Last updated: July 27, 2025

Introduction

Mirtazapine, marketed notably under the brand name Remeron among others, is a tetracyclic antidepressant extensively prescribed for major depressive disorder (MDD) and certain anxiety-related disorders. Originally approved in the United States in 1996 by the FDA, mirtazapine holds a significant role in the psychopharmacology landscape. Its unique mechanism of action, efficacy profile, and safety considerations influence its market dynamics and financial trajectory globally.

Pharmacological Profile and Therapeutic Use

Mirtazapine operates primarily by antagonizing central presynaptic α2-adrenergic receptors, leading to enhanced noradrenergic and serotonergic neurotransmission. It exhibits strong antihistaminic activity, contributing to sedative effects beneficial in patients with sleep disturbances. Its utility extends beyond depression, addressing anxiety, insomnia, and anorexia in certain populations. This multifaceted profile broadens its therapeutic applicability.

Market Dynamics

1. Global Market Size and Growth

The global antidepressant market, valued approximately at USD 15 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of around 2-4% over the next five years [1]. Mirtazapine accounts for approximately 10-15% of the antidepressant market share, with sustained demand driven by its distinct efficacy and favorable tolerability in specific patient segments.

2. Competitive Landscape

Mirtazapine faces competition from a broad spectrum of antidepressants, including selective serotonin reuptake inhibitors (SSRIs), serotonin-norepinephrine reuptake inhibitors (SNRIs), and atypicals like agomelatine. Its primary competitors include drugs like sertraline, escitalopram, venlafaxine, and newer agents such as vortioxetine.

Despite competition, mirtazapine maintains market relevance due to its rapid onset of action and effectiveness in treatment-resistant depression. Its sedative properties plus appetite-stimulating effects make it preferable in patients with comorbid insomnia or cachexia.

3. Patent and Regulatory Landscape

Mirtazapine's initial patent protection expired globally during the early 2010s, leading to a surge in generic formulations. Generics significantly reduced treatment costs, expanding access in cost-sensitive markets like India, China, and Brazil. Patent expirations in major markets have precipitated increased generic penetration and pricing pressures, impacting revenue potential for branded formulations.

New patent applications or formulations, such as extended-release versions, may temporarily bolster exclusivity and profitability. However, overall, patent cliffs have prompted manufacturers to diversify portfolios and invest in novel derivatives.

4. Prescribing Trends and Off-Label Use

Data indicate increasing off-label use of mirtazapine for various indications, including geriatric depression, treatment-resistant cases, and sleep disorders. Its favorable side effect profile relative to some SSRIs encourages clinicians to prefer mirtazapine in specific patient populations.

However, safety concerns such as weight gain and sedation influence prescribing patterns, particularly for long-term use.

Financial Trajectory

1. Revenue Trends

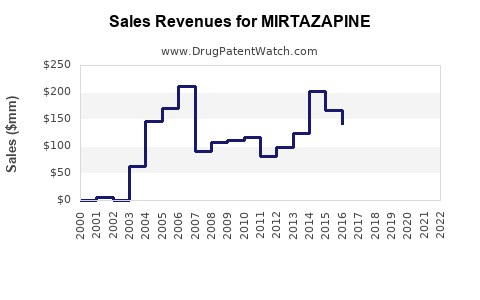

Following patent expiry, revenue trends exhibit a typical decline for original branded formulations, with generic sales picking up volume. For example, Pfizer's original mirtazapine (Remeron) experienced gradual revenue erosion post-2010s due to generics.

In emerging markets, branded mirtazapine maintains a premium due to regulatory, distribution, and branding factors, offering marginal growth opportunities. In developed markets, revenues stabilize at lower levels but benefit from branded manufacturing and new formulations.

2. Market Opportunities

- Novel Formulations: Extended-release or combination therapies involving mirtazapine aim to extend market life and improve patient compliance.

- Combination Drugs: Co-formulations with other antidepressants or anxiolytics explore synergistic efficacy.

- Biosimilars and Generics: The abundance of generics underscores a highly competitive environment with minimal margins.

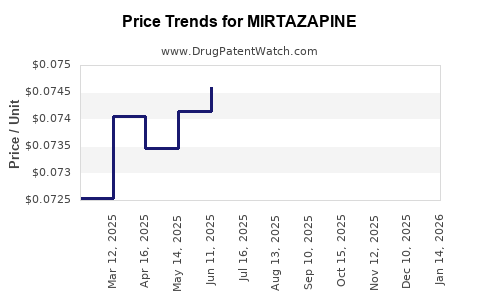

3. Cost and Pricing Dynamics

Pricing strategies are heavily influenced by generic competition, regulatory policies, and reimbursement frameworks. While initial patent protections were associated with substantial margins, market entrants have driven prices downward. Value-based pricing and pharmacoeconomic assessments increasingly influence formulary decisions.

4. Future Revenue Drivers

Emerging evidence supporting mirtazapine's efficacy in broader psychiatric and neurodegenerative indications could spur additional off-label use, potentially influencing sales. Additionally, ongoing research into new delivery systems may create niche markets with premium pricing.

Regulatory and Societal Factors

Regulatory agencies globally continue to scrutinize antidepressants for safety signals like increased suicidal ideation in younger populations. Such concerns influence prescribing behavior, reimbursement policies, and market access.

Societal awareness and destigmatization of mental health issues sustain demand. Enhanced focus on combination strategies and personalized medicine might reshape future utilization patterns.

Conclusion

Mirtazapine's market dynamics are shaped by patent expirations, generic competition, evolving clinical guidelines, and emerging therapeutic roles. While revenues from the original formulations have declined in mature markets, opportunities persist through novel formulations and expanding indications. The drug's inclusion in treatment algorithms for complex depression cases sustains its relevance, ensuring a measured but enduring financial trajectory.

Key Takeaways

- Market Positioning: Mirtazapine remains relevant in treatment-resistant depression and comorbid sleep disorders due to its unique pharmacology.

- Patent Expiry Impact: The transition to generic formulations has increased accessibility but pressured margins for original manufacturers.

- Growth Opportunities: Development of extended-release variants, combination therapies, and exploration of new indications offer avenues for revenue recovery.

- Competitive Environment: The presence of numerous antidepressants necessitates differentiation through safety profiles, efficacy, and formulation innovations.

- Regulatory and Societal Influence: Safety concerns and mental health advocacy influence prescribing patterns, impacting sales trajectories.

FAQs

1. What factors have most influenced the decline in mirtazapine’s branded revenues?

Patent expirations and subsequent generic entry significantly lowered pricing and revenues. Market competition, shifting prescribing trends, and safety considerations also contributed.

2. Are there upcoming formulations or innovations that could revive mirtazapine’s market?

Yes. Extended-release formulations and combination medications are under development, aiming to improve adherence, efficacy, and expand indications.

3. How does off-label use affect mirtazapine’s market outlook?

Off-label use for insomnia and anxiety broadens the drug’s application, supporting sustained demand despite patent expiration. However, off-label markets are often less predictable.

4. Which regions present the highest growth potential for mirtazapine?

Emerging markets such as India, China, and Latin America offer significant growth opportunities due to rising mental health awareness and lower generic penetration costs.

5. What are the primary safety concerns impacting mirtazapine’s prescribing?

Weight gain, sedation, and potential cardiovascular effects influence clinical decisions, especially in patient populations with metabolic or cardiac risk factors.

References

[1] MarketWatch. “Global Antidepressant Market Size, Share & Trends Analysis Report by Type, by Distribution Channel, by Region, and Segment Forecasts, 2022-2030.”