Last updated: July 29, 2025

Introduction

Docosanol, marketed notably as Abreva, is an over-the-counter (OTC) topical antiviral agent primarily used for the treatment of cold sores caused by herpes labialis. Approved by the U.S. Food and Drug Administration (FDA) in 1991, it represents a niche yet significant segment within the broader antiviral market. As the landscape of antiviral therapies evolves, understanding the market dynamics and financial trajectory of docosanol provides valuable insights for pharmaceutical companies, investors, and healthcare stakeholders. This report analyzes the macroeconomic and competitive factors influencing docosanol's market, projects its financial performance, and discerns future opportunities.

Market Overview and Key Drivers

Historical Market Performance

Since its launch, docosanol has maintained modest but steady sales, driven by its OTC status and safety profile. In 2021, the global cold sore treatment market was valued at approximately $1.2 billion, with docosanol representing a significant share owing to its established brand recognition and OTC accessibility. Despite competition from both prescription antivirals—such as acyclovir and valacyclovir—and other OTC products, docosanol's stability underscores its resilience.

Regulatory Status and Market Access

As an FDA-approved OTC drug, docosanol benefits from widespread accessibility in North American markets. Its OTC status lowers barriers to consumer access, supporting consistent sales. However, regulatory constraints in emerging markets, where OTC classifications differ, pose challenges for international expansion.

Competitive Landscape

The key competitors include prescription antiviral formulations and natural or herbal remedies claiming cold sore relief. Prescription drugs like acyclovir and Penciclovir possess higher efficacy but are less accