Last updated: July 28, 2025

Introduction

DILATRATE-SR, a sustained-release formulation of the popular antihypertensive agent dilatrate (isradipine), has garnered attention within the cardiovascular therapeutic landscape. With increasing prevalence of hypertension and associated comorbidities globally, the market for calcium channel blockers such as DILATRATE-SR is poised for growth. This analysis explores the current market dynamics, competitive landscape, regulatory environment, and forecasted financial trajectory for DILATRATE-SR, offering vital insights for stakeholders across the pharmaceutical sector.

Market Overview and Disease Burden

Hypertension remains a leading global health challenge, affecting approximately 1.28 billion adults worldwide as per the World Health Organization (WHO). The condition significantly elevates the risk of stroke, myocardial infarction, and chronic kidney disease. Sustained-release formulations like DILATRATE-SR provide key clinical advantages, including improved medication adherence due to reduced dosing frequency, and stable plasma drug concentrations that mitigate side effects.

The global antihypertensive drugs market is projected to surpass USD 35 billion by 2025, driven predominantly by aging populations, urbanization, and increasing awareness regarding cardiovascular health. Among drug classes, calcium channel blockers (CCBs) hold a significant share due to their proven efficacy, safety profile, and versatility across multiple patient demographics.

DILATRATE-SR’s Competitive Position

DILATRATE-SR faces competition from several other CCBs and sustained-release formulations, including amlodipine, nifedipine, and newly emerging fixed-dose combinations. Its unique selling points include its controlled-release mechanism, which enhances patient compliance and minimizes peak-trough plasma concentration variations. However, market penetration depends on factors such as brand recognition, physician prescribing preferences, formulary positioning, and pricing strategies.

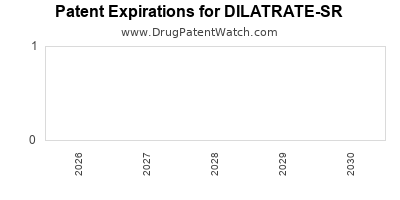

The drug’s patent status influences market exclusivity; if patent protections have lapsed or are under challenge, generic versions can enter, intensifying price competition. Conversely, if proprietary rights are maintained, DILATRATE-SR can command premium pricing, bolstering revenue streams.

Regulatory and Reimbursement Environment

Regulatory frameworks heavily influence DILATRATE-SR’s market access. Countries such as the U.S., EU, and Japan require rigorous clinical trials demonstrating safety and efficacy. Regulatory approvals facilitate approval for broader indications or new formulations, expanding the market potential.

Reimbursement policies also dictate market performance. In regions with comprehensive healthcare coverage, like Western Europe or North America, reimbursement fosters higher utilization. Conversely, in emerging markets with out-of-pocket payment systems, affordability becomes a critical determinant. Strategies aligning with policymakers and demonstrating cost-effectiveness are vital for expanding market share.

Market Drivers and Barriers

Drivers:

- Growing Hypertension Prevalence: Aging populations and lifestyle factors accelerate demand for effective antihypertensive therapies.

- Patient Compliance Focus: Extended-release formulations like DILATRATE-SR improve adherence rates, a key factor in chronic disease management.

- Combination Therapy Trends: Increasing use of fixed-dose combinations incorporating CCBs makes sustained-release formulations more attractive.

- Clinical Evidence and Guidelines: Updated hypertension management guidelines favor the inclusion of CCBs, increasing their prescription rates.

Barriers:

- Generic Competition: Entry of generic formulations reduces prices and margins.

- Pricing Pressures: Public and private payers’ emphasis on cost containment limits premium pricing.

- Physician Prescribing Habits: Established preference for other CCBs or combination therapies can hinder uptake.

- Manufacturing and Supply Chain Risks: Consistent product quality and supply stability are imperative for sustained market presence.

Financial Trajectory Analysis

Forecasting the financial trajectory of DILATRATE-SR involves analyzing revenue potential, market penetration, pricing strategies, and operational costs. Considering the global hypertension burden, initial expansion through developed markets can generate robust revenues, especially if DILATRATE-SR is positioned as a premium product with distinctive clinical benefits.

Revenue Projections:

- Short-Term (1–3 years): Limited market penetration due to existing competition; revenues may range from USD 50–100 million globally, heavily reliant on key markets like the U.S. and Western Europe.

- Mid-Term (4–7 years): Increased adoption driven by clinical guideline endorsements and wider formulary inclusion, potentially doubling revenues with targeted marketing efforts.

- Long-Term (8+ years): Potential plateauing or decline due to patent expiry and generic competition; licensing deals or formulation enhancements may sustain revenue streams.

Cost Considerations:

- Research & Development: Expenses related to regulatory filings, clinical trials, and manufacturing improvements for bioequivalence with generics.

- Manufacturing & Supply Chain: Costs associated with quality assurance, raw materials, and logistic scalability.

- Marketing & Sales: Investment in physician education, key opinion leader engagement, and distribution channels.

Market Entry and Expansion Strategies

To capitalize on growth opportunities, stakeholders should focus on differentiating DILATRATE-SR through clinical data showcasing superior efficacy or safety profiles. Leveraging real-world evidence can support formulary acceptance. Additionally, pursuing strategic alliances with payers and distributors facilitates broader access.

Emerging markets present high-growth opportunities, provided pricing and distribution strategies are adapted accordingly. Tailoring marketing campaigns to regional healthcare priorities enhances acceptance.

Future Outlook and Innovation Pathways

Innovation in sustained-release technology, such as novel delivery systems or combination formulations, can extend DILATRATE-SR’s market relevance. Developing fixed-dose combinations with other antihypertensives or cardioprotective agents could enhance value propositions.

Furthermore, digital health integrations, including adherence monitoring tools and personalized medicine approaches, are emerging trends that can boost patient outcomes and market share.

Key Takeaways

- Growing global hypertension prevalence ensures sustained demand for sustained-release CCBs like DILATRATE-SR.

- Market success hinges on differentiating clinical benefits, regulatory approvals, and reimbursement strategies.

- Patent expiration and competitive pressures necessitate proactive portfolio management, including formulation innovations and strategic partnerships.

- Emerging markets offer significant growth opportunities with tailored pricing and distribution approaches.

- Innovation, real-world evidence, and digital health integrations are critical to extending the product’s lifecycle and maintaining market relevance.

Conclusion

DILATRATE-SR’s future market trajectory hinges on navigating a dynamic landscape marked by intensifying competition, evolving regulatory demands, and shifting payer policies. Strategic positioning emphasizing clinical advantages, affordability, and patient-centric innovations will determine its financial success. Stakeholders must adopt adaptive, data-driven approaches to optimize revenue streams and sustain long-term growth in a competitive cardiovascular therapeutics market.

FAQs

- What factors influence the market share of DILATRATE-SR?

Market share depends on clinical efficacy, safety profile, patent status, pricing, physician prescribing patterns, and reimbursement policies. Differentiation through clinical data and formulary placement are pivotal.

- How does patent expiration affect DILATRATE-SR’s profitability?

Patent expiry opens the market to generics, leading to significant price erosion but also increased volume. Strategic innovations and extension of formulations can mitigate revenue loss.

- Are there specific regions where DILATRATE-SR is gaining more traction?

Developed markets like the US and Europe are primary revenue sources, but emerging markets, especially in Asia and Latin America, offer substantial growth potential, contingent on effective pricing and distribution.

- What are the key regulatory challenges facing DILATRATE-SR?

Regulatory challenges include demonstrating bioequivalence, securing approvals for new indications, and navigating differing regional requirements, all of which influence market access timelines.

- What strategic moves can enhance DILATRATE-SR’s long-term financial trajectory?

Innovations in drug delivery, strategic collaborations, expansion into combination therapies, strengthening digital health integration, and targeted marketing in emerging regions can extend its market viability.

Sources

[1] WHO Global Health Observatory data on hypertension, 2022.

[2] MarketWatch, “Antihypertensive Drugs Market Size & Trends,” 2022.

[3] FDA Guidance for Industry: Bioequivalence Studies, 2021.

[4] European Medicines Agency (EMA), “Regulatory Frameworks for Cardiovascular Drugs,” 2022.

[5] IQVIA Medical Data, “Prescription Trends for Calcium Channel Blockers,” 2022.