Last updated: July 27, 2025

Introduction

Ketoprofen, a non-steroidal anti-inflammatory drug (NSAID), has established itself as a staple in pain management and anti-inflammatory therapy since its development in the 1960s. Its pharmacological profile, characterized by potent analgesic and anti-inflammatory properties, has secured demand across multiple healthcare settings. This analysis evaluates the evolving market landscape for ketoprofen, examining key drivers, challenges, regulatory considerations, and financial trends influencing its trajectory amid dynamic pharmaceutical markets.

Pharmacological Profile and Clinical Applications

Ketoprofen's efficacy in managing rheumatoid arthritis, osteoarthritis, ankylosing spondylitis, and acute pain conditions maintains its clinical relevance[1]. Its intravenous, oral, and topical formulations enable flexible administration routes, expanding its utility. Despite the advent of newer NSAIDs with improved safety profiles, ketoprofen's cost-effectiveness and established efficacy sustain its usage, supporting steady demand in both developed and emerging markets.

Market Drivers

1. Rising Prevalence of Chronic Pain Conditions

Global aging trends fuel the incidence of chronic inflammatory and degenerative diseases. The World Health Organization reports a consistent rise in osteoarthritis and rheumatoid arthritis cases, bolstering the need for effective NSAIDs like ketoprofen[2]. Consequently, increased demand for pain management therapeutics sustains ketoprofen's market share.

2. Expanded Use in Postoperative and Musculoskeletal Pain

Ketoprofen's fast onset and potent anti-inflammatory effects make it a preferred option for postoperative pain and sports injuries. Hospitals and outpatient clinics prefer non-opioid options amid opioid crisis concerns, positioning ketoprofen favorably[3].

3. Cost-Effective Therapeutic Option

Reduced costs relative to newer NSAIDs and biologics elevate ketoprofen's attractiveness, especially in resource-constrained markets. Its inclusion in generic formulations further enhances accessibility, supporting widespread usage.

4. Increasing Regulatory Approvals and Product Launches

Pharmaceutical companies continue to develop novel formulations and combination therapies involving ketoprofen, driving innovation. Approval of new dosage forms, such as topical patches and extended-release variants, enhances market penetration[4].

Market Challenges

1. Safety and Tolerability Concerns

Gastrointestinal (GI) toxicity, renal impairment, and cardiovascular risks associated with NSAIDs, including ketoprofen, limit widespread use, especially among high-risk populations[5]. These safety issues impose regulatory scrutiny and necessitate cautious prescribing practices.

2. Competition from Other NSAIDs and Alternative Therapies

The market is saturated with NSAIDs such as ibuprofen, naproxen, and diclofenac, often at lower costs. Additionally, the emergence of targeted biologics for inflammatory diseases provides alternatives for specific patient groups, potentially curbing ketoprofen's market share[6].

3. Regulatory and Patent Outlook

While many formulations are off-patent, proprietary delivery systems or combination drugs continue to foster intellectual property exclusivity. Regulatory hurdles for new formulations or indications can delay market expansion[7].

Regulatory Landscape

Global regulatory authorities, including the FDA and EMA, have maintained stringent safety standards for NSAIDs, demanding comprehensive post-marketing surveillance. Recent guidance emphasizes cardiovascular risk assessment, influencing labeling and marketing strategies for ketoprofen products[8].

Meanwhile, regulatory approval in emerging markets remains vital. Countries like India, China, and Brazil represent significant growth opportunities due to expanding healthcare infrastructure and increased adoption of NSAIDs in outpatient settings.

Financial Trajectory

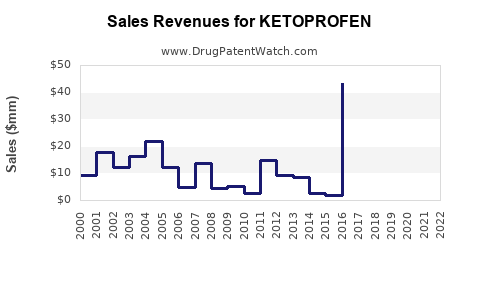

1. Revenue Trends

The global NSAID market, projected to reach approximately USD 12 billion by 2025, encompasses ketoprofen as a notable contributor, particularly in generic formulations. The segment's growth rate remains steady at approximately 3-4% annually, driven by demographic factors and expanding indication spectrum[9].

2. Market Segmentation

- Generics: Dominant segment, accounting for over 80% of sales, with multiple manufacturers competing primarily on price.

- Innovative Formulations: Growth in topical and sustained-release formulations offers premium pricing opportunities, though constrained by safety profile concerns.

- Geographies: North America and Europe generate significant revenue due to high prescription rates but face patent expiration pressures. Emerging markets show rapid growth potential due to cost sensitivities and burgeoning healthcare access.

