Last updated: July 29, 2025

Introduction

Metaxalone, marketed under the brand name Skelaxin among others, is a centrally acting muscle relaxant primarily prescribed for the management of acute musculoskeletal conditions. Its therapeutic profile, market positioning, and evolving regulatory landscape shape its commercial trajectory. This analysis explores the nuanced market dynamics and financial prospects influencing metaxalone’s growth trajectory, incorporating historical trends, current demand drivers, and future growth opportunities within the global pharmaceutical landscape.

Pharmacological Profile and Therapeutic Indications

Metaxalone functions by depressing central nervous system activity to alleviate muscle spasms and associated pain. Approved by the U.S. Food and Drug Administration (FDA) in 1962, its primary indication pertains to short-term treatment of discomfort associated with musculoskeletal conditions [1]. It is often used in conjunction with physical therapy and other analgesics, positioning it as a complementary component within pain management protocols.

Despite its longstanding clinical presence, metaxalone remains a niche agent in the broader muscle relaxant market, overshadowed by alternatives like cyclobenzaprine, tizanidine, and methocarbamol, which often promise superior efficacy or more favorable side effect profiles. Nonetheless, metaxalone’s minimal sedative effects and muscle relaxant properties sustain its clinical utility, especially where specific patient tolerability is concerned.

Market Dynamics Influencing Metaxalone

1. Market Demand Drivers

The global musculoskeletal disorder (MSD) market, of which metaxalone is a component, is driven by increasing prevalence rates, aging populations, and rising sedentary lifestyles. The CDC estimates that nearly 50% of adults experience musculoskeletal pain annually [2], fostering steady demand for muscle relaxants.

Moreover, the COVID-19 pandemic amplified the importance of remote and non-invasive treatments, potentially narrowing reliance on pharmacotherapies like metaxalone that do not require clinician visits or invasive procedures. As outpatient management becomes more prevalent, the demand for oral muscle relaxants persists, bolstering market stability.

2. Competitive Landscape

The market position of metaxalone is shaped by fierce competition among muscle relaxants. Cyclobenzaprine remains dominant due to extensive clinical data, affordability, and formulary prevalence. Tizanidine and methocarbamol also compete effectively with different efficacy and side-effect profiles.

In recent years, the advent of biologic agents and potent analgesics has importantly shifted some of the treatment landscape away from traditional muscle relaxants, including metaxalone. These newer modalities target underlying inflammatory pathways or chronic pain syndromes, thereby reducing the relative market share of older agents.

3. Regulatory and Patent Status

Metaxalone’s generic status since patent expiry limits pricing power, constrains revenue growth potential, and intensifies generic competition. Patent protections are vital to maintaining exclusivity; however, for metaxalone, these protections have long lapsed, leading to price erosion typical of many older, off-patent medicines.

Additionally, regulatory constraints such as restrictions on off-label use and evolving safety profiles impact market dynamics. Although generally considered safe, reports of hepatotoxicity and hypersensitivity reactions necessitate careful regulatory oversight. The ongoing monitoring influences both prescribing practices and market willingness to invest in marketing campaigns.

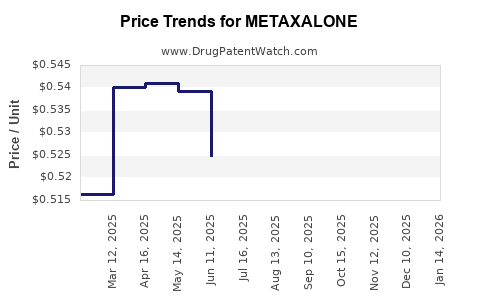

4. Pricing and Reimbursement Environment

In the U.S. and other developed markets, pricing pressures from payers heavily influence sales. As a generic drug, metaxalone’s affordability supports continued utilization where prescribers favor cost-effective options. However, shrinking reimbursement margins and mandatory formulary restrictions challenge profitability for suppliers.

Emerging markets present opportunities via expanding healthcare infrastructure and rising healthcare expenditure, with pricing strategies adjusted to local income levels. However, price sensitivity remains a strategic hurdle for stakeholders seeking higher profit margins.

5. Innovative Developments and R&D Landscape

Pharmaceutical companies focus R&D efforts on newer molecules with better efficacy, fewer side effects, or unique delivery methods. Metaxalone’s formulation modifications or combination therapies have shown limited development interest, given the crowded and competitive landscape.

Nonetheless, there remains potential for lifecycle management strategies, such as extended-release formulations or fixed-dose combinations, which could improve patient adherence and clinical outcomes, thereby influencing future market prospects.

Financial Trajectory and Revenue Analysis

The financial trajectory of metaxalone hinges on multiple factors, including market penetration, manufacturing costs, pricing strategies, and competitive positioning.

