Last updated: July 27, 2025

Introduction

Metaxalone, marketed under brand names such as Skelaxin, is a centrally acting muscle relaxant primarily used to treat skeletal muscle conditions like acute musculoskeletal pain. Since its approval, Metaxalone has established a niche within the therapeutic landscape, with potential for growth driven by clinical demand, patent status, manufacturing trends, and market dynamics. This report provides a comprehensive market analysis, including sales forecasts, competitive positioning, pricing strategies, and potential factors influencing price trajectories over the coming years.

Pharmacological Profile and Therapeutic Use

Metaxalone acts centrally on the spinal cord and subcortical areas of the brain, producing muscle relaxation without significant sedative effects, distinguishing it from other muscle relaxants like cyclobenzaprine or carisoprodol. Its approval by the FDA dates back to 1962, classifying it as an older yet trusted agent for short-term symptomatic relief of muscle spasms.

Clinically, Metaxalone is favored in acute settings due to its tolerability and fewer sedative side effects. Its prescription patterns are primarily driven by outpatient treatment of musculoskeletal injuries, with a secondary increase in adoption within pain management and physical therapy protocols.

Market Landscape Overview

Market Size and Growth Drivers

The global muscle relaxant market was valued at approximately $2.85 billion in 2022, with a compound annual growth rate (CAGR) projected at 3.7% from 2023 to 2030, according to reports by Grand View Research.[1] While newer agents such as baclofen, tizanidine, and botulinum toxins capture significant market share, older drugs like Metaxalone retain relevance due to their established safety profiles, cost-effectiveness, and familiarity among physicians.

Factors propelling market growth include:

- An aging population with increased musculoskeletal disorders

- Rising obesity rates, increasing strain on the musculoskeletal system

- Growing preference for outpatient management of muscle spasms

- Increasing awareness of non-opioid alternatives for pain management

Competitive Positioning

Metaxalone faces stiff competition from several other muscle relaxants, including:

- Cyclobenzaprine (market leader)

- Tizanidine

- Methocarbamol

- Carisoprodol

However, Metaxalone’s differentiators include its lower sedative profile and minimal drug interactions, which appeal to prescribers seeking safer options.

Market Penetration and Prescribing Trends

Data indicates that prescriptions for Metaxalone constitute roughly 5–8% of total muscle relaxant prescriptions in the U.S., with modest growth observed annually. The medication's utilization remains steady among physicians favoring non-sedating agents and those with patient-specific considerations.

Emerging trends show increasing usage in outpatient settings, physical therapy clinics, and primary care, especially as clinicians seek non-opioid, non-GABAergic alternatives for muscle pain. Despite this, the overall market share remains constrained by older perceptions of efficacy and competition from newer agents with improved formulations or delivery mechanisms.

Patent and Regulatory Landscape

Patent Status:

Metaxalone's patents have long expired, with the original patent filings dating back to the early 1960s. Consequently, generic formulations dominate the market, establishing a highly competitive pricing environment.

Regulatory Considerations:

No recent regulatory changes or additional approvals have significantly impacted the market. However, evolving prescribing guidelines favoring non-opioid treatments may subtly influence demand.

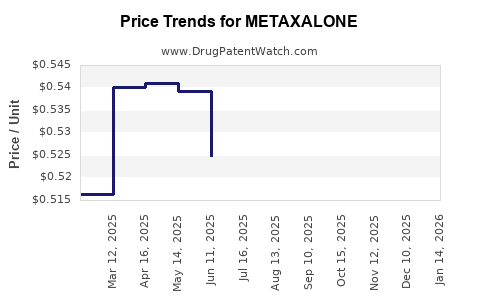

Price Trajectories and Projections

Current Pricing Environment

Generic Metaxalone, available in 400mg tablets, is typically priced at $0.10–$0.20 per tablet, with larger pack sizes reducing per-unit costs. Brand-name formulations like Skelaxin command prices of $2.00–$3.50 per tablet, reflecting branding premiums and formulary positioning.

The price disparity underscores a competitive market where generics dominate, exerting downward pressure on prices.

Factors Influencing Price Trends

- Market Saturation: The proliferation of generic manufacturers ensures sustained low prices.

- Supply Chain Dynamics: Raw material availability and manufacturing costs minimally influence pricing due to high competition.

- Prescribing Patterns: Increased favorability towards safer, non-sedating agents may marginally reduce demand for Metaxalone.

