Last updated: November 17, 2025

Introduction

Liraglutide, marketed under brand names such as Victoza and Saxenda, is a once-daily injectable glucagon-like peptide-1 (GLP-1) receptor agonist developed by Novo Nordisk. It is approved for managing type 2 diabetes mellitus (T2DM) and obesity. With its expanding therapeutic indications, evolving regulatory landscape, and a competitive pharmaceutical environment, understanding the market dynamics and financial trajectory of liraglutide offers insights into its commercial potential and strategic positioning.

Market Overview

Therapeutic Indications and Growing Demand

Liraglutide primarily targets two indications:

-

Type 2 Diabetes Mellitus: Approved globally for glycemic control, liraglutide has become an integral component of T2DM management. Its efficacy in reducing HbA1c levels and weight loss benefits have differentiated it in a crowded market dominated by other GLP-1 receptor agonists.

-

Obesity Management: Marketed as Saxenda, liraglutide gained FDA approval for chronic weight management in obese or overweight adults with comorbidities in 2014. The global obesity epidemic has fueled demand, positioning liraglutide as a key pharmacological tool for weight control.

Market Penetration and Competition

The global diabetes therapeutics market is projected to reach $118 billion by 2027 (Grand View Research, 2022). While insulin maintains a significant market share, GLP-1 receptor agonists like liraglutide are experiencing accelerated growth due to their cardiovascular benefits and favorable side effect profiles.

Competitive landscape includes:

- Other GLP-1 receptor agonists: Semaglutide (Ozempic, Wegovy), dulaglutide, exenatide.

- DPP-4 inhibitors: Sitagliptin, linagliptin.

- SGLT2 inhibitors: Empagliflozin, canagliflozin.

Among these, semaglutide, with once-weekly dosing and superior weight loss efficacy, poses the most significant competitive threat, potentially impacting liraglutide’s market share.

Market Dynamics

Regulatory Environment and Label Expansions

Regulatory agencies such as the FDA and EMA have progressively expanded liraglutide's approved indications, broadening its market potential. Notably:

- Approval for obesity management has unlocked a sizable market segment.

- Recent cardiovascular outcome trials (CVOTs) demonstrate liraglutide's benefits in reducing major adverse cardiovascular events (MACE) in T2DM patients, further validating its positioning.

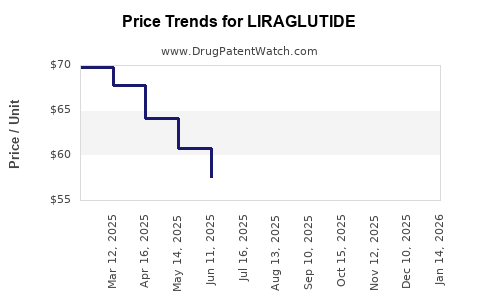

Pricing Strategies and Reimbursement

Liraglutide commands premium pricing due to its documented efficacy and safety profile. Reimbursement decisions from payers significantly influence uptake, especially in mass-market obesity applications. Cost-effectiveness analyses demonstrate positive valuations, supporting formulary inclusion.

Clinical Research and Pipeline Developments

Ongoing research aims to optimize dosing, improve patient adherence, and expand indications. Novo Nordisk’s exploration of fixed-dose combinations with other agents indicates a commitment to enhancing therapeutic profiles and competitive differentiation.

Financial Trajectory

Revenue Generation and Growth

- In 2022, Novo Nordisk reported that Victoza revenue from liraglutide was approximately $2 billion, dominated by T2DM sales, with increased contributions from Saxenda for obesity (Novonordisk Annual Report, 2022).

- The obesity segment has shown significant growth, driven by increased prevalence and expanding approval of higher doses.

Market Share and Forecast

Projection models estimate:

- CAGR for liraglutide to hover around 8-10% over the next five years, reflecting steady demand growth.

- Obesity market segment expected to expand at a higher CAGR (~12%) due to rising obesity rates and increased awareness.

However, the imminent entry of once-weekly semaglutide formulations, which have demonstrated superior weight loss, could temper liraglutide’s growth trajectory.

Pricing and Revenue Impact from Competition

Competitive pressures from new formulations threaten premium pricing strategies. However, liraglutide's established safety and efficacy record, combined with long-term CVOT data, support sustained revenue streams, especially in cardiovascular risk mitigation.

Emerging Trends and Opportunities

- Digital health integration: Telemedicine and digital adherence tools present avenues for improved patient engagement.

- Combination therapies: Development of fixed-dose combinations (e.g., with insulin) could broaden usage.

- Expanding indications: Potential approval for non-alcoholic steatohepatitis (NASH) and other metabolic disorders.

Risks and Challenges

- Market saturation: Growing competition, especially from weekly formulations like semaglutide, may cap growth.

- Pricing pressures: Payer strategies may limit premium pricing.

- Regulatory hurdles: Extended approval processes or label restrictions could impede market expansion.

- Patent expirations: Although patents provide exclusivity, generic or biosimilar entrants may erode revenue.

Key Takeaways

- Liraglutide remains a cornerstone in T2DM and obesity management, with a robust and expanding market.

- Competitive landscape shifts, notably the emergence of semaglutide, will influence liraglutide’s market share.

- Regulatory approvals for broader indications and positive CVOT outcomes support sustained demand.

- Strategic positioning, including pricing, pipeline innovation, and digital integration, will determine long-term financial success.

- Healthcare providers and payers will continue to favor therapies with proven efficacy, safety, and cardiovascular benefits, bolstering liraglutide’s market trajectory.

FAQs

1. How does liraglutide compare to other GLP-1 receptor agonists?

Liraglutide offers proven efficacy in glycemic control and weight loss, backed by extensive CVOT data. However, newer agents like semaglutide provide once-weekly dosing and may offer superior weight reduction, influencing market preferences.

2. What factors could limit the future growth of liraglutide?

Increased adoption of competing agents, pricing pressures, patent expirations, and regulatory constraints can constrain growth. Additionally, market saturation and changing treatment guidelines may impact demand.

3. What is the outlook for liraglutide’s revenue in the coming years?

While projected to grow at a healthy CAGR of around 8-10%, revenue gains may decelerate due to competition. Continued expansion in obesity and cardiovascular indications will be pivotal.

4. Are there upcoming developments or pipeline drugs related to liraglutide?

Yes, research into combination therapies, new formulations (e.g., once-weekly), and exploring other metabolic indications are underway, which could extend liraglutide’s market relevance.

5. How significant is the FDA’s approval of Saxenda for obesity?

It marked a substantial expansion of liraglutide’s market, addressing a massive global health challenge. The recognition of obesity as a chronic disease has elevated pharmacological interventions like Saxenda, promising sustained revenue growth.

Sources

[1] Grand View Research. (2022). Global Diabetes Therapeutics Market Report.

[2] Novo Nordisk Annual Report. (2022).

[3] U.S. Food and Drug Administration. (2014). Approval of Saxenda for Weight Management.

[4] Clinical trials registry. (2022). CVOTs and other ongoing studies on liraglutide.