Last updated: July 30, 2025

Introduction

Lundbeck NA Ltd, a subsidiary of the Danish pharmaceutical company H. Lundbeck A/S, plays a pivotal role in the North American neuropsychiatric and neurological drug market. Specializing in the development, manufacturing, and commercialization of medications for such conditions, Lundbeck has carved a niche through innovative therapies and strategic collaborations. This analysis evaluates Lundbeck's market positioning, key strengths, competitive challenges, and strategic pathways within the rapidly evolving pharmaceutical landscape.

Market Position

Lundbeck NA Ltd operates within a highly competitive segment characterized by intense R&D activity and regulatory scrutiny. The company’s primary focus on central nervous system (CNS) disorders distinguishes it but also constrains its market scope—primarily targeting schizophrenia, depression, anxiety, Alzheimer’s Disease, and Parkinson’s Disease.

In North America, Lundbeck’s efficacy in capturing market share hinges on its portfolio's clinical differentiation and regulatory approvals. The company holds notable products like Trintellix (vortioxetine) for depression, which competes with established SSRIs and newer agents. While Lundbeck’s revenue streams remain substantial, its market share lags behind industry giants such as Pfizer, Johnson & Johnson, or Novartis, mainly due to its more specialized, focused product pipeline.

According to IQVIA data, Lundbeck’s North American revenues account for approximately 8–10% of total sales in their therapeutic areas, reflecting stable but niche market penetration. Its strategic alliances with healthcare providers and payers bolster access and adoption but limit broad market dominance.

Strengths

1. Focused CNS Portfolio

Lundbeck’s core strength lies in its exclusive focus on neuropsychiatric disorders, fostering deep expertise, targeted R&D, and robust clinical pipelines. This specialization results in significant innovation potential for unmet needs, especially in treatment-resistant conditions.

2. Innovation and R&D Capabilities

The company is renowned for its research-driven approach, investing approximately 20% of revenues into R&D annually. Its pipeline includes novel formulations and mechanisms of action aimed at neurodegeneration and mental health disorders, positioning Lundbeck as a thought leader in CNS therapeutics.

3. Strategic Collaborations and Licensing Deals

Lundbeck has engaged in targeted collaborations with biotech firms, academia, and licensing agreements with larger pharmaceutical companies, enhancing its R&D capacity and expanding its product portfolio. For example, partnerships with SAGE Therapeutics have expedited access to innovative sleep and anxiety treatments.

4. Regulatory Expertise and Clinical Credibility

Over decades, Lundbeck has accumulated strong regulatory experience, ensuring efficient approval pathways for its key products. Its clinical credibility is reinforced by multiple successful trials and peer-reviewed publications supporting its therapies’ efficacy and safety profiles.

5. Market Niche and Loyalty

Lundbeck’s focus on difficult-to-treat conditions has fostered a loyal customer base, with clinicians appreciating its targeted, science-backed products. Its niche positioning mitigates some competitive pressures typical in broader pharmaceutical markets.

Strategic Challenges

1. Limited Market Diversification

The company’s concentration on CNS disorders limits revenue diversification, exposing it to sector-specific risks such as pricing pressures, regulatory changes, or shifts in treatment paradigms.

2. Competition from Larger Pharmaceutical Firms

Major players advancing pipeline therapies and expanding indications pose a constant threat. For example, companies like Lilly and Biogen, with their broad CNS portfolios, outspend Lundbeck in R&D and global marketing.

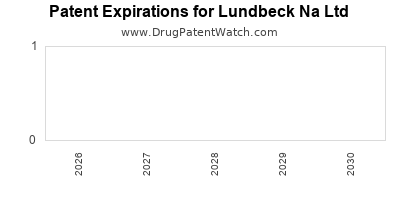

3. Patent Expirations and Generic Competition

Lundbeck faces imminent patent cliffs with some of its established products. The impending entry of generics could significantly erode sales unless new proprietary therapies are successfully launched.

