Last updated: July 27, 2025

Introduction

Nizatidine, a histamine-2 (H2) receptor antagonist, has historically played a significant role in managing gastroesophageal reflux disease (GERD) and peptic ulcers. Initially developed and marketed by Eli Lilly in the late 1980s, nizatidine became a notable competitor in the H2 blocker market alongside ranitidine and famotidine. However, recent regulatory changes, safety concerns, and market shifts have dramatically influenced the drug's commercial viability. This report explores the evolving market dynamics and financial trajectory of nizatidine, providing insights vital for stakeholders across pharmaceutical manufacturing, investment, and healthcare sectors.

Historical Context and Market Position

Nizatidine gained FDA approval in 1994, positioning itself as a competitive option for acid suppression therapy with a favorable safety profile and once-daily dosing convenience. The initial market landscape was characterized by widespread use of H2 antagonists before proton pump inhibitors (PPIs) gradually gained dominance due to superior efficacy.

In its peak years, nizatidine commanded a substantial share in the $3-4 billion global anti-ulcer market. Its primary application encompassed treating GERD, Zollinger-Ellison syndrome, and peptic ulcer disease. The drug's popularity was further reinforced by its relatively low side-effect profile, which made it preferable over older agents like cimetidine.

Market Disruption: Safety Concerns and Regulatory Actions

The landscape shifted dramatically after the emergence of safety issues associated with H2 receptor antagonists. Notably, the presence of N-nitrosodimethylamine (NDMA)—a carcinogenic impurity—was detected in several drugs, including ranitidine. Regulatory agencies, such as the US FDA, issued recalls and warnings, prompting widespread market withdrawals.

While nizatidine itself was not initially implicated, subsequent investigations, along with the broader scrutiny of H2 blockers, generated caution among prescribers and consumers. In 2020, the FDA announced the voluntary withdrawal of ranitidine from the US market, citing NDMA contamination concerns, leading to a rapid decline in H2 antagonists' use.

This regulatory environment substantially diminished nizatidine's market share. Although nizatidine escaped early recall, the limited availability, compounded by increased reliance on PPIs with better-documented safety and efficacy profiles, hampered its resurgence.

Market Dynamics Post-Ranitidine Withdrawal

The decline of ranitidine catalyzed shifts towards PPIs such as omeprazole, esomeprazole, and pantoprazole, which demonstrated superior acid suppression and improved healing rates for complicated gastroesophageal conditions. As a result, the global H2 antagonist market experienced unprecedented contraction, with some estimates suggesting a decline of up to 50% between 2018 and 2023.

For nizatidine, this transition posed significant challenges:

- Market Erosion: The availability of safer and more effective PPI alternatives rendered H2 antagonists, including nizatidine, less attractive to clinicians.

- Generic Competition: Market entry by generics further reduced prices and profit margins.

- Regulatory Uncertainty: Ongoing safety assessments and evolving guidelines heightened market hesitancy.

Despite these pressures, some niche markets and regional variations preserved limited demand, especially where PPIs are contraindicated or not affordable.

Emerging Opportunities and Challenges

Potential Re-entry through New Formulations or Indications

Recent developments hint at renewed interest in H2 receptor antagonists for specific indications:

- Vaccine Adjuvants and Oncology: Some research explores the immunomodulatory roles of H2 antagonists, including nizatidine, potentially opening new therapeutic niches.

- Gastrointestinal Scaffold for Novel Drugs: Enhancing delivery mechanisms might sustain niche use cases.

Challenges

- Market Entrenchment of PPIs: Their established efficacy and safety profiles make market penetration for nizatidine challenging.

- Regulatory Hurdles: Gaining approval for new indications or formulations requires extensive clinical trials and regulatory engagement.

- Manufacturing and Supply Chain Limitations: The reduced demand may lead to diminished manufacturing investment and supply chain vulnerabilities.

