Share This Page

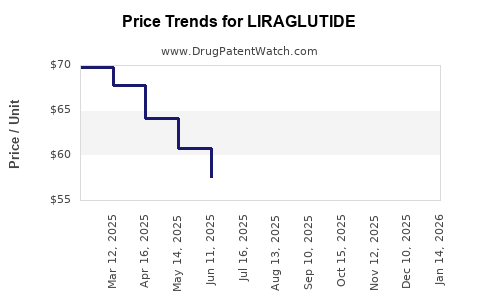

Drug Price Trends for LIRAGLUTIDE

✉ Email this page to a colleague

Average Pharmacy Cost for LIRAGLUTIDE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LIRAGLUTIDE 2-PAK 18 MG/3 ML | 71288-0563-85 | 54.15620 | ML | 2025-12-17 |

| LIRAGLUTIDE 2-PAK 18 MG/3 ML | 00143-9144-02 | 54.15620 | ML | 2025-12-17 |

| LIRAGLUTIDE 2-PAK 18 MG/3 ML | 00480-3667-20 | 54.15620 | ML | 2025-12-17 |

| LIRAGLUTIDE 2-PAK 18 MG/3 ML | 70748-0346-02 | 54.15620 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Liraglutide

Introduction

Liraglutide, a glucagon-like peptide-1 (GLP-1) receptor agonist, has established itself as a critical therapeutic agent in managing type 2 diabetes mellitus (T2DM), obesity, and related metabolic disorders. Originally developed and marketed by Novo Nordisk under the brand name Victoza, liraglutide has expanded its indications, fueling market growth and competitive dynamics. This analysis evaluates the current market landscape, assesses key drivers, reviews regulatory and reimbursement factors, and projects future pricing trends and revenue potential for liraglutide.

Current Market Landscape

Therapeutic Indications and Market Penetration

Liraglutide’s principal indications include:

- Type 2 Diabetes Mellitus (T2DM): Approved for glycemic management, with a broader adoption owing to its superior efficacy and safety profile compared to older agents like sulfonylureas.

- Obesity: Under the brand Saxenda, liraglutide has received FDA approval for weight management, notably expanding its revenue streams beyond glucose control.

The drug’s role in obesity management has gained traction, especially in markets emphasizing metabolic health and lifestyle management, positioning liraglutide as a premium therapeutic option.

Market Size and Growth Trends

The global diabetes drug market was valued at approximately $61 billion in 2021, with an expected compound annual growth rate (CAGR) of around 7.6% through 2028, driven by rising prevalence rates, aging populations, and increasing awareness [1]. Liraglutide's segment benefits from this growth, alongside its obesity indications, which are projected to generate over $5 billion annually by 2025 [2].

In 2021, Novo Nordisk claimed a dominant share, with Victoza generating approximately $3.5 billion in revenues, complemented by Saxenda’s approximately $1.3 billion globally [3]. The drug’s expanding approvals and positive clinical data underscore its sustained market relevance.

Competitive Landscape

The GLP-1 receptor agonist landscape features key competitors:

- Semaglutide (Novo Nordisk): Marketed as Ozempic (T2DM) and Wegovy (obesity), demonstrating superior efficacy and adherence advantages.

- Dulaglutide (Eli Lilly): Known as Trulicity, focusing on T2DM.

- Albiglutide and Lixisenatide: Previously marketed but phased out due to better alternatives.

- Emerging Agents: Tirzepatide (Eli Lilly), a dual GIP/GLP-1 agonist, shows promising results, potentially affecting liraglutide’s market share.

While semaglutide’s higher efficacy and dosing convenience provide competitive leverage, liraglutide retains a niche due to its established safety and versatility across indications.

Pricing Dynamics and Cost Analysis

Current Pricing Landscape

The wholesale acquisition cost (WAC) for liraglutide varies:

- Victoza: Approximate list price of $8,400–$9,000 annually (assuming a daily dose of 1.2–1.8 mg).

- Saxenda: Around $1,300–$1,500 per month, totaling roughly $15,600–$18,000 annually, reflecting higher dosing for weight management.

Rebates, insurance negotiations, and pharmacy benefit manager (PBM) discounts significantly influence actual patient out-of-pocket costs, which often reduce the acquisition expense by 20–50%.

Price Trends and Influencing Factors

Several factors influence future liraglutide pricing:

- Market Competition: Semaglutide’s superior efficacy and dosing reduce its price elasticity against liraglutide.

- Regulatory and Reimbursement Policies: Emphasis on value-based care and biosimilar entry may introduce downward pressure.

- Manufacturing and R&D Costs: Continued innovation and manufacturing efficiencies could stabilize or reduce prices over time.

- Patent Expirations: Although liraglutide’s primary patents expire in the US around 2028, patent litigations and exclusivity extensions can alter this timeline.

Price Projections and Revenue Outlook (2023–2030)

Short-Term Outlook (2023–2025)

- Stable Pricing: Expect minor fluctuations (~±5%) owing to market competition and inflation.

- Increased Adoption: Growing prescribing for obesity and T2DM on the back of positive clinical outcomes.

Projected revenue: Novo Nordisk could see annual liraglutide sales expand modestly, reaching $4.2–$4.8 billion globally by 2025, driven by increased market saturation and expanded indications.

Medium to Long-Term Outlook (2026–2030)

- Potential Price Erosion: Entry of biosimilars post-patent expiry, coupled with competitive pressure from semaglutide and emerging agents like tirzepatide, could reduce prices by 15–25%.

- Market Share Dynamics: While innovative competitors may undercut liraglutide’s price, legacy status and clinical familiarity help sustain revenue levels, especially for established markets.

Revenue estimates: Stabilization around $3.5–$4 billion annually is plausible, with variability based on competitive innovations and payer strategies.

Regulatory and Reimbursement Impact

Global approval expansion, notably in emerging markets, can drive volume growth but may exert pressure on pricing. Payer models increasingly favor value-based arrangements, potentially leading to risk-sharing agreements that influence net prices. Furthermore, the push toward biosimilar and generic insulin analogs in some regions could influence liraglutide’s pricing structure.

Strategic Considerations for Stakeholders

- Pharmaceutical Manufacturers: Focus on differentiation, such as new dosing formulations or combo therapies, to defend against price erosion.

- Payors and Policymakers: Prioritize value-based pricing models to optimize cost-effectiveness.

- Investors: Monitor pipeline developments (e.g., tirzepatide) and patent landscapes, which can significantly influence future pricing.

Key Takeaways

- Liraglutide remains a leading GLP-1 receptor agonist, buoyed by its multi-indication approval and clinical efficacy.

- The global market is expanding, with revenues projected to grow moderately through 2025, then stabilize amid increasing competition.

- Pricing will likely experience slight declines due to biosimilar competition and newer agents offering superior profiles.

- Price projections indicate a possible annual revenue of $3.5–$4.8 billion up to 2025, leveling off thereafter.

- Stakeholders should prepare for shifting payer strategies and competitive pressures, emphasizing value-based arrangements and innovation.

FAQs

-

How does liraglutide’s price compare to newer GLP-1 agents?

Higher than some newer formulations like semaglutide (Ozempic/Wegovy), which benefit from dosing convenience and efficacy, potentially reducing per-dose costs for patients and payers. -

When will biosimilars likely impact liraglutide’s market price?

Biosimilar versions could enter the US market around 2028–2029, possibly reducing prices by up to 25%, contingent on regulatory and patent litigations. -

What factors could accelerate or delay liraglutide’s patent expiry and market erosion?

Patent challenges, legal disputes, and regulatory extensions can delay biosimilar entry, while litigation wins and patent cliffs can accelerate erosion. -

Are there any upcoming regulatory modifications that could affect liraglutide’s pricing?

Increased emphasis on value-based care and payer negotiations might lead to more restrictive formularies and negotiated discounts. -

How is the competition from tirzepatide influencing liraglutide’s market dynamics?

Tirzepatide, with superior efficacy in weight and glycemic control, may capture significant market share, pressuring liraglutide’s pricing and sales volume, especially post-patent expiration.

References

[1] Grand View Research. "Diabetes Drugs Market Size & Trends." 2022.

[2] EvaluatePharma. "Obesity Pharmacotherapy Market Forecast." 2022.

[3] Novo Nordisk Annual Report 2021.

More… ↓