Share This Page

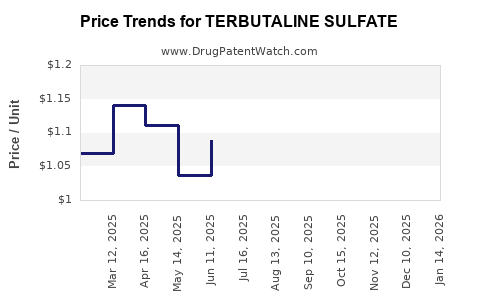

Drug Price Trends for TERBUTALINE SULFATE

✉ Email this page to a colleague

Average Pharmacy Cost for TERBUTALINE SULFATE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TERBUTALINE SULFATE 2.5 MG TAB | 00527-1318-01 | 1.00928 | EACH | 2025-12-17 |

| TERBUTALINE SULFATE 2.5 MG TAB | 62135-0524-90 | 1.00928 | EACH | 2025-12-17 |

| TERBUTALINE SULFATE 2.5 MG TAB | 62559-0721-01 | 1.00928 | EACH | 2025-12-17 |

| TERBUTALINE SULFATE 2.5 MG TAB | 24979-0132-01 | 1.00928 | EACH | 2025-12-17 |

| TERBUTALINE SULFATE 5 MG TAB | 62559-0722-01 | 1.16061 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Terbutaline Sulfate

Introduction

Terbutaline sulfate, a selective beta-2 adrenergic receptor agonist, plays a pivotal role in the management of respiratory conditions such as asthma and chronic bronchitis, as well as in obstetric indications for delaying preterm labor. Although developed decades ago, its pharmaceutical market remains significant due to its established efficacy and ongoing clinical use. This analysis delineates current market dynamics, competitive landscape, regulatory factors, and forecasts future pricing trends for terbutaline sulfate over the next five years.

Market Overview

Global Demand and Market Size

The global bronchodilator market was valued at approximately USD 9.2 billion in 2022, with beta-2 agonists like terbutaline sulfate accounting for a notable share (Grand View Research, 2022). The demand is driven predominantly by the high prevalence of respiratory diseases such as asthma, affecting over 262 million individuals worldwide (WHO, 2022). Additionally, obstetric applications contribute to specialty segment growth, primarily in developed markets.

In terms of formulations, terbutaline sulfate is available as tablets, injectable solutions, and inhalation preparations. The doping of generic drug formulations, particularly in developing countries, sustains ongoing demand, while patent expirations in mature markets incentivize generic proliferation.

Regional Market Dynamics

-

North America: Led by the United States, North America accounts for the largest market share owing to high disease prevalence, advanced healthcare infrastructure, and robust pharmaceutical manufacturing. In the U.S., the compound is available as a generic, and prescribing patterns remain stable.

-

Europe: Similar demand dynamics are observed, with a growing emphasis on respiratory health, bolstered by regulatory support for generic drugs.

-

Asia-Pacific: Rapidly expanding due to increasing respiratory disease burden, rising healthcare access, and local manufacturing capabilities.

Manufacturing and Supply Chain

Major players include Teva Pharmaceuticals, Mylan, and Cipla, with numerous regional producers. The supply chain relies on bulk active pharmaceutical ingredient (API) manufacturing, predominantly from India and China, followed by formulation and distribution.

Patent and Regulatory Landscape

Terbutaline sulfate's patent expiry dates back to the early 2000s, leading to a surge in generic manufacturing. Regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) facilitate approvals, but post-approval, compounded formulations and off-label uses contribute to unregulated markets.

While existing patents have expired, recent regulatory initiatives focus on ensuring quality standards for generics, influencing market entry and pricing strategies.

Market Drivers

- Rising prevalence of respiratory diseases.

- Increased adoption of inhalation therapies.

- Expanding obstetric indications for preterm labor management.

- Cost-containment measures favoring generic alternatives.

- Growth in healthcare infrastructure in emerging markets.

Market Challenges

- Safety and efficacy concerns related to terbutaline use in obstetrics.

- Competition with newer, targeted long-acting bronchodilators.

- Regulatory restrictions due to adverse event reports.

- Limited innovation for compounded formulations.

Pricing Analysis

Historical Pricing Trends

Generic terbutaline sulfate's pricing has steadily declined over the last decade, primarily due to generic competition following patent expiration. In the U.S., the average wholesale price (AWP) for a 30-day supply of tablets has fallen from around $30 in 2010 to approximately $5–$7 in 2023.

In emerging markets, prices are often lower due to local manufacturing and distribution, with variations based on regulatory approvals and market competition.