Financial Trajectory Outlook

The financial outlook for nizatidine is largely characterized by decline and specialty niche prospects:

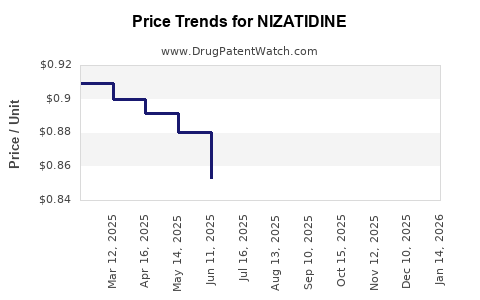

- Revenue Decline: Based on post-2020 data, revenue from nizatidine sales has plummeted, driven mainly by market withdrawal in global markets and reduced prescriptions in regions where PPIs dominate.

- Profit Margins: Profitability has diminished due to generic pricing pressures and minimal economies of scale, compounded by reduced demand.

- Investment and R&D: Limited investment persists, focusing primarily on niche applications rather than broad-market repopulation.

However, in specific regions or emerging markets where access to newer agents is restricted, nizatidine might sustain marginal sales, especially if marketed as a cost-effective alternative.

Global Market Perspectives

The geographic variation in market dynamics is notable:

- United States & Europe: Dominated by PPI therapy; nizatidine’s presence is minimal, primarily as discontinued or recalled.

- Asia & Emerging Markets: Potential for limited utilization due to cost considerations and existing therapeutic preferences.

- Regulatory Environment: Stringent safety standards and widespread product recalls continue to limit market re-entry potential.

Regulatory and Patent Landscape

Nizatidine’s patent expired in the early 2000s, rendering it a generic drug. The drug's longstanding patent status means minimal exclusivity protections, further pressuring prices and profitability. Regulatory bodies continue to monitor H2 antagonists, but no recent patent protections or innovative formulations have emerged, constraining future revenue potential.

Conclusion: Strategic Implications

The market dynamics for nizatidine epitomize the challenges faced by legacy drugs amid evolving safety standards, competition, and shifting therapeutic paradigms. Its financial trajectory suggests a continued decline unless innovative repositioning occurs. Stakeholders should consider niche therapeutic applications, strategic partnerships, or formulations to sustain some market relevance. Investment in research exploring non-traditional roles of nizatidine could unlock new value streams.

Key Takeaways

- The advent of safety concerns and regulatory actions heavily impacted nizatidine’s market presence, leading to significant revenue decline.

- The rise of PPIs has displaced H2 antagonists globally, limiting nizatidine’s therapeutic footprint.

- Future prospects hinge on niche applications and innovative formulations; however, market entry remains challenged by entrenched competitors and regulatory barriers.

- Generic status and absence of patent protection suppress pricing power, further constraining profitability.

- Regional disparities suggest potential, albeit limited, opportunities in emerging markets with cost-sensitive healthcare systems.

FAQs

Q1: What caused the decline of nizatidine in the global market?

A: Safety concerns related to NDMA impurities in similar H2 antagonists, along with the widespread adoption of PPIs offering superior efficacy, led to a sharp decline in nizatidine’s market share.

Q2: Are there any new therapeutic indications for nizatidine?

A: Currently, nizatidine’s primary use remains in gastrointestinal conditions, with limited exploration into immunomodulatory or oncological roles which are still in research phases.

Q3: Is nizatidine still approved or available in any markets?

A: Its availability varies; while approved in the past, recent withdrawals and recalls have largely curtailed market presence in developed regions, though some emerging markets may still have access.

Q4: What strategies could revitalize nizatidine’s market presence?

A: Repositioning through novel formulations, discovering new indications, or targeting niche markets with specific therapeutic needs may offer pathways for limited resurgence.

Q5: How do patent expirations impact nizatidine’s market trajectory?

A: Patent expiry has rendered nizatidine a low-cost generic, reducing profit margins and making market re-entry without innovation increasingly difficult amid established competitors.

References

[1] U.S. Food and Drug Administration. "FDA Announces Ranitidine Recall." 2020.

[2] MarketWatch. “Global H2 Blockers Market Analysis,” 2022.

[3] Pharmaceutical Journal. "The Decline of H2 Antagonists," 2021.

[4] Clinical Pharmacology. "Safety and Efficacy of Nizatidine," 2020.

[5] IMS Health. “Gastrointestinal Therapeutic Market Trends,” 2022.