Last updated: July 27, 2025

Introduction

Tafluprost, a prostaglandin analog used primarily in glaucoma and ocular hypertension management, has garnered significant attention in ophthalmic pharmacology. As a topical agent, it functions by increasing aqueous humor outflow to reduce intraocular pressure (IOP), thereby safeguarding against optic nerve damage. This comprehensive analysis explores the evolving market dynamics and the projected financial trajectory for tafluprost, considering its therapeutic advantages, competitive landscape, regulatory environment, and commercial potential.

Pharmacological Profile and Clinical Positioning

Tafluprost distinguishes itself from other prostaglandin analogs through its efficacy, safety profile, and unique formulation features. Approved in multiple regions, including Japan, Europe, and the United States (under the name Zioptan), tafluprost is notable for its preservative-free formulation, which minimizes ocular surface irritation—a critical factor influencing patient compliance.

Clinically, tafluprost has demonstrated comparable IOP reduction to established agents such as latanoprost and bimatoprost. Its safety profile, particularly regarding conjunctival hyperemia and eyelash growth, remains favorable, reinforcing its position as a first-line therapy.

Market Dynamics

1. Growing Global Prevalence of Glaucoma and Ocular Hypertension

The global burden of glaucoma exceeds 76 million individuals, with projections reaching over 111 million by 2040. This increasing prevalence drives sustained demand for effective IOP-lowering therapies like tafluprost. The aging population worldwide exacerbates this trend, particularly in developed countries where glaucoma management aligns closely with the rising prevalence of age-related ocular conditions.

2. Increased Adoption Driven by Preservative-Free Formulations

Patients with ocular surface diseases and sensitivities prefer preservative-free options. Notably, tafluprost’s preservative-free formulation appeals to this segment, boosting its adoption among clinicians aiming to optimize patient tolerability and compliance.

3. Regulatory Approvals and Market Penetration

Initially launched in Japan in 2007, tafluprost gained regulatory approval in Europe in 2012 and the U.S. in 2016. Its early entry into mature markets facilitated initial sales, but late entry relative to competitors like latanoprost and travoprost limited market share in some regions. Nonetheless, its niche positioning as a preservative-free anti-glaucoma agent enhances its growth prospects.

4. Competitive Landscape

The prostaglandin analog class is highly competitive, with established blockbusters such as latanoprost (Xalatan), travoprost (Travatan), and bimatoprost (Lumigan). Tafluprost competes by emphasizing its preservative-free benefit, especially in patients intolerant to preservatives.

Emerging agents, including rock inhibitors and combination therapies, pose potential threats by offering simplified or synergistic approaches. However, the specificity, safety profile, and patient preference for tafluprost remain significant advantages.

5. Market Challenges and Limitations

Pricing strategies, reimbursement policies, and formulary placements influence tafluprost’s market penetration. Limited awareness among clinicians unfamiliar with its unique formulation may hinder rapid adoption. Additionally, patent expirations, if any, could impact pricing and market share.

Financial Trajectory and Forecasting

1. Revenue Projections and Market Share

The global glaucoma drug market is projected to reach USD 5.8 billion by 2025, growing at a compound annual growth rate (CAGR) of approximately 4-6% (Source: MarketWatch). Tafluprost, currently holding a modest market share, is poised to expand as prescribing trends favor preservative-free therapies.

Considering its current sales trajectory, extrapolated growth hinges on factors such as:

- Geographical expansion: Increasing approvals in emerging markets.

- Prescriber education: Elevating awareness of its benefits.

- Patient preference shifts: Favoring preservative-free formulations.

Assuming a conservative CAGR of 8% for tafluprost within its niche segment, revenues could approach USD 200-300 million globally within five years, particularly if broader indications and combination products gain regulatory approval.