Current Price Landscape

| Region | Formulation | Approximate Price (per 30-day supply) | Notes |

|---|---|---|---|

| North America | Tablets | USD 5–USD 7 | High competition, premium generics |

| Europe | Tablets | EUR 4–EUR 6 | Similar to North America, regional variations |

| India | Tablets | INR 50–INR 80 | Cost-effective, high generic penetration |

| China | Tablets | CNY 20–CNY 40 | Market growth in respiratory segment |

Factors Affecting Prices

- Regulatory status: Faster approvals lower prices through increased competition.

- Manufacturing costs: Lower in Asia, supporting price declines.

- Market competition: Entry of multiple generics drives prices down.

- Reimbursement and insurance policies: Impacts end-user prices in developed nations.

Future Price Projections (2023-2028)

Considering current trends, regulatory influences, and market dynamics, the following projections are presented:

General Outlook

-

Stability in developed markets: Prices are expected to remain relatively stable, with slight declines driven by continued generic competition. In North America and Europe, prices are projected to decrease by approximately 5–10% over five years, reaching USD 4–USD 6 for a 30-day supply.

-

Potential price stabilization in emerging markets: In India and China, prices might plateau due to high local manufacturing capacity, with marginal decreases of 2–5%.

Influencing Factors

-

Potential reformulations or new delivery mechanisms may influence pricing. However, as no new patent filings or formulations are currently anticipated, significant price increases are unlikely.

-

Market saturation in developed countries could lead to commoditization, further reducing prices.

-

Regulatory actions addressing safety concerns could temporarily impact pricing due to market disruptions or increased testing costs.

Impact of Regulatory and Clinical Trends

Recent safety warnings concerning terbutaline's obstetric use in certain jurisdictions may influence prescribing patterns, potentially reducing demand and exerting downward pressure on prices.

Overall Price Trajectory

| Year | Estimated Average Price (USD) for 30-day supply | Predicted Trend | Key Notes |

|---|---|---|---|

| 2023 | $5–$7 | Baseline | Established generic competition |

| 2024 | $4.8–$6.5 | Slight decline | Price stabilization, minor reductions |

| 2025 | $4.5–$6 | Continued decline | Market saturation effects |

| 2026 | $4.3–$5.8 | Modest decline | Regulatory influences, generic proliferation |

| 2027 | $4.2–$5.7 | Stabilization | Market equilibrium reached |

| 2028 | $4–$5.5 | Slight decline | Overall trend persists |

Strategic Insights

-

Investors and manufacturers should monitor generic market entries and regional regulatory changes, as these directly affect pricing and profitability.

-

Pharmaceutical companies might capitalize on regional demand in emerging markets, where prices remain lower but volumes are increasing.

-

Healthcare payers should consider the impact of cost-effective generics on budget management, especially amid rising respiratory disease burden.

Key Takeaways

-

The terbutaline sulfate market is predominantly driven by generic availability, with declining prices across all regions.

-

Developed markets exhibit price stabilization with modest reductions due to intense competition, regulatory factors, and safety considerations.

-

Emerging markets present opportunities for growth despite lower prices, owing to expanding healthcare infrastructure and disease prevalence.

-

Future price trajectories suggest minor declines, with no significant upward trend anticipated unless new formulations or indications emerge.

-

Regulatory pressures related to safety concerns, particularly in obstetric indications, could influence prescribing trends and impact the demand-side pricing.

FAQs

1. Will the price of terbutaline sulfate increase with the introduction of new formulations?

Currently, no significant new formulations are in development. Existing formulations are mature, with generic competition exerting downward pressure on prices. Unless novel delivery systems or indications are approved, price increases are unlikely.

2. How do safety concerns impact the market for terbutaline sulfate?

Safety warnings, especially regarding obstetric use, may reduce prescribing, decreasing demand and pressuring prices further. They might also prompt regulatory restrictions, affecting market stability.

3. Is there potential for patent prolongation or new protection for terbutaline sulfate?

No active patents extend the protected period. The market relies mainly on generic manufacturers, maintaining low price levels.

4. Which regions are expected to experience the greatest price decline?

Developed markets like North America and Europe will see gradual price reductions due to mature competition, while emerging markets like India and China will maintain lower but relatively stable prices.

5. What are the primary factors influencing future demand for terbutaline sulfate?

Demand is driven by respiratory disease prevalence and obstetric indications. Increasing global disease burden and expanding healthcare access in emerging markets suggest moderate growth in demand, though safety concerns could temper this trend.

References

[1] Grand View Research. (2022). Bronchodilator Market Size, Share & Trends Analysis Report.

[2] World Health Organization. (2022). Global Asthma Report.

[3] U.S. Food and Drug Administration. (2023). Approved Drug Products with Therapeutic Equivalence Evaluations.

More… ↓