Last updated: July 27, 2025

Introduction

Podofilox, a topical antimitotic agent primarily employed for treating external genital warts, has established a niche within the dermatology and sexual health segments. Given the rising prevalence of human papillomavirus (HPV) infections and the consequent demand for effective wart management solutions, understanding the evolving market dynamics and financial trajectory of Podofilox is crucial for stakeholders—including pharmaceutical companies, investors, and healthcare providers. This analysis explores the core factors influencing the market, future growth prospects, competitive landscape, regulatory considerations, and key financial indicators shaping Podofilox’s trajectory.

Market Overview and Segmentation

Podofilox’s primary application lies in the treatment of external anogenital warts caused predominantly by HPV types 6 and 11. The product’s global market is segmented based on geography, end-user, and application:

- Geography: North America dominates due to high HPV awareness and prevalent healthcare infrastructure, followed by Europe and Asia-Pacific, where rising health awareness and improving medical access catalyze growth.

- End-User: Healthcare professionals, clinics, and patients leveraging over-the-counter formulations in some regions.

- Application: External genital warts—primarily in adult populations; narrower scope in other dermatological indications.

Market Drivers and Growth Catalysts

1. Rising Incidence of HPV and Genital Warts

The global burden of HPV-related conditions continues to escalate, with the CDC estimating approximately 12.5 million new HPV infections annually in the U.S. alone, leading to an increased focus on wart management therapies like Podofilox [1].

2. Increasing Awareness and Screening

Enhanced HPV screening programs and sexual health education are driving earlier diagnoses and treatment initiation, consequently boosting demand for topical agents such as Podofilox.

3. Patient Preference for Non-Invasive Therapies

Clinicians and patients prefer topical treatments over surgical interventions for genital warts, favoring safety, convenience, and minimal discomfort, thereby supporting Podofilox’s market position.

4. Pending Patent Expirations and Generic Competition

While Podofilox faces patent expirations in several regions, the entry of generics could expand accessibility, albeit with potential price competition influencing overall revenue.

Market Challenges and Restraints

1. Limited Therapeutic Spectrum

Podofilox’s narrow scope restricts its growth potential, particularly as newer immunomodulatory and laser therapies emerge.

2. Competition from Alternative Treatments

Imiquimod, sinecatechins, and cryotherapy offer alternative modalities, often with higher efficacy or patient preference, pressuring Podofilox’s market share.

3. Regulatory and Pricing Pressures

Stringent regulations concerning topical drug safety and variable reimbursement policies impact market expansion and profitability.

Financial Trajectory and Revenue Forecasts

Historical Performance

Worldwide sales of Podofilox approximated USD 150-200 million in recent years, driven primarily by the U.S., with steady growth fueled by HPV prevalence [2].

Projected Growth

Analysts forecast a Compound Annual Growth Rate (CAGR) of approximately 3–5% over the next five years, reaching an estimated USD 230–250 million by 2028. Factors supporting this include increased HPV awareness, expanded treatment guidelines, and rising rates among underserved populations.

Key Revenue Influencers

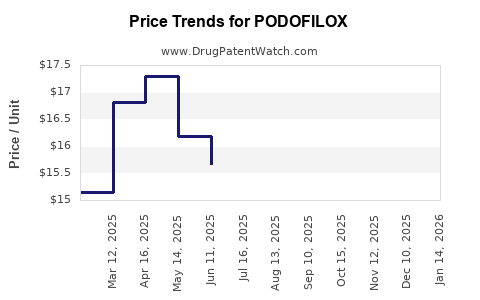

- Product pricing strategies and patent status.

- Geographic expansion into emerging markets.

- Adoption by non-specialist clinicians.

- Medical reimbursement frameworks and insurance coverage.

Regulatory Environment and Patent Landscape

Regulatory Approvals

Podofilox’s regulatory path has been well established in North America, with approvals from FDA, and in Europe via EMA pathways. Ongoing efforts focus on biosimilar developments and new formulations to improve efficacy and safety profiles.

Intellectual Property

Patent protections, primarily covering formulation and delivery methods, influence market exclusivity. The expiration of patents in certain jurisdictions is anticipated to introduce generic versions, impacting revenues and encouraging price competition.

Competitive Landscape

Podofilox's primary competitors include:

- Imiquimod (Aldara, Zyclara): An immune response modifier, often used for external genital and perianal warts, with broader indications.

- Sinecatechins (Veregen): A botanical immune response modifier approved for external genital warts.

- Cryotherapy: Physical destruction of warts, generally performed in clinical settings.

- Surgical removal: Complete excision in resistant cases.

Manufacturers focusing on optimizing formulations, reducing side effects, and broadening indications could influence competitive dynamics.

Emerging Trends and Future Opportunities

1. Novel Delivery Systems

Innovations such as nanotechnology and transdermal patches could enhance drug penetration, reduce application discomfort, and improve compliance.

2. Combination Therapies

Research into combining Podofilox with immune modulators or other topical agents may potentiate efficacy and expand treatment options.

3. Market Penetration in Developing Countries

Growing healthcare infrastructure and awareness in regions like Asia-Pacific and Latin America offer significant growth opportunities, especially with cost-effective generic formulations.

4. HPV Vaccination Synergy

Widespread vaccination programs reducing HPV incidence could indirectly diminish wart cases, potentially moderating long-term market growth.

Regulatory and Ethical Considerations

Ensuring compliance with regional drug safety regulations remains paramount, especially concerning topical application safety, carcinogenicity potential, and patient education. Transparent clinical data supporting efficacy and safety fortifies market confidence.

Conclusion and Outlook

Podofilox’s financial trajectory remains cautiously optimistic, buttressed by rising HPV prevalence, patient preference for topical treatments, and expanding awareness. However, market growth may be tempered by intense competition, patent expirations, and the advent of newer therapies. Strategic positioning—such as diversifying formulations, exploring novel delivery mechanisms, and entering emerging markets—can enhance revenue streams. Stakeholders should closely monitor regulatory developments, pricing strategies, and technological innovations to capitalize on opportunities while mitigating risks.

Key Takeaways

- The Podofilox market is driven by increasing HPV-related genital warts, patient preference for non-invasive therapy, and expanding awareness.

- Projected revenue growth of 3–5% CAGR reflects incremental but steady market expansion, with potential accelerators including geographic expansion and formulation improvements.

- Competitive pressures from alternatives like imiquimod and cryotherapy necessitate innovation and strategic differentiation.

- Patent expirations and generics will influence pricing and market share, emphasizing the importance of pipeline diversification.

- Emerging trends—such as advanced delivery systems and combination therapies—will shape future growth and landscape dominance.

FAQs

Q1: How does Podofilox compare to alternative treatments like imiquimod?

A: Podofilox offers a topical, outpatient solution with proven efficacy; however, imiquimod may induce a stronger immune response, potentially leading to higher clearance rates. Choice depends on patient-specific factors, side effect profiles, and clinician preference.

Q2: What is the impact of patent expiration on Podofilox’s market dominance?

A: Patent expiration opens the market to generic versions, likely reducing prices and expanding accessibility but potentially decreasing overall revenue for original manufacturers.

Q3: Are there ongoing developments to improve Podofilox formulations?

A: Yes, research focusing on enhancing delivery systems, reducing side effects, and broadening indications continues to evolve. Such innovations could significantly impact future sales.

Q4: What regions present the most promising growth opportunities for Podofilox?

A: Emerging markets in Asia-Pacific, Latin America, and parts of Africa hold substantial potential due to improving healthcare infrastructure, increasing HPV awareness, and demand for accessible treatment options.

Q5: How might HPV vaccination programs influence Podofilox’s market?

A: Widespread vaccination could reduce HPV infection rates, potentially decreasing the incidence of genital warts to some extent, which might moderate the long-term market size for Podofilox but could also shift focus toward post-vaccination management strategies.

References

[1] Centers for Disease Control and Prevention (CDC). HPV and Related Cancers. 2022.

[2] MarketWatch. Global Topical Wart Treatment Market Size and Forecast. 2023.