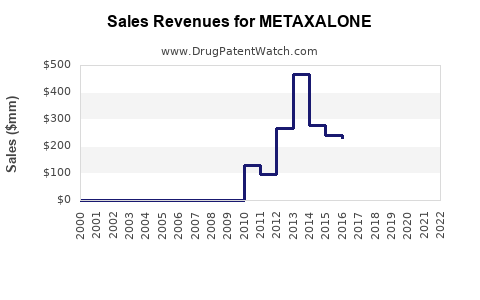

1. Historical Sales Data

Although precise global sales figures for metaxalone are sparse due to its age and generic status, estimated annual sales in the U.S. marketplace have historically ranged in the low hundred-million-dollar bracket. Post-patent expiry and generic competition have driven sales downward from peak levels observed in the late 1990s and early 2000s.

2. Revenue Projections

Given the current landscape, revenue projections for metaxalone are modest and characterized by stagnation or slight decline. Markets with increasing musculoskeletal disorder prevalence or limited generic penetration could stabilize revenues. Conversely, market saturation and price erosion constrain growth prospects.

Emerging markets may offer growth opportunities, buoyed by expanding healthcare access and affordability. Estimated compound annual growth rates (CAGR) for such generic products stand at approximately 1-3%, reflecting overall market conditions.

3. Cost and Margin Considerations

Manufacturing costs are relatively low for metaxalone, typical of oral generics. Profit margins are squeezed by price competition, regulatory compliance costs, and patent expirations. Companies adopting lifecycle management tools—such as authorized generics or novel formulations—aim to sustain profitability and market share.

4. Impact of Patent and Market Exclusivity

The absence of patent protection since the 1980s has meant minimal exclusivity rights, forcing manufacturers to compete primarily on price. Strategies for premium positioning or niche indications are limited, emphasizing cost leadership.

5. Market Entry and Expansion Strategies

Regional expansion into emerging markets offers potential revenue growth. Local manufacturing partnerships and adaptation to regional regulatory standards can facilitate market entry. However, presence in these markets often involves price sensitivity and competitive pressures from local or low-cost generic manufacturers.

Future Outlook

The future of metaxalone resides in a stable, mature market with limited growth potential but consistent demand driven by the prevalence of musculoskeletal conditions. Main drivers include:

- Population aging: As elderly populations grow globally, demand for short-term musculoskeletal relief could stabilize or slightly increase.

- Emerging markets: Expanding healthcare infrastructure presents opportunities for incremental sales.

- Formulation innovations: Development of combination therapies or extended-release formulations could provide differentiation, albeit with limited impact given the crowded generic landscape.

- Regulatory stability: Maintaining acceptable safety profiles and compliance will be critical in preserving market share.

However, competition from newer, potentially more effective agents remains a significant challenge, constraining pricing power and revenue growth prospects.

Key Takeaways

- Market Demand: The global migration towards conservative and outpatient management sustains demand for muscle relaxants, including metaxalone, though the growth rate remains modest.

- Competitive Dynamics: The substitution effect from newer agents and the dominance of generics exert downward pressure on prices and margins.

- Regulatory and Pricing Environment: Patent expiry and reimbursement constraints have led to a saturated, low-margin market environment.

- Growth Opportunities: Emerging markets, lifecycle management, and formulation innovations represent potential avenues for limited growth.

- Outlook Summary: Metaxalone will likely maintain a steady but flat financial trajectory, with peaks and troughs dictated by regional market developments and competitive pressures.

Conclusion

Metaxalone’s market dynamics reflect a crowded, mature segment dominated by generic competition and limited innovation. While it remains a clinically relevant option for short-term musculoskeletal management, the financial outlook is constrained by pricing pressures and competition. Strategic shifts toward entering emerging markets and exploring formulation innovations could marginally improve its economic profile, but significant growth remains unlikely in the foreseeable future.

FAQs

1. What factors have historically influenced metastalone’s market share?

Market share has been primarily influenced by patent expiration, competition from newer muscle relaxants, and price sensitivity within generic markets, leading to a decline in sales over time.

2. How does patent status impact metaxalone’s marketability?

Following patent expiry, patent protections no longer provide exclusivity, intensifying generic competition and reducing pricing power, thus capping revenue potential.

3. Are there any ongoing developments or innovations in metaxalone formulations?

Currently, there are limited developments; most efforts focus on generic manufacturing. Lifecycle management strategies like extended-release formulations have not demonstrated significant market impact.

4. What regional markets offer growth opportunities for metaxalone?

Emerging markets in Asia, Latin America, and Africa present growth potential due to expanding healthcare infrastructure and demand for affordable therapeutics.

5. How do safety and regulatory concerns affect metaxalone’s market prospects?

Concerns about hepatotoxicity and hypersensitivity reactions necessitate regulatory vigilance, potentially limiting off-label use and affecting prescriber confidence in some regions.

Sources:

[1] U.S. Food and Drug Administration. Skelaxin (metaxalone) approval history.

[2] Centers for Disease Control and Prevention. Musculoskeletal pain prevalence statistics.