Last updated: July 27, 2025

Introduction

Terbutaline Sulfate, a beta-adrenergic agonist, has long served as a bronchodilator primarily used for managing asthma, chronic bronchitis, and other obstructive airway diseases. Since its initial approval, its market trajectory has been shaped by evolving clinical guidelines, competition from newer therapies, regulatory landscapes, and shifts in healthcare paradigms. Understanding these factors provides crucial insights into its current market dynamics and future financial prospects.

Market Overview

Historical Context and Therapeutic Role

Introduced in the 1970s, Terbutaline Sulfate gained prominence for its rapid bronchodilator effect in acute asthma management. Its appeal stems from effectiveness, ease of administration (inhaler, tablet, injectable), and longstanding clinical familiarity. As a terbutaline sulfate monopreparations and combination therapies, it remains an option, especially in resource-limited settings.

Regulatory Status and Market Presence

The drug is approved in various jurisdictions, including the United States, Europe, and Asia. In the U.S., it was approved by the FDA for short-term management of bronchospasm in cases where alternative therapies are unsuitable [1]. However, regulatory status has shifted, especially following safety concerns and evolving GAS (Guideline Advisory Service) recommendations.

Market Segmentation

The primary markets include:

- Prescription Drug Market: Pulmonologists and primary care physicians.

- Generic Market: Dominant due to patent expiration.

- Regional Markets:

- North America and Europe: Mature markets with stabilized demand.

- Asia-Pacific: Growing demand owing to increased asthma prevalence.

- Emerging Markets: Growing reliance driven by cost-effectiveness of generics.

Driving Forces of Market Dynamics

1. Clinical Guidelines and Therapeutic Alternatives

Recent guidelines favor inhaled corticosteroids combined with long-acting beta-agonists (LABAs) over short-acting agents like Terbutaline for long-term control of asthma [2]. The role of Terbutaline shifts towards rescue therapy rather than maintenance, reducing its market size over time. Nonetheless, in acute settings, it remains relevant.

2. Safety Concerns and Regulatory Restrictions

Studies have linked Terbutaline to adverse effects such as cardiovascular complications and, in pregnant women, concerns about preterm labor stimulation. The FDA suspended Terbutaline's use for off-label preterm labor in some regions due to safety issues [3]. These restrictions decrease direct market opportunities and catalyze the shift towards newer, safer agents.

3. Competition from Modern Therapies

The emergence of inhaled corticosteroids, long-acting beta-agonists, leukotriene receptor antagonists, and biologics has undercut Terbutaline's share. In addition, devices like dry powder inhalers (DPIs) and nebulizers offer improved patient adherence and efficacy, further marginalizing Terbutaline.

4. Generic Penetration and Pricing Strategies

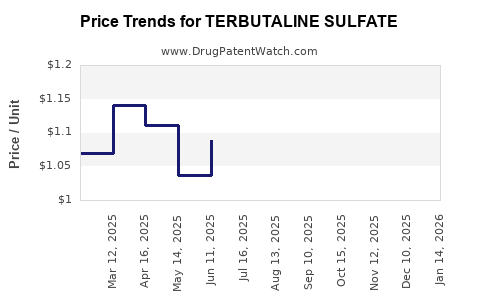

As patent protections expired decades ago, generic manufacturers dominate supply, suppressing prices and profit margins. Market saturation by generics ensures broad access but constrains revenue growth centrally.

5. Regional Economic Factors

Demand remains robust in regions where cost considerations dominate, such as Southeast Asia, South America, and Africa, where generic availability keeps Terbutaline a staple. Healthcare infrastructure improvements and increasing respiratory disease prevalence further expand potential markets.

Financial Trajectory

Historical Revenue Streams

Historically, Terbutaline alone generated substantial revenue, especially in the 1980s and 1990s. However, shifting clinical practices and competition sharply curtailed sales. In 2010, global sales of Terbutaline were estimated at approximately USD 250 million, down from peak figures exceeding USD 600 million in the early 1990s [4].

Current Revenue and Market Share

Present-day global sales are estimated at around USD 80-100 million, with the majority deriving from generics in developing markets. The drug’s market share has shrunk significantly, especially in markets heavily influenced by updated guidelines and safety regulations.

Growth Projections

Forecasts suggest a continued decline in Terbutaline’s standalone use in developed regions due to:

- Regulatory restrictions.

