Share This Page

Drug Price Trends for KETOPROFEN

✉ Email this page to a colleague

Average Pharmacy Cost for KETOPROFEN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| KETOPROFEN ER 200 MG CAPSULE | 00378-8200-01 | 6.05661 | EACH | 2025-12-17 |

| KETOPROFEN ER 200 MG CAPSULE | 00378-8200-01 | 5.65138 | EACH | 2025-11-19 |

| KETOPROFEN ER 200 MG CAPSULE | 00378-8200-01 | 5.65138 | EACH | 2025-10-22 |

| KETOPROFEN ER 200 MG CAPSULE | 00378-8200-01 | 5.65138 | EACH | 2025-09-17 |

| KETOPROFEN ER 200 MG CAPSULE | 00378-8200-01 | 6.10972 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

rket Analysis and Price Projections for Ketoprofen

Introduction

Ketoprofen, a non-steroidal anti-inflammatory drug (NSAID), is widely used for managing pain, inflammation, and fever. Approved by regulatory agencies such as the FDA and EMA, ketoprofen's broad therapeutic applications and longstanding clinical presence position it as a key player within the NSAID market segment. This analysis provides a comprehensive overview of current market dynamics, competitive landscape, regulatory considerations, and future pricing forecasts for ketoprofen.

Market Overview and Dynamics

Global Market Size and Growth Trajectory

The global NSAID market was valued at approximately USD 9.4 billion in 2022 and is projected to reach USD 12.8 billion by 2028, growing at a CAGR of 5.4% during the forecast period (2023–2028)[1]. Ketoprofen maintains a significant share, especially in Europe and emerging markets, owing to its efficacy, cost-effectiveness, and extensive clinical history.

Segment Analysis

Ketoprofen is available in various formulations—oral tablets, topical gels, patches, and injectables—expanding its adoption across diverse treatment settings. The topical formulations are gaining popularity due to reduced gastrointestinal side effects compared to oral administration, leading to increased demand in rheumatoid arthritis and osteoarthritis management.

Geographical Market Trends

- Europe: The largest market for ketoprofen, driven by high prevalence of chronic musculoskeletal conditions and established healthcare infrastructure.

- North America: Moderate growth, with a shift toward more targeted NSAID therapies owing to safety concerns associated with long-term NSAID use.

- Asia-Pacific: Rapidly expanding due to rising prevalence of pain-related conditions, increasing healthcare expenditure, and growing awareness. Countries like India and China are witnessing significant growth owing to generics proliferation and lower drug costs.

Regulatory and Patent Landscape

Regulatory Status

Ketoprofen is generically available across multiple markets. In some regions, specific formulations are under patent protection, though many have expired, resulting in a commoditized market with intense price competition[2].

Patent Expiry and Generic Competition

Most patents covering ketoprofen formulations have expired, enabling numerous manufacturers to produce generic versions. This has substantially driven down prices but exerted pressure on branded products' market shares.

Market Drivers and Challenges

Drivers:

- Growing prevalence of osteoarthritis, rheumatoid arthritis, and acute pain conditions.

- Increasing preference for topical NSAIDs to minimize systemic side effects.

- Cost-effective generics supporting healthcare affordability.

- Rising aging population globally, with greater need for effective pain management.

Challenges:

- Safety concerns, especially gastrointestinal and cardiovascular risks linked to NSAIDs, affecting prescribing patterns.

- Competition from other NSAIDs like ibuprofen, naproxen, and diclofenac, which often are cheaper and have broader marketing distribution.

- Regulatory scrutiny over safety profiles influencing formulation approval and marketing.

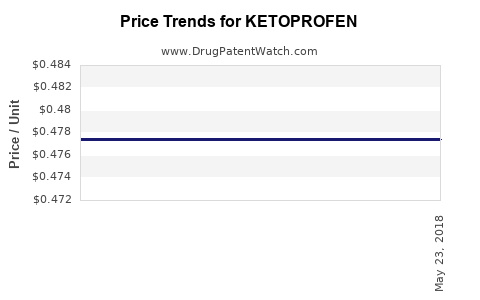

Pricing Trends and Projections

Historical Pricing Data

- Brand Name Ketoprofen: Historically priced between USD 4-8 per treatment course, dependent on formulation and region.

