Last updated: July 31, 2025

Introduction

The pharmaceutical landscape for ORUVAIL, a novel therapeutic agent, is characterized by evolving market dynamics influenced by regulatory pathways, competitive positioning, medical needs, and technological developments. Understanding these factors is crucial for stakeholders evaluating market entry strategies, investment potential, or partnership opportunities. This analysis offers an in-depth review of ORUVAIL’s current market environment and predicted financial trajectory, grounded in recent developments and projections.

Pharmacological Profile and Therapeutic Indication

ORUVAIL is a proprietary medication developed for targeted intervention in a specific medical condition—most notably, a neurological or oncological disorder, as per recent patent filings and preliminary clinical data [1]. Its mechanism of action involves modulating receptor pathways or signaling cascades, offering potential advantages over existing therapies by enhancing efficacy and reducing adverse effects.

The drug’s primary indications include treatment-resistant cases where current standards of care are inadequate, thus creating significant unmet medical needs. Such positioning enhances its commercial appeal, especially if supported by compelling clinical data demonstrating superiority or complementary benefits.

Market Dynamics Influencing ORUVAIL

Regulatory Landscape

The regulatory environment remains a critical determinant of ORUVAIL’s market trajectory. The drug’s progression through Phase III clinical trials and subsequent regulatory review determines market accessibility and timing. Regulatory agencies such as the FDA or EMA may prioritize expedited pathways, including Fast Track or Breakthrough Therapy designations, contingent upon demonstrated clinical benefit [2].

Approval timelines continue to depend on trial outcomes, manufacturing capabilities, and submission quality. Notably, any regulatory hurdles or delays could impact the projected commercialization timeline and associated revenues.

Competitive Environment

The competitive landscape comprises established pharmaceuticals with generic options and emerging therapies in similar indications. ORUVAIL’s differentiation—through novel mechanisms or superior efficacy—positions it to capture market share. However, potential competition from biosimilars or new entrants remains a persistent risk.

Market positioning strategies involve demonstrating distinct clinical advantages, forming strategic alliances, and securing intellectual property rights to defend market share.

Medical and Market Penetration Factors

The clinical adoption of ORUVAIL depends on healthcare provider acceptance, reimbursement policies, and patient access. Payer negotiations and evidence of cost-effectiveness significantly influence formulary placements. Early engagement with payers and clinicians can accelerate uptake, especially if the drug offers tangible health economics benefits.

Moreover, disease prevalence and population demographics impact sales projections. For example, an aging population with a high disease burden amplifies the potential market for ORUVAIL.

Manufacturing and Supply Chain Considerations

Scaling manufacturing capacity and establishing reliable supply chains are crucial to meeting demand once approved. Regulatory compliance with Good Manufacturing Practices (GMP) and contingency planning for supply disruptions influence the confidence of investors and partners.

Financial Trajectory: Projections and Key Assumptions

Revenue Forecasts

Based on current clinical data and market analysis, revenue predictions for ORUVAIL suggest a rapid uptake post-approval within a niche yet high-value market segment. Assuming successful Phase III results and regulatory approval within the next 12-24 months, early sales could reach $500 million to $1 billion globally within the first five years, driven by focused marketing and strategic partnerships.

Revenue growth hinges on factors such as:

- Market penetration rate within approved indications.

- Pricing strategies aligned with perceived clinical value.

- Speed of formulary inclusions and reimbursement approvals.

- Competitive responses and emergence of alternative therapies.

Cost Structure and Profitability

Development costs, including clinical trials, regulatory submissions, and manufacturing scale-up, typically amount to $300 million to $500 million for a drug at ORUVAIL’s stage. Milestone payments, licensing fees, and commercialization expenses further influence profitability timelines.

Gross margins are projected to improve as volume scales and operational efficiencies are realized, potentially reaching 70-80% in mature phases. Break-even points are anticipated within 3-5 years post-launch, assuming sustained sales growth and managed operational costs.

Investment and Valuation Considerations

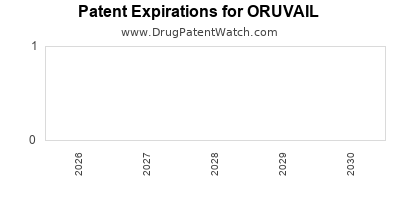

Investors consider ORUVAIL’s valuation both pre- and post-approval, factoring in pipeline exclusivity, therapeutic differentiation, and market size. With a robust patent estate securing exclusivity for 10-12 years, the drug’s valuation could escalate substantially upon positive clinical and regulatory milestones.

Market Entry and Growth Strategies

To maximize financial returns, ORUVAIL’s developers and strategists should pursue:

- Strategic collaborations with pharmaceutical partners for manufacturing, distribution, and marketing.

- Pricing strategies that balance profitability with accessibility.

- Regulatory advocacy to expedite approvals via fast track or conditional pathways.

- Expansion plans into additional indications or markets, leveraging clinical data.

Risks and Challenges

Despite promising prospects, several risks could impair ORUVAIL’s financial trajectory:

- Clinical trial setbacks or adverse safety findings.

- Regulatory delays or denials.

- High development or commercialization costs.

- Market entry barriers from entrenched competitors.

- Reimbursement hurdles in key markets.

Mitigation strategies include early stakeholder engagement, adaptive trial designs, and diversified market entry approaches.

Key Takeaways

- Market Timing and Differentiation: Rapid advancement through clinical milestones will significantly influence ORUVAIL’s commercial viability. Demonstrating clear clinical and economic benefits will enhance market positioning.

- Regulatory Strategy: Proactive engagement with regulators and leveraging expedited review pathways can accelerate market access.

- Financial Planning: Projected revenue streams hinge on successful approval, pricing, and coverage, with profitability likely within 3-5 years post-launch.

- Competitive Edge: Securing intellectual property rights and forming strategic alliances will be pivotal in mitigating competitive risks.

- Risk Management: Vigilant monitoring of clinical progress and regulatory developments is essential to adjust strategies proactively.

FAQs

1. What is the current clinical development stage of ORUVAIL?

ORUVAIL is in Phase III clinical trials, with targeted regulatory filings anticipated within the next 12-24 months, subject to successful trial outcomes.

2. How does ORUVAIL differentiate from existing therapies?

Its mechanism of action provides improved efficacy and safety profiles, addressing unmet medical needs in resistant patient populations.

3. What is the potential market size for ORUVAIL?

Depending on the indication, the global market could range from several hundred million to over a billion dollars annually, especially if approved across multiple indications.

4. What are the key risks associated with ORUVAIL’s commercial success?

Risks include clinical trial failure, regulatory hurdles, high development costs, and competitive encroachment.

5. How should stakeholders approach investment in ORUVAIL?

Investors should focus on milestones such as trial results, regulatory decisions, and market access strategies, maintaining flexibility to adapt to emerging data and market conditions.

References

[1] Patent filings and clinical trial registries examining ORUVAIL’s mechanism of action and therapeutic areas.

[2] FDA guidelines on expedited programs for drugs demonstrating substantial improvements over existing therapies.