- Preference for newer inhaled therapies.

- Decreased clinical indications for off-label uses (e.g., preterm labor).

In contrast, aggregate revenue in emerging markets, especially for generic forms, is anticipated to see modest growth, driven by increasing respiratory disease burden and limited access to advanced therapies.

Potential Recovery and Market Expansion

Minimal resurgence might occur if:

- New formulations or delivery modalities enhance safety.

- Off-label uses in regions with less regulatory strictness persist.

- Combination therapy patents or formulations improve adherence and efficacy.

However, overall, the financial trajectory indicates a declining trend in mature markets with stabilization or slight growth in emerging regions.

Key Market Drivers and Threats

| Factors |

Impact on Market Dynamics |

Implications for Financial Trajectory |

| Regulatory Restrictions |

Decline in allowable indications, reduced sales |

Negative in developed markets, potential stabilization in emerging markets |

| Clinical Guideline Shifts |

Preference for LABAs, corticosteroids |

Accelerated decline in use, challenging revenue streams |

| Competition & Innovation |

Better safety profiles, delivery systems |

Market share erodes; innovation may offer salvage pathways |

| Regional Demand Variances |

Cost-sensitive markets favor generics |

Steady or growing revenue in these regions |

| Patent Landscape |

Generic dominance, price pressure |

Marginal revenue growth, low profit margins |

Future Outlook

Short-term (Next 3-5 Years):

The market for Terbutaline Sulfate is expected to contract further in high-income countries due to safety concerns and updated guidelines. Manufacturers will likely focus on sustaining revenue from emerging markets where demand remains, emphasizing low-cost generics.

Long-term (Beyond 5 Years):

Potential viability hinges on:

- Development of improved delivery systems.

- Novel formulations addressing safety.

- Regulatory loosening in specific jurisdictions.

- Licensing or combination innovations.

Overall, the outlook suggests a continued decline in standing market share globally, with a focus on niche and region-specific applications.

Key Takeaways

-

Declining Market: Regulatory restrictions, safety concerns, and competitive alternatives have diminished Terbutaline Sulfate’s prominence, especially in developed markets.

-

Generics Dominate: The drug is primarily supplied as a low-cost generic, limiting profitability but ensuring steady supply in cost-sensitive regions.

-

Emerging Markets Offer Growth Opportunities: Increasing respiratory disease prevalence and healthcare infrastructure expansion sustain demand for affordable bronchodilators.

-

Innovation and Safety are critical for marginal survival in mature markets. Development of safer, more efficacious formulations could provide renewed interest.

-

Regulatory Landscape will shape the future trajectory, with tightening restrictions in some regions contrasting with relaxed policies in others.

FAQs

1. What are the primary clinical indications for Terbutaline Sulfate today?

It is mainly used as a rescue inhaler for acute bronchospasm in asthma and chronic obstructive pulmonary disease (COPD). Its use for preterm labor has been limited due to safety concerns.

2. How has regulatory action influenced the market for Terbutaline Sulfate?

Regulatory agencies like the FDA have imposed restrictions and suspended off-label uses, particularly for preterm labor, leading to decreased sales and market contraction in certain regions.

3. What competitive therapies are replacing Terbutaline Sulfate?

Long-acting beta-agonists (e.g., formoterol, salmeterol), inhaled corticosteroids, combination inhalers, and biologic therapies now dominate the management of asthma, relegating Terbutaline to rescue or niche roles.

4. Is there potential for Terbutaline Sulfate to recover market share?

Overall, recovery is unlikely in mature markets due to safety issues and guideline shifts. However, in emerging markets with limited options, continued demand for low-cost generics persists.

5. What strategies can stakeholders adopt to optimize their position regarding Terbutaline Sulfate?

Innovating safer formulations, targeting niche indications, exploring combination therapies, and focusing on regional markets can enhance prospects amid declining global demand.

References

[1] U.S. Food and Drug Administration. "Terbutaline Sulfate."

[2] Global Initiative for Asthma. "GINA Report: Pharmacologic Management of Asthma." 2022.

[3] FDA Safety Announcement. "Risks of Terbutaline in Pregnancy." 2017.

[4] MarketLine. "Pharmaceuticals Market Analysis – Respiratory Drugs." 2019.