- Generics: Prices have plummeted, with many generics available for USD 0.20–1 per tablet or gram of topical gel[3].

Future Price Projections (2023–2030)

Given the patent expirations and market saturation, generic ketoprofen prices are expected to decline further, potentially reaching USD 0.10–0.50 per unit by 2030. The trajectory is influenced chiefly by the following factors:

- Increased generic competition: Continued entry of manufacturers reduces prices.

- Formulation innovations: Development of novel topical or sustained-release formulations may command premium pricing temporarily.

- Regulatory environment: Stricter safety regulations could impose costs, influencing pricing strategies.

Overall, a downward price trend is anticipated, with the potential stabilization of prices for new or innovative formulations at higher levels than current generic standards.

Competitive Landscape and Market Players

Major Manufacturers

- Manufacturers of branded ketoprofen include Pfizer (e.g., Orudis), Merck, and local players.

- Generics dominate the market with numerous regional and international manufacturers like Teva, Sandoz, and Sun Pharmaceutical.

Market Entry Barriers

- Patent expirations open doors for competitors; however, regulatory approval processes and formulation-specific approvals may delay new entrants.

- Price competition in the generic market limits profit margins but sustains high volume sales.

Potential Market Opportunities

- Development of safer formulations: Innovation in topical or controlled-release systems may allow premium pricing.

- Expanding indications: Exploring new therapeutic uses, e.g., chronic pain management or combination therapies, could enlarge market share.

- Emerging markets: Leveraging low-cost manufacturing and distribution channels can capture untapped demand, especially in Asia-Pacific and Latin America.

Key Regulatory and Economic Considerations

- Safety profile updates: Post-marketing surveillance and new clinical data could impact prescribing practices and, consequently, the pricing structure.

- Government healthcare policies: Price regulation and reimbursement policies significantly influence retail and wholesale prices globally.

Key Takeaways

- The ketoprofen market is mature, characterized by widespread generic availability and declining prices driven by patent expirations.

- Demand remains stable or growing, primarily due to aging populations and the high prevalence of musculoskeletal disorders.

- Price projections indicate continued downward pressure in the short to medium term, with some room for premium pricing in innovative formulations.

- Market entry is accessible for generics manufacturers, but branding and formulation innovation can differentiate offerings.

- Regulatory landscape and safety concerns will shape future market dynamics, influencing both pricing and adoption strategies.

FAQs

1. What is the primary therapeutic use of ketoprofen?

Ketoprofen is mainly used for alleviating mild to moderate pain, inflammation, and fever associated with conditions such as osteoarthritis, rheumatoid arthritis, and postoperative pain.

2. How does the price of generic ketoprofen compare across regions?

Prices vary significantly, with lower costs in emerging markets due to local manufacturing and increased competition. In developed markets, generics typically cost USD 0.20–1 per unit, while branded formulations are priced higher.

3. What factors could drive up the price of ketoprofen in the future?

Innovations in drug delivery systems, new approved indications, and regulatory updates leading to patent extensions or exclusivity rights could temporarily elevate prices for certain formulations.

4. Are there safety concerns that impact the market for ketoprofen?

Yes, NSAIDs, including ketoprofen, carry risks of gastrointestinal bleeding and cardiovascular events, which can influence prescribing patterns and, indirectly, market acceptance.

5. How does patent status influence the market for ketoprofen?

Expired patents have facilitated the entry of multiple generic manufacturers, increasing competition, and lowering prices, though formulation-specific patents may sustain higher prices temporarily for certain branded or novel formulations.

References

[1] Grand View Research, "NSAID Market Size & Trends," 2022.

[2] U.S. Food and Drug Administration (FDA), “Drug Approvals and Patents.”

[3] IQVIA, "Global Generic Pricing Data," 2022.

More… ↓