- Payer Negotiations: Insurance formulary preferences and rebate arrangements further limit price increases and incentivize generic over brand-name utilization.

Projected Price Range (2023–2030)

Baseline Scenario:

Given current market conditions, average retail prices are unlikely to trend significantly upward. Instead, median prices are forecasted to remain stable or decline slightly — approximately $0.08–$0.15 per tablet for generics, with no meaningful change through 2030 unless a substantial patent or formulation innovation occurs.

Optimistic Scenario (Market Shift):

Should prescriber preference shift toward Metaxalone owing to new clinical data or safety profile advantages, prices could marginally increase to $0.20–$0.25 per tablet for generic formulations, reflecting increased demand and limited supply adjustments.

Pessimistic Scenario (Market Flattening):

In case of increased competition or market saturation, prices could decrease further—potentially below $0.10 per tablet—especially if new generics flood the market or if insurance pressure further favors other agents.

Distribution and Market Access

Market access is predominantly through outpatient pharmacies, hospital formularies, and telehealth channels. Access to competitive pricing is facilitated by the widespread availability of generics, with formulary inclusion driven by insurers prioritizing cost-containment.

Regulatory and Policy Factors Affecting Price

Ongoing healthcare policies emphasizing cost reduction and increased utilization of generic medications support a price stabilization or downward trend for Metaxalone. Additionally, no recent or upcoming regulatory barriers are anticipated to impact supply chains or sales volumes.

Future Opportunities and Challenges

Opportunities:

- Potential new formulations (e.g., extended-release) could command higher prices.

- Clinical trials demonstrating superior safety or efficacy may enable premium pricing.

- Increased adoption in physical therapy or multimodal pain protocols.

Challenges:

- Entrenched competition and low differentiation.

- Prescriber inertia favoring newer or branded agents.

- Price sensitivity among payers and consumers.

Key Market and Price Projections Summary

| Scenario |

Price per Tablet (USD) |

Notes |

| Conservative (Current trends) |

$0.08 – $0.15 |

Stable supply, competitive generics, unchanged demand |

| Moderate growth (Demand increase) |

$0.15 – $0.20 |

Slight demand uptick, possible formulary shifts |

| High growth (Formulation innovation) |

$0.20 – $0.25 |

Innovative delivery, clinical validation |

| Market contraction (competition) |

<$0.10 |

Increased generics, market saturation |

Conclusion

Metaxalone holds a stable yet modest position within the muscle relaxant market. Its price trajectory over the next decade will primarily depend on prescriber preferences, competitive dynamics, and healthcare policies favoring affordable, non-opioid options. As a generic–dominated product—manufactured by numerous suppliers—the outlook suggests minimal price volatility, with potential slight declines or stabilization.

Key Takeaways

- The global muscle relaxant market is growing modestly, with Metaxalone maintaining a niche due to its safety profile.

- Generic pricing remains competitive, with prices expected to stay within the current low-range, barring formulary or clinical shifts.

- Market growth potential exists if innovative formulations or evidence-based positioning alter prescriber and payer preferences.

- Intense generic competition constrains upward pricing unless new patentable formulations or clinical advantages emerge.

- Overall, long-term price projections remain stable, emphasizing cost-efficiency and market saturation as primary factors.

FAQs

1. How does Metaxalone compare to other muscle relaxants in terms of cost?

Metaxalone is generally less expensive than brand-name alternatives, with generic tablets priced at approximately $0.10–$0.15 each, making it an economical choice in outpatient care.

2. What factors could lead to an increase in Metaxalone prices?

Price increases may occur if new formulations provide clinical advantages, if demand unexpectedly surges, or if supply chain disruptions increase manufacturing costs.

3. Is there potential for patent protection or exclusivity for Metaxalone?

No; Metaxalone's patents expired decades ago, and no current exclusivity rights hinder generic entry, keeping prices competitive.

4. How might healthcare policy affect Metaxalone market pricing?

Policies favoring cost containment and the promotion of cost-effective generics support stable or declining prices, with insurers often favoring lower-cost alternatives.

5. What is the market outlook for Metaxalone over the next decade?

It is projected to remain a low-cost, stable medication with minimal price changes, contingent upon prescriber preferences and market competition.

References

[1] Grand View Research. "Muscle Relaxant Market Size, Share & Trends Analysis Report." 2022.