Last updated: July 27, 2025

Introduction

Isoniazid (INH), introduced in the 1950s, remains a cornerstone in tuberculosis (TB) management worldwide. Its efficacy, affordability, and role in combination therapies have entrenched it as a foundational anti-tubercular agent. However, evolving market forces, patent landscapes, resistance challenges, and public health priorities influence its commercial and clinical trajectory. This analysis assesses current market dynamics and forecasts the financial trajectory of isoniazid within the global pharmaceutical landscape.

Historical Context and Clinical Significance

Isoniazid, a first-line anti-TB agent, swiftly became essential due to its potent bactericidal activity against Mycobacterium tuberculosis[^1]. It revolutionized TB treatment, enabling shorter, more effective regimens. While no longer under patent protection, its affordability has cemented its status in both developed and developing countries.

Despite its established efficacy, issues such as drug resistance, especially multidrug-resistant TB (MDR-TB), pose challenges. The emergence of isoniazid-resistant strains has prompted the need for novel agents and combination strategies, influencing market size and investment.

Market Dynamics

1. Patent and Regulatory Landscape

Isoniazid is off-patent worldwide, which fosters generic manufacturing and significant price competition. This accessibility benefits public health but curtails proprietary income streams for pharmaceutical companies. Regulatory agencies, such as the FDA and EMA, continue to approve generic forms, with limited incentive for innovation centered solely on isoniazid[^2].

2. Competitive Market and Generics

The global TB drug market predominantly relies on generics, with large manufacturers across Asia, Africa, and Latin America producing cost-effective formulations. Market saturation, low profit margins, and limited R&D incentives reduce the likelihood of novel derivatives or formulations for isoniazid, unless addressing resistance or improving delivery.

3. Resistance and the Need for New Therapies

Rising rates of isoniazid-resistant TB (mono-resistant and MDR strains) influence clinical guidelines and market focus. The WHO recommends against monotherapy in resistant cases, prompting demand for newer, resistant-strain-effective agents[^3]. This scenario shifts some investment towards developing new drugs, but the relevance of isoniazid diminishes in resistant contexts.

4. Public Health Policies and Funding

Global health initiatives, such as the Global Fund and WHO programs, prioritize affordable TB treatments, underpinning ongoing use of isoniazid. Despite funding for research into TB, investments are often geared toward newer agents, diagnostics, and vaccines, indirectly affecting isoniazid’s market expansion.

5. COVID-19 Impact and Future Trends

The COVID-19 pandemic disrupted TB control programs, leading to diagnostic delays and treatment interruptions. While this impacted TB drug markets broadly, it also underlined the importance of robust supply chains for essential medicines like isoniazid[^4]. Post-pandemic recovery may influence procurement and funding strategies, potentially stabilizing existing markets.

Financial Trajectory Analysis

Current Market Valuation

The global TB drug market is valued at approximately USD 1.2 billion (2022), with isoniazid constituting a substantial share due to its widespread use[^5]. As a generic drug, it commands low margins, with existing revenue primarily driven by volume.

Growth Drivers

- Global TB Burden: An estimated 10 million new TB cases annually[^6], sustaining demand for first-line therapies, including isoniazid.

- Public Sector Procurement: Governments and NGOs procure large quantities of generic isoniazid, maintaining a steady revenue stream.

- Programmatic Use in Latent TB Infection (LTBI): Increased use of isoniazid for LTBI treatment, especially in high-burden countries, could augment demand.

Challenges to Growth

- Resistance Patterns: Increasing resistance undermines isoniazid’s utility, potentially reducing its market in favor of second-line agents.

- Limited Innovation and Patent Expiry: Absence of new, protected formulations constrains revenue growth opportunities.

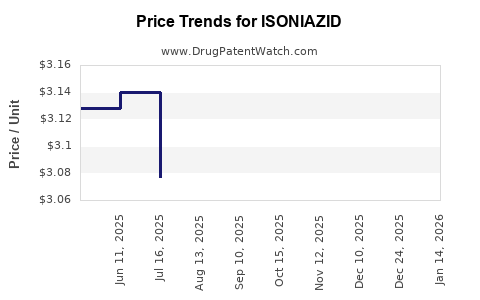

- Price Competition: Widespread generic manufacturing ensures low unit costs, squeezing margins.

