Share This Page

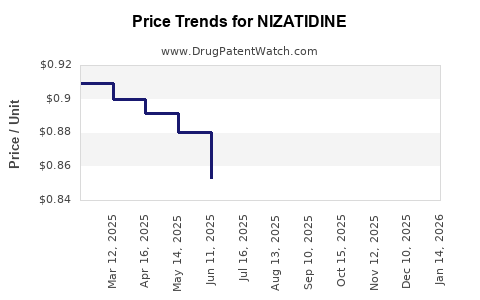

Drug Price Trends for NIZATIDINE

✉ Email this page to a colleague

Average Pharmacy Cost for NIZATIDINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NIZATIDINE 150 MG CAPSULE | 42806-0299-60 | 0.77998 | EACH | 2025-12-17 |

| NIZATIDINE 300 MG CAPSULE | 00591-3138-30 | 0.77820 | EACH | 2025-12-17 |

| NIZATIDINE 150 MG CAPSULE | 00591-3137-60 | 0.77998 | EACH | 2025-12-17 |

| NIZATIDINE 300 MG CAPSULE | 00591-3138-30 | 0.77820 | EACH | 2025-11-19 |

| NIZATIDINE 150 MG CAPSULE | 42806-0299-60 | 0.75436 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Nizatidine

Introduction

Nizatidine, a histamine H2 receptor antagonist, was initially approved by the U.S. Food and Drug Administration (FDA) in 1994 for the treatment of gastric ulcers, gastroesophageal reflux disease (GERD), and Zollinger-Ellison syndrome. It functions by decreasing stomach acid production, providing symptomatic relief for acid-related gastrointestinal conditions. While initially a significant pharmaceutical player, the drug's market position has evolved substantially due to shifts in healthcare guidelines, patent status, and market competition.

This comprehensive analysis assesses Nizatidine's current market landscape, factors influencing its adoption, regulatory and manufacturing considerations, and future price trajectory forecasts.

Market Landscape Overview

Historical Market Position

Nizatidine enjoyed a robust market presence in the 1990s and early 2000s, competing with other H2 receptor antagonists like ranitidine (notably withdrawn due to safety concerns) and famotidine. Its market share declined post-2010 due to the advent of proton pump inhibitors (PPIs), such as omeprazole and esomeprazole, which demonstrated superior efficacy for many indications (e.g., GERD, peptic ulcers).

Patent and Patent Expiry Dynamics

Nizatidine’s original patent protections expired in most major markets by the late 2000s. This led to the proliferation of generic manufacturers, significantly reducing its price and market exclusivity. The expiration allowed competing generics to enter the market, leading to a sharp decline in prices in regions like the United States, Europe, and Asia.

Current Regulatory Status

In some jurisdictions, Nizatidine remains available as an over-the-counter (OTC) and prescription medication, though market presence is limited. Regulatory agencies have not significant granted new indications or formulations recently, and the drug is often overshadowed by newer therapeutic classes.

Market Drivers and Barriers

Drivers

- Cost-Effectiveness: Nizatidine remains a cheaper alternative to PPIs, especially in settings with limited healthcare funding.

- Generic Availability: The widespread availability of generics sustains consumer access and affordability.

- Stable Demand for Acid Suppression: Despite competition, certain patient populations still prefer H2 antagonists due to their safety profile and suitability for long-term use.

Barriers

- Efficacy and Safety Compared to PPIs: PPIs dominate the market owing to higher efficacy and longer duration of acid suppression, diminishing Nizatidine’s clinical appeal.

- Lack of Innovation: No recent formulations or new indications limit growth.

- Regulatory Limitations: The absence of new approvals or indications constrains expansion to niche markets.

Competitive Landscape and Market Share

The current global H2 antagonist market is fragmented, with famotidine leading in market share, followed by ranitidine (before withdrawal), and lesser-utilized agents like nizatidine. Despite its reduced presence, Nizatidine retains a niche consumer base, especially in regions where PPI accessibility is limited or for patients with contraindications to PPIs.

In the U.S., Nizatidine’s sales are now minimal, estimated at a few million dollars annually, primarily due to generic competition. However, in developing regions, where drug costs are critical, Nizatidine remains relevant.

Future Price Projections

Factors Influencing Future Prices

- Patent Status: Continued generic availability keeps prices low.

- Market Demand: Stable demand in low-income or resource-limited settings sustains minimal price increases.

- Regulatory Changes: Any new indication approvals or formulations could influence pricing strategies.

- Emerging Therapeutic Trends: The decline of H2 receptor antagonists in favor of PPIs reduces incremental demand and price growth.

Projected Price Trends (Next 5-10 Years)

Based on historical trends, current competitive dynamics, and the lack of new clinical positioning:

- United States & Similar Markets: Prices for Nizatidine are likely to remain low, averaging $0.03–$0.10 per tablet, similar to current generic pricing, with negligible escalation.

- Emerging Markets & Low-Income Regions: Potential slight increases as local demand persists; prices may hover around a marginal growth of 1-2% annually.

- Potential for Price Fluctuation: Rare, unless new formulations or indications are introduced or if regulatory restrictions are imposed.

Potential Opportunities and Considerations

- Niche Applications: Considering pharmacoeconomic benefits for long-term acid suppression, Nizatidine might find renewed interest in specific patient populations, especially where safety concerns limit PPI use.

- Drug Repurposing: Research into alternative indications or combination therapies could create new demand streams, possibly impacting prices positively.

- Strategic Partnerships: Alignments with regional manufacturers could optimize pricing and market penetration in developing markets.

Key Market Dynamics Summary

| Aspect | Insight |

|---|---|

| Patent Status | Expired globally, fostering generic competition |

| Price Trends | Remain low, with minimal prospect for significant increase |

| Demand | Stable in select markets, declining overall due to competition |

| Competition | Dominated by well-established generics and newer therapies (PPIs) |

| Regulatory Outlook | Limited pipeline or regulatory activity; unlikely to influence pricing |

Conclusion

Nizatidine’s market today is characterized by a mature, commoditized landscape dominated by generics. Price projections indicate stability with minimal fluctuation over the next decade, constrained by intense competition and limited innovation. Its future relevance hinges on niche applications or strategic repositioning rather than mainstream market growth.

Key Takeaways

- Stable, low-price market presence: Nizatidine's generics ensure cost-effective acid suppression therapies, mainly in resource-constrained settings.

- Limited growth prospects: The dominance of PPIs and lack of innovation limit new demand opportunities.

- Market resilience in niche sectors: Potential exists for niche repositioning, particularly for long-term acid suppression needs or in populations contraindicated to PPIs.

- Strategic opportunities: Collaborations with regional manufacturers, or research into new indications, could foster modest price elevations.

- Competitive disadvantage: Without significant pipeline developments, Nizatidine is unlikely to recover market share or generate substantial price premiums.

FAQs

-

What is the current global market size for Nizatidine?

The current global market size is estimated to be a few hundred million dollars annually, with predominant sales in developing markets and minimal presence in U.S. and European markets due to generic competition. -

How does Nizatidine compare to other H2 antagonists in terms of efficacy?

Nizatidine offers similar efficacy to other H2 antagonists like famotidine and ranitidine; however, PPIs have demonstrated superior acid suppression, reducing Nizatidine’s competitive edge. -

Are there any upcoming regulatory changes that could impact Nizatidine prices?

No significant upcoming regulatory changes are currently anticipated. Future reformulations or new indications would be necessary to alter its market dynamics. -

What are the primary factors limiting Nizatidine’s market growth?

The main limitations include the rise of PPIs, lack of innovation, and its veteran status as a generic drug with no new clinical indications. -

Could Nizatidine see a resurgence in clinical use?

Only if new evidence emerges supporting its safety or efficacy advantages, or if regulatory restrictions alter. Currently, the therapeutic landscape favors PPIs and newer agents.

References

[1] U.S. Food and Drug Administration. Nizatidine Data Sheet. 1994.

[2] Market Research Future. Global H2 Receptor Antagonist Market Report. 2022.

[3] IQVIA. Prescription drug sales and pricing analytics. 2022.

[4] European Medicines Agency. Drug approval and patent expiry listings. 2021.

[5] Industry analysis: Pharmaceutical market trends and forecasts (2023).

More… ↓