Last updated: July 28, 2025

Introduction

Potassium citrate, a potassium salt of citric acid, is a widely used pharmaceutical agent primarily prescribed for kidney stone prevention, metabolic acidosis correction, and urinary alkalization. Its global demand is influenced by evolving healthcare needs, regulatory landscapes, advancing formulations, and demographic shifts. This analysis examines the market dynamics shaping potassium citrate's commercial trajectory, alongside financial trends, to inform strategic decision-making.

Global Market Overview

The demand for potassium citrate is primarily driven by the rising prevalence of nephrolithiasis (kidney stones), which affects approximately 10-15% of the population worldwide[1]. The increasing incidence correlates with lifestyle factors such as obesity, dehydration, and dietary habits. The global market size was valued at USD 300 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of approximately 5.2% over the next five years, reaching USD 400 million by 2027[2].

Major markets include North America, Europe, Asia-Pacific, and Latin America, with North America commanding the largest share due to advanced healthcare infrastructure and high awareness levels. The Asia-Pacific region is anticipated to demonstrate the fastest growth owing to increasing urbanization, rising healthcare expenditure, and expanding pharmaceutical manufacturing capabilities.

Market Drivers

Rising Incidence of Kidney Stones

The surge in kidney stone cases remains the primary driver. Factors include aging populations, lifestyle-related health issues, and dietary changes. Potassium citrate's efficacy in reducing stone recurrence by alkalizing urine and increasing citrate levels sustains its demand[3].

Expanding Therapeutic Applications

Beyond nephrolithiasis, potassium citrate finds applications in conditions such as metabolic acidosis associated with chronic kidney disease and certain drug-induced acid-base disorders. Continuous research into its broader nephroprotective and metabolic benefits is likely to broaden its clinical use.

Innovations in Formulation and Delivery

Development of extended-release formulations and combination therapies aims to improve patient adherence and reduce side effects. Pharmaceutical companies investing in these innovations are capturing emerging market segments.

Regulatory Approvals and Reimbursement Policies

Stringent regulatory pathways in major markets necessitate robust clinical data. However, approved indications and inclusion in formularies bolster market penetration. Reimbursement policies, particularly in North America and Europe, support sustained sales.

Market Restraints

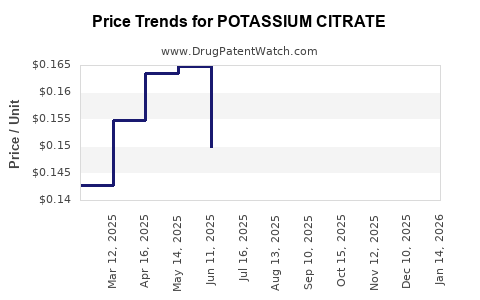

Generic Competition and Price Pressures

The availability of cheaper generic formulations hampers margins for branded entrants. Market saturation by multiple manufacturers exerts downward pressure on prices, impacting revenue growth.

Stringent Regulatory Environment

Regulatory hurdles for new formulations or higher dosage strengths can delay product launches. Compliance costs, notably in the U.S. and Europe, impact profitability.

Side Effects and Patient Preferences

Potential side effects like gastrointestinal discomfort and alternative therapies may influence patient preference and adherence. This challenge necessitates improved formulations and patient education.

Key Market Players and Competitive Landscape

Leading pharmaceutical companies, such as Mylan (a subsidiary of Viatris), Towa Pharmaceutical, and Fresenius Kabi, among others, dominate potassium citrate production. These players focus on manufacturing, marketing, and expanding their product portfolios through acquisitions and collaborations.

Market consolidation trends include mergers and acquisitions aimed at expanding manufacturing capacity and penetrating emerging markets. Strategic alliances with healthcare providers and payers enhance market reach.

Financial Trajectory and Revenue Outlook

Historical Financial Trends

Over the past five years, major manufacturers have reported steady revenue streams, with annual growth translating into cumulative revenues exceeding USD 1 billion globally. The revenue growth reflects increased adoption, improved formulations, and geographic expansion.

Projected Financial Performance

Forecasts suggest a compound annual growth rate of 5.2% from 2022 to 2027, driven by rising disease prevalence and expanded indications[2]. Gross margins remain moderate, averaging around 30-40%, affected by generic competition and pricing strategies.

Pricing and Market Penetration Strategies

Companies adopting value-based pricing, patient assistance programs, and targeted marketing are likely to improve margins and market share. Investments in R&D for novel formulations could command premium pricing and extend product lifecycle.

Emerging Trends

Personalized Medicine

Increasing emphasis on individualized therapy regimens may influence dosing strategies and formulations, opening niche markets.

Digital and Telehealth Integration

Remote monitoring of urinary pH and patient adherence apps can enhance treatment efficacy, aligning with the broader digital health movement.

Regulatory Innovations

Adaptive regulatory pathways and accelerated approvals for formulations targeting unmet needs could expedite market entry for innovative potassium citrate products.

Conclusion

The market for potassium citrate is poised for stable growth, underpinned by epidemiological trends and therapeutic advancements. Companies focusing on innovation, cost competitiveness, and regulatory compliance are well-positioned to capitalize on this trajectory. However, market entrants must navigate challenges such as generic competition and regulatory complexities effectively.

Key Takeaways

- The potassium citrate market is projected to grow at ~5.2% CAGR between 2022-2027, reaching USD 400 million globally.

- Major growth drivers include increasing kidney stone prevalence, expanding clinical indications, and formulation innovations.

- Market dynamics are heavily influenced by generic competition, pricing strategies, and regulatory environments.

- Financial performance remains steady, with innovations and geographic expansion critical to maintaining profitability.

- Strategic focus areas include R&D, digital health integration, and navigating regulatory landscapes to sustain growth.

FAQs

1. What are the primary clinical indications for potassium citrate?

Potassium citrate is mainly prescribed for kidney stone prevention, urinary alkalization, and correcting metabolic acidosis in chronic kidney disease.

2. How does generic competition impact the potassium citrate market?

The proliferation of generic versions exerts price pressure on branded products, reducing margins but also expanding market access through lower price points.

3. What emerging innovations are shaping the future of potassium citrate formulations?

Extended-release formulations, combination therapies, and patient-centered delivery systems are key innovations enhancing efficacy and adherence.

4. What regulatory challenges face pharmaceutical companies producing potassium citrate?

Regulatory hurdles include demonstrating bioequivalence for generics, securing approval for new indications, and ensuring compliance with evolving safety standards.

5. Which regions show the most promising growth opportunities for potassium citrate?

The Asia-Pacific region offers significant growth potential due to increasing healthcare investment and rising disease incidence, followed by North America and Europe.

Sources

[1] National Kidney Foundation. Kidney Stone Facts.

[2] MarketWatch. Potassium Citrate Market Size and Forecast.

[3] U.S. Food and Drug Administration. Approved Labeling for Potassium Citrate.