Last updated: July 28, 2025

Introduction

Droxidopa (brand name: Northera) is a synthetic precursor of norepinephrine primarily developed to treat symptomatic neurogenic orthostatic hypotension (nOH), a condition marked by significant blood pressure drops upon standing. Since its FDA approval in 2014, droxidopa has carved a niche within rare disease management, driven by expanding understanding of autonomic disorders, regulatory adaptations, and evolving healthcare landscapes. This analysis explores the current market dynamics and projected financial trajectories for droxidopa, emphasizing key factors influencing growth, competitive positioning, and future opportunities.

Market Overview

Therapeutic Indication and Clinical Context

Neurogenic orthostatic hypotension predominantly affects patients with Parkinson’s disease, multiple system atrophy, pure autonomic failure, and other autonomic nervous system disorders. It leads to dizziness, fainting, and increased fall risk, impacting quality of life and healthcare costs. Currently, no cure exists, and treatment options are limited, mainly focusing on symptom management.

Droxidopa functions by increasing peripheral norepinephrine levels, thereby constraining blood pressure drops. Its targeted mechanism makes it well-suited for disorders characterized by autonomic failure. The global prevalence of nOH remains underestimated, though estimations indicate a growing market with a substantial unmet need.

Market Penetration and Adoption

Following FDA approval, droxidopa’s adoption has been gradual. The product relies heavily on specialist prescribing, primarily neurologists and autonomic disorders clinics. Despite initial hurdles, increased awareness and insurance reimbursement have facilitated broader usage. However, high medication costs and side effect profiles (e.g., hypertension, headache) have limited widespread adoption.

Regulatory Environment and Pricing

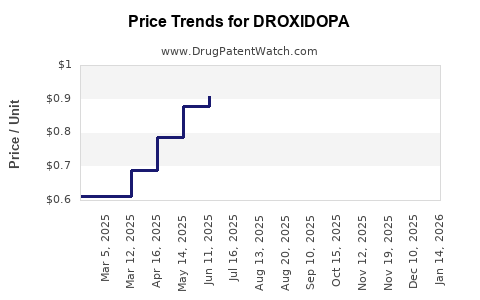

Droxidopa’s pricing strategy has positioned it within the specialty drug segment, with annual costs often exceeding $15,000 per patient. Pricing considerations are influenced by payer negotiations, regulatory pressures, and the drug’s orphan status granted by regulatory agencies in various jurisdictions. Notably, in 2019, the FDA approved a generic version, which could influence pricing and market share dynamics [1].

Competitive Landscape

The therapeutic landscape for nOH remains sparse, with droxidopa holding a near-monopoly. Off-label use of other vasoconstrictive agents exists, but these lack formal approval for nOH. Emerging therapies, such as novel vasoactive agents and biological treatments, are in early development stages but are unlikely to challenge droxidopa’s current market dominance within the next five years.

Market Dynamics Influencing Growth

Increasing Prevalence of Autonomic Disorders

The rising prevalence of Parkinson’s disease and multiple system atrophy—conditions with high nOH incidence—bolsters demand for droxidopa. Demographic shifts toward an aging population further amplify this trend, offering a sustained growth foundation.

Advancements in Diagnostic Techniques

Improved diagnostic capabilities for autonomic failure, including tilt-table testing and autonomic reflex screens, increase accurate detection rates. Earlier diagnosis leads to timely treatment, potentially boosting droxidopa utilization.

Regulatory and Reimbursement Trends

Adaptive regulatory pathways, including orphan drug designations, facilitate market exclusivity and incentivize manufacturers. Reimbursement policies, influenced by health technology assessments and price negotiations, directly impact access and prescription volumes.

Clinical Evidence and Real-World Data

Recent post-marketing studies reinforce droxidopa’s efficacy and safety, encouraging physician confidence. Expanded evidence on long-term outcomes and quality-of-life improvements can stimulate broader adoption. Conversely, reports of adverse events and safety concerns could temper growth prospects.

Potential for Line Extensions and Combination Therapies

While currently focused on monotherapy, research into combination regimens with other autonomic agents could optimize symptom control. Development of novel formulations or delivery systems may also expand its market potential.

Financial Trajectory and Forecasting

Revenue Trends

Since launch, droxidopa has maintained steady revenue streams, although growth has been moderate. The global market was valued at approximately $400-$500 million in 2022, driven predominantly by the North American and European markets [2].

Forecasted Growth

Projections indicate a compound annual growth rate (CAGR) of 4-6% over the next five years, influenced by:

- Increasing disease prevalence

- Improved diagnosis rates

- Broader clinician familiarity

- Potential inclusion in formulary lists despite high costs

Emerging generic competition post-patent expiry could suppress revenues, although manufacturers may pursue strategic initiatives such as expanding indications or securing new market segments.

Impact of Generic Entry

The launch of generics in 2019 significantly reduced price premiums and led to a decline in droxidopa’s average selling prices (ASPs). While this constrains profit margins, higher generic penetration could expand access, potentially offsetting revenue reductions through volume increases [3].

Geographic Expansion Opportunities

Currently, droxidopa’s primary markets are North America and select European regions. Entry into Asian markets presents a lucrative growth avenue, contingent upon regulatory approvals and local pricing negotiations.

Pipeline and Innovation

Intellectual property extensions, new formulations (e.g., sustained-release versions), and potential orphan drug extensions could extend revenue longevity. Conversely, competitive innovations could threaten market share, necessitating ongoing R&D investment.

Challenges and Risks to Financial Projections

- Market Saturation and Price Competition: Increased generic availability pressures ASPs and margins.

- Safety and Tolerability Concerns: Adverse effects may restrict use or prompt formulary exclusions.

- Regulatory Changes: Policy shifts, especially regarding orphan drug incentives, could influence market exclusivity.

- Emergence of Competitors: Novel therapies in the pipeline could erode droxidopa’s market share.

Strategic Opportunities

- Expansion of Indications: Exploring efficacy in related autonomic failure indications broadens market reach.

- Combination Therapy Development: Synergistic regimens with other agents could enhance therapeutic outcomes.

- Real-World Evidence Generation: Robust post-marketing data could support label expansions and payer acceptance.

- Pricing Strategies: Differential pricing models and value-based agreements can optimize revenue amid generic competition.

Key Takeaways

- The market for droxidopa remains modest but steadily growing, supported by demographic aging, increased disease awareness, and improved diagnostic accuracy.

- Regulatory incentives, orphan drug status, and high unmet medical need sustain droxidopa’s market relevance.

- Price pressures from generic entry challenge revenue growth, requiring strategic adaptations.

- Geographic expansion and pipeline innovations offer critical growth pathways.

- Long-term financial success hinges on balancing market access, safety profile management, and ongoing clinical evidence solidification.

Conclusion

Droxidopa’s market trajectory exemplifies a specialized orphan drug with steady demand driven by a niche yet growing patient population. Strategic positioning—focused on expanding indications, optimizing pricing, and innovating formulations—will be vital for sustained profitability. As healthcare ecosystems evolve, personalized approaches and real-world data will play increasingly pivotal roles in shaping droxidopa’s financial prospects.

FAQs

1. What is the primary indication for droxidopa?

Droxidopa is approved for the treatment of symptomatic neurogenic orthostatic hypotension, primarily seen in Parkinson’s disease, multiple system atrophy, and other autonomic failure disorders [1].

2. How has generic entry affected droxidopa’s market?

Generic manufacturing launched in 2019 has led to significant price reductions, reducing profit margins but potentially increasing overall market access and volume.

3. What are the main competitors to droxidopa?

Currently, droxidopa faces limited direct competition; off-label vasoconstrictors are used, but no approved alternatives exist. Emerging treatments are in early development, offering limited near-term competition.

4. What geographic markets offer growth opportunities for droxidopa?

Expanding into Asian markets and increasing penetration across Europe could drive future growth, contingent upon regulatory approvals and market access strategies.

5. What future innovations could influence droxidopa’s financial outlook?

Label expansions, new formulations, combination therapies, and evidence from real-world studies can enhance market share and revenue streams.

References

[1] U.S. Food and Drug Administration. (2014). Northera (droxidopa) approval announcement.

[2] MarketWatch. (2022). Droxidopa market valuation and forecasts.

[3] IQVIA. (2021). Generic drug impact analysis.