Future Outlook

The financial trajectory of isoniazid is expected to stabilize or decline modestly in conventional markets due to resistance issues, static innovation, and low margins. However, in low-income regions with high TB prevalence, demand remains steady, supported by international funding.

Potential growth avenues include:

- Combination Formulations: Fixed-dose combinations (FDCs) containing isoniazid, which improve adherence and treatment outcomes, can sustain demand.

- Development of Resistance-Directed Formulations: Advances in diagnostics leading to targeted therapy may carve niche markets for specific formulations.

- Alternative Delivery Systems: Liposomal or nanoparticle formulations might enhance bioavailability, appealing for niche markets but unlikely to significantly alter the overall financial outlook.

Long-Term Prognosis

Given current trends, isoniazid's future financial trajectory hinges on global TB control efforts, resistance management, and innovation in formulation or delivery. The market is expected to remain stable in volume but with limited growth potential. Substituting for resistant TB strains and integrating into comprehensive treatment regimens will determine its continued clinical relevance.

Strategic Implications for Industry Stakeholders

- Public-Private Partnerships: Collaborations with global health agencies ensure continued demand and facilitate affordable access.

- Focus on Resistance Monitoring: Supporting resistance surveillance can sustain the relevance of isoniazid in tailored therapies.

- Investment in Combination Therapies: Developing.Fixed-dose combinations with isoniazid enhances adherence and market stability.

- Exploration of New Formulations: While unlikely to generate blockbuster revenues, specialized formulations may open niche markets.

Key Takeaways

- Isoniazid remains a critical component of TB treatment globally, especially in resource-limited settings, due to its affordability and efficacy.

- The patent expiry and generic manufacturing landscape create a highly competitive environment with slim margins, constraining significant revenue growth.

- Escalating drug resistance diminishes isoniazid’s role in resistant TB cases, prompting a shifted focus toward novel agents and treatment strategies.

- The steady demand in low-resource regions, coupled with international funding, ensures a baseline market, though growth prospects are limited.

- Future market stability depends on enhancements in formulations, strategic use in combination therapies, and resistance management.

FAQs

-

What factors influence the global demand for isoniazid?

Demand primarily depends on TB prevalence, treatment guidelines, resistance patterns, and international funding programs. Its affordability and inclusion in combination therapies also sustain steady propagation, particularly in low- and middle-income countries.

-

How does drug resistance impact the market for isoniazid?

Rising resistance, especially in MDR and mono-resistant TB, reduces isoniazid’s use as a monotherapy. This shift favors second-line agents and diminishes standalone market value.

-

Are there ongoing innovations in isoniazid formulations?

While limited, some research explores improved delivery systems and fixed-dose combinations to enhance adherence. However, significant proprietary innovations are scarce due to generic dominance.

-

What role do global health initiatives play in the isoniazid market?

Programs led by the WHO and the Global Fund procure large quantities of isoniazid, particularly in high-burden settings, ensuring steady demand but not significantly fueling revenue growth.

-

What is the outlook for isoniazid in the next decade?

The outlook predicts steady, resilient demand driven by public health needs, but limited growth potential due to resistance issues, low margins, and lack of innovation.

Sources

[^1]: World Health Organization. Global Tuberculosis Report 2022.

[^2]: U.S. Food and Drug Administration. Drug Approvals & Regulatory Information.

[^3]: World Health Organization. Treatment of Drug-Resistant Tuberculosis: Reduced Use of Isoniazid in MDR Regimens.

[^4]: Stop TB Partnership. Impact of COVID-19 on TB Services.

[^5]: MarketsandMarkets. Global Tuberculosis Drugs Market Report, 2022.

[^6]: CDC. Global TB Statistics and Trends.