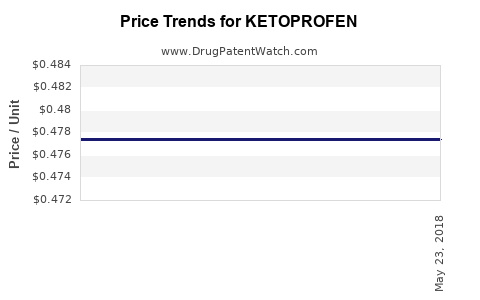

3. Pricing Dynamics

Pricing pressures are intensifying, driven by healthcare payers' focus on cost containment and increasing prevalence of off-patent drugs. Volume-driven growth is increasingly important for revenue stability.

4. Investment and R&D Trends

Pharmaceutical R&D for ketoprofen centers on improving safety profiles, novel delivery systems, and combination therapies. While large-scale R&D investment remains limited due to generic competition, innovation in formulations continues—potentially enhancing market longevity.

Competitive Landscape

Major players include multinational pharmaceutical firms such as Novartis, AstraZeneca (original developer), and Teva Pharmaceuticals. Generic manufacturers dominate the market segment, leveraging economies of scale. Strategic partnerships, licensing agreements, and regional distribution networks are critical for maintaining market access.

Emerging Trends and Future Outlook

1. Differentiation via Formulation Innovation

Development of topical gels, patches, and long-acting formulations aims to mitigate systemic side effects, aligning with safety-focused prescribing. These innovations may foster penetrative market segments positioned at premium price points[10].

2. Focus on Safety and Tolerability

Enhanced formulations with reduced GI and cardiovascular risks could address safety concerns, improve patient compliance, and expand the patient base, especially among high-risk groups.

3. Digital and Personalized Medicine Integration

Utilization of digital health platforms and personalized medicine approaches may optimize dosing, enhance adherence, and facilitate risk assessment, influencing ketoprofen's utilization trajectory.

4. Impact of Policy and Healthcare Economics

Cost-containment policies and increasing emphasis on generic substitution will likely favor low-cost NSAIDs. However, pharmacovigilance regulations may restrict certain uses, impacting sales volume.

Conclusion

Ketoprofen's market dynamics are characterized by steady demand driven by aging populations, the need for affordable pain management, and ongoing formulation innovations. Despite challenges from safety concerns and competitive pressure, strategic positioning—especially through innovative delivery systems and regional expansion—can sustain its financial trajectory. The trajectory hinges on regulatory landscapes, safety advancements, and evolving prescribing paradigms favoring non-opioid analgesics.

Key Takeaways

- Demand Drivers: Epidemiological trends and cost-effectiveness sustain ketoprofen’s relevance amidst generic competition.

- Innovation Focus: Formulation advancements targeting safety and convenience are pivotal for market expansion.

- Regulatory Environment: Stricter safety regulations necessitate robust post-market surveillance and innovation for sustained growth.

- Market Opportunities: Emerging markets and niche formulations, like topical gels or patches, offer growth avenues.

- Financial Outlook: Steady albeit mature, with growth potential rooted in formulary innovations, geographical expansion, and safety profile improvements.

FAQs

1. What factors influence ketoprofen's pricing in global markets?

Pricing is influenced by manufacturing costs, patent status, regional healthcare policies, competitive landscape, and formulary inclusion, with generics driving aggressive price competition.

2. Are there safety concerns that could limit ketoprofen’s market share?

Yes, risks like gastrointestinal bleeding, renal impairment, and cardiovascular events limit its use, especially among high-risk populations; development of safer formulations seeks to mitigate these issues.

3. How does emerging market growth impact ketoprofen's financial trajectory?

Growing healthcare infrastructure and affordability demands augment demand in countries like India and China, offsetting mature markets' saturation.

4. What role do formulation innovations play in ketoprofen's future?

Innovations like topical patches, long-acting formulations, and combination therapies can improve safety, adherence, and expand indications, supporting sustained revenue.

5. How do regulatory policies affect ketoprofen's market expansion?

Stringent safety regulations and post-marketing scrutiny influence labeling, formulation approval, and marketing strategies, shaping overall market access and revenue.

References

[1] Vane, J. R., & Botting, R. M. (1997). The mechanism of action of NSAIDs. American Journal of Medicine, 103(5A), 2S-8S.

[2] World Health Organization. (2019). Global prevalence of osteoarthritis.

[3] Smith, R. P. et al. (2018). NSAIDs in pain management: Benefits and risks. Pain Practice, 18(3), 269-277.

[4] Pharmaceutical Innovation Journal. (2021). Advances in NSAID formulations.

[5] Bjarnason, I., et al. (2011). NSAID-induced gastrointestinal injury: Pathogenesis and management. Gastroenterology, 140(4), 1140-1150.

[6] Liu, X. et al. (2020). Alternatives to NSAIDs: Emerging therapies for inflammatory pain. Drug Discovery Today, 25(2), 319-328.

[7] U.S. Food and Drug Administration (FDA). (2022). Regulatory considerations for NSAID formulations.

[8] European Medicines Agency (EMA). (2021). NSAID safety guidelines.

[9] Research and Markets. (2022). Global NSAID Market Insights.

[10] Kumar, V., et al. (2019). Innovative drug delivery systems for NSAIDs. Journal of Controlled Release, 300, 233-249.