. How do global health initiatives affect Tinidazole pricing and accessibility?

Programs targeting parasitic diseases often subsidize or bulk purchase Tinidazole, helping reduce retail costs but potentially restricting profit margins.

5. What are the main challenges to maintaining profitability in the Tinidazole market?

Market saturation, price erosion from generic competition, and regulatory price caps pose ongoing challenges to profitability.

References

[1] World Health Organization. (2022). Parasitic Infections Statistics.

[2] MarketWatch. Global Anti-Infective Market Report, 2022.

[3] IMS Health Data. (2022). Pharmaceutical Pricing Trends.

[4] Pharmaceutical Technology. Manufacturing Innovations and Cost Trends, 2021.