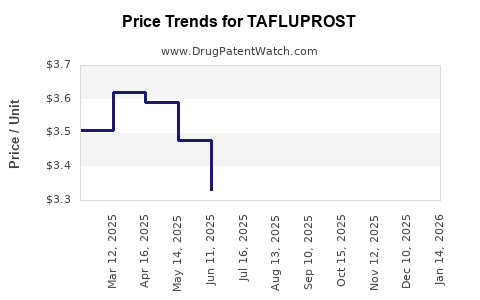

2. Pricing Dynamics and Reimbursement Landscape

Pricing remains a critical factor; tafluprost commands premium pricing in markets where preservative-free formulations are deemed essential. Reimbursement policies and insurance coverage influence uptake, especially in the U.S. and Europe where healthcare payers favor cost-effective, evidence-backed therapies.

3. Strategic Collaborations and Market Expansion

Partnerships with regional pharmaceutical firms and ophthalmology networks could accelerate market penetration. Licensing agreements for biosimilar or combination formulations may further enhance financial prospects.

4. Potential for Indication Expansion

Research exploring tafluprost’s utility in additional ocular conditions or as part of combination therapies could diversify revenue streams. Novel delivery systems, such as sustained-release implants, may also augment long-term sales.

Regulatory and Commercial Outlook

Regulators’ acceptance of preservative-free formulations, coupled with innovation in drug delivery, positions tafluprost favorably. The global shift toward personalized and tolerability-focused therapies suggests steady demand growth.

Commercially, companies investing in clinician education, patient awareness, and healthcare provider engagement are more likely to succeed in expanding tafluprost’s footprint.

Conclusion

Tafluprost’s market dynamics are driven by its differentiation as a preservative-free prostaglandin analog amid an expanding glaucoma population. Its financial trajectory appears promising, supported by increasing global prevalence, rising adoption of preservative-free formulations, and strategic market expansion. However, challenges persist from established competitors, pricing pressures, and regulatory hurdles.

As the ophthalmic pharmaceutical landscape evolves, tafluprost’s niche positioning and continued innovation will be key determinants of its long-term financial performance.

Key Takeaways

- Growing Patient Demographics: The rising global prevalence of glaucoma underpins ongoing demand for tafluprost and similar therapies.

- Unique Value Proposition: Its preservative-free formulation enhances patient tolerability, increasing its appeal amid a crowded market.

- Market Expansion Potential: Geographical and indication expansion, alongside strategic partnerships, can significantly boost revenues.

- Competitive Challenges: Dominance of existing prostaglandin analogs necessitates focused marketing and clinician education.

- Forecasted Growth: With cautious estimates, tafluprost’s revenues could approach triple digits in millions globally within five years, contingent on regulatory, market, and innovation factors.

FAQs

1. How does tafluprost differ from other prostaglandin analogs?

Tafluprost is distinct as a preservative-free formulation, reducing ocular surface irritation and improving tolerability, especially in sensitive patients, which can enhance adherence compared to preserved formulations.

2. What are the primary barriers to increasing tafluprost’s market share?

Barriers include strong brand loyalty to established agents like latanoprost, pricing and reimbursement policies, clinician awareness gaps, and limited geographic approval.

3. Is tafluprost approved for use in all major markets?

No. While approved in Japan, Europe, and the U.S., regulatory approvals are pending or absent in several emerging markets, limiting its global reach.

4. What future developments could impact tafluprost’s financial trajectory?

Advances in combination therapies, sustained-release formulations, and expanded indications can positively influence its revenue. Conversely, new competitors or biosimilars could exert pressure.

5. How significant is patient preference for preservative-free therapies in market growth?

Very significant. As clinicians recognize the benefits, patient demand for preservative-free formulations like tafluprost is expected to fuel adoption and drive revenue growth.

References

[1] Global Burden of Glaucoma. (2021). International Journal of Ophthalmology.

[2] MarketWatch. (2022). Glaucoma Drugs Market Size, Share & Trends.

[3] European Medicines Agency. (2012). Summary of Product Characteristics for Tafluprost.

[4] U.S. Food and Drug Administration. (2016). FDA Approval for Zioptan (Tafluprost).

[5] Research and Markets. (2021). Ophthalmic Drugs Market Analysis.