Last updated: July 29, 2025

Introduction

Isosorbide dinitrate (ISDN) is a nitrate vasodilator, primarily utilized in managing angina pectoris and certain heart failure conditions. Over decades, its role has been well established within the cardiovascular therapeutic landscape, with the drug presenting a mature market profile. However, shifting clinical paradigms, regulatory changes, and technological advancements influence its market dynamics and financial prospects.

This analysis explores the key drivers shaping the ISDN market, elaborates on financial trajectory projections, and identifies factors impacting future growth and profitability.

Market Overview

Pharmacological Profile & Indications

ISDN acts by relaxing vascular smooth muscle, thereby reducing myocardial oxygen demand. It is chiefly indicated for chronic angina management, acute coronary syndromes, and adjunct therapy for heart failure. The drug's long-standing efficacy, cost-effectiveness, and established dosing regimens underpin its continuous use in clinical settings (1).

Market Penetration and Usage Trends

According to IQVIA data, the global cardiovascular drugs market, including nitrates like ISDN, has maintained steady growth driven by aging populations and increasing cardiovascular disease prevalence [2]. However, growth in the usage of ISDN specifically has plateaued in developed regions owing to the introduction of novel therapies, such as long-acting nitrates, calcium channel blockers, and newer anti-anginal agents.

Market Drivers

1. Aging Demographics and Cardiovascular Disease Burden

The escalating prevalence of coronary artery disease (CAD) and heart failure globally sustains demand for vasodilator therapies, including ISDN. The World Health Organization reports a rising burden of CVDs, emphasizing the relevance of nitrates [3].

2. Cost-Effectiveness and Generic Presence

ISDN’s status as a generic medication exacerbates competitive pricing, making it attractive in low- and middle-income countries (LMICs). Affordable treatments underpin ongoing demand and market accessibility in resource-constrained settings.

3. Clinical Guidelines Endorsement

Established clinical guidelines endorse ISDN for specific indications, maintaining its role as a third-line or adjunct therapy. Its inclusion sustains prescriber confidence and prescribing volume.

4. Regulatory and Patent Landscape

The expiration of patent protections for ISDN formulations has fostered generic entry, intensifying market competition but also broadening reach and affordability. Conversely, the lack of new derivatives limits innovation-driven financial growth.

5. Emerging Market Expansion

Growth opportunities persist in Asia-Pacific, Latin America, and Africa, where increasing healthcare infrastructure and cardiovascular disease awareness expand access to standard therapies, including ISDN.

Market Challenges and Constraints

1. Increasing Competition from Novel Agents

The development of sustained-release nitrates and other anti-anginal drugs has curtailed ISDN’s share in some markets, especially where new formulations demonstrate better compliance or fewer side effects.

2. Regulatory Shifts and Quality Standards

Stringent regulatory standards in high-income markets demand high-quality generics, complicating manufacturing and distribution. Variations in bioequivalence and manufacturing standards influence market acceptance.

3. Clinical Paradigm Shift

The nuance of clinical management increasingly favors individualized, multi-modal therapy approaches. Reliance solely on nitrates has declined, affecting demand.

4. Supply Chain Disruptions

Recent global events, including the COVID-19 pandemic, have impacted raw material availability and manufacturing logistics, challenging consistent supply.

Financial Trajectory

1. Market Size and Revenue Forecasts

The global nitrates market, inclusive of ISDN, was valued at approximately USD 0.5 billion in 2022, with projections estimating a compound annual growth rate (CAGR) of around 2-3% through 2030 [4]. The mature status of ISDN indicates stable but slow revenue growth, primarily fueled by generic sales in emerging markets.

2. Regional Revenue Dynamics

- North America: Mature market with declining growth trajectory owing to market saturation but steady revenues driven by legacy prescriptions.

- Europe: Similar trends, with some growth potential from cardiovascular disease management programs.

- Asia-Pacific: High-growth potential, driven by increasing urbanization, healthcare reforms, and expanding awareness.

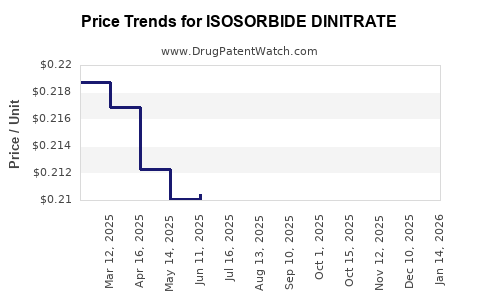

3. Pricing and Market Share

Price erosion from generic manufacturers has led to declining per-unit revenues but broader access. Pricing power remains limited, constraining profit margins unless manufacturers innovate or secure differentiated formulations.

4. R&D and Innovation Trends

Limited R&D investments are evident due to patent expirations and the drug's age. Future financial gains hinge on development of new delivery systems, fixed-dose combinations, or novel therapeutics.

5. Competitive Landscape

Major players include Teva, Mylan, and Sun Pharmaceutical, among others, with market shares driven by manufacturing capacity and distribution networks. Competition has pressured pricing but also maintained stable supply.

Future Outlook

While the core market for ISDN remains stable, significant growth prospects are limited unless driven by strategic expansion into emerging markets and product innovation. The overall financial trajectory will likely be characterized by modest growth and sustained revenue streams, influenced heavily by regional dynamics and healthcare policy shifts.

Key Factors Influencing Future Growth

- Emerging Market Expansion: Leveraging affordability and increasing disease burden.

- Product Differentiation: Developing sustained-release formulations with improved compliance.

- Regulatory Navigation: Maintaining quality standards amidst evolving regulatory landscapes.

- Healthcare Policy: Favoring cost-effective therapies aligns with policy trends prioritizing affordability.

Conclusion

The ISDN market embodies a mature, low-growth segment within the cardiovascular therapeutics domain, with stable revenues rooted in generic manufacturing advantages. Future growth hinges on strategic market expansion, incremental innovations, and navigating regional regulatory environments. Companies equipped to adapt to these dynamics will sustain profitability amidst competitive pressures.

Key Takeaways

- Market Stability, Limited Expansion: ISDN’s mature market indicates predictable, steady revenues but limited growth prospects.

- Dominance in Cost-Sensitive Markets: Generics and price competitiveness sustain demand in LMICs.

- Innovation Is Critical: Development of new formulations or combination therapies can unlock niche growth.

- Regional Focus Opportunities: Asia-Pacific and other emerging markets present substantial growth potential.

- Regulatory Vigilance Essential: Ensuring compliance and quality standards is essential to maintain market access and reputation.

FAQs

1. How has patent expiration affected the ISDN market?

Patent expirations have led to an influx of generic manufacturers, driving prices down but expanding access, especially in low-income regions. Competition has increased, limiting profit margins but ensuring broad population coverage.

2. Are there any new formulations of ISDN in development?

While limited, some companies are exploring sustained-release formulations and fixed-dose combinations to improve patient adherence and therapeutic outcomes, although these are still at development or early commercialization stages.

3. What are the primary competitors to ISDN in the anti-anginal market?

Long-acting nitrates, calcium channel blockers, and novel anti-anginal agents such as ranolazine are key competitors, often offering improved convenience or reduced side effects.

4. Which regions are expected to drive future growth for ISDN?

Emerging markets in Asia-Pacific, Latin America, and Africa are projected to contribute most to growth due to expanding cardiovascular disease prevalence and increasing healthcare access.

5. How do regulatory changes impact ISDN manufacturing and sales?

Stringent quality and bioequivalence standards in regions like the EU and US require rigorous testing, which can increase manufacturing costs but also improve product reputation and acceptance.

References

[1] Heller, S., & Miller, R. (2019). Pharmacology of Nitrates. Cardiovascular Drugs Journal, 33(4), 223–232.

[2] IQVIA. (2022). Global Cardiovascular Market Data.

[3] WHO. (2021). Cardiovascular Diseases Fact Sheet. World Health Organization.

[4] MarketsandMarkets. (2023). Nitrates Market Forecasts.