4. Pricing and Reimbursement Pressures

In the North American healthcare environment, pricing pressures and evolving reimbursement policies challenge profit margins. Payers favor cost-effective treatments, pressuring Lundbeck to justify premium positioning of its innovative medications.

5. R&D Risks and Pipeline Uncertainties

While investment in R&D is a strength, it also bears inherent risks. The high attrition rate of CNS drug candidates and lengthy development timelines can delay revenue streams and impact financial stability.

Strategic Insights and Future Outlook

Innovation-Driven Growth

Lundbeck’s sustained focus on R&D should prioritize breakthrough therapies for treatment-resistant CNS conditions. Emphasis on biomarkers and personalized medicine can enhance clinical trial success and patient adherence.

Market Expansion and Collaborations

Expanding geographic presence beyond North America, especially in Asia-Pacific, offers high-growth opportunities. Additionally, strategic licensing and co-development agreements with biotech firms can mitigate R&D risks while expanding its pipeline.

Product Lifecycle Management

Proactive lifecycle management—including reformulations, fixed-dose combinations, and new indications—could extend the market viability of existing products such as Trintellix or Caplyta.

Digital Transformation and Data Utilization

Deploying digital health tools and leveraging real-world evidence can optimize clinical development, improve patient outcomes, and support value-based pricing models.

Regulatory Engagement and Policy Advocacy

Active engagement with regulators and payers is essential to shape policies favoring innovative CNS therapies. Demonstrating cost-effectiveness and patient benefits can help mitigate reimbursement challenges.

Conclusion

Lundbeck NA Ltd maintains a strong niche position within the CNS segment, driven by focused R&D, clinical credibility, and strategic collaborations. To sustain growth amid fierce competition, it must accelerate innovation, diversify markets, and adapt to evolving payer landscapes. Future success hinges on its ability to deliver groundbreaking, patient-centric therapies that address high unmet needs in neuropsychiatry.

Key Takeaways

- Lundbeck’s niche focus on CNS disorders provides competitive differentiation but limits diversification, requiring continuous innovation.

- Strategic collaborations and a strong pipeline are vital to counter emerging competition and patent expirations.

- Expanding global footprint and integrating digital health solutions can unlock new growth avenues.

- Addressing reimbursement and pricing pressures proactively enhances market stability.

- Investment in personalized medicine and biomarkers can improve clinical success rates and patient outcomes.

FAQs

1. How does Lundbeck differentiate itself from larger pharmaceutical competitors?

Lundbeck’s exclusive focus on neuropsychiatric and neurological disorders enables deep expertise, targeted innovation, and tailored clinical offerings, setting it apart from broader Pharma rivals.

2. What are the primary growth opportunities for Lundbeck in North America?

Key opportunities include expanding indications for existing products, developing novel therapies for resistant conditions, and increasing strategic partnerships to accelerate pipeline development.

3. How is Lundbeck addressing patent expirations and generic competition?

The company relies on lifecycle management strategies, such as reformulations and new indications, coupled with pipeline diversification to maintain revenue streams amid impending patent cliffs.

4. What role does R&D play in Lundbeck’s strategic growth?

R&D is central, with significant investment in novel CNS therapies, biomarker research, and personalized medicine approaches to sustain innovation and competitive advantage.

5. How can Lundbeck navigate the pricing and reimbursement pressures in North America?

By demonstrating value through real-world evidence, emphasizing clinical benefits, and engaging with payers early, Lundbeck can better align its offerings with market expectations and reimbursement policies.

References

[1] IQVIA. North American Pharma Market Data, 2022.

[2] Lundbeck NA Ltd Annual Report 2022.

[3] Industry Analysis Reports. Global CNS Market Outlook, 2023.

[4] Regulatory and Clinical Data Reports, FDA and EMA.

[5] Company Press Releases and Strategic Initiatives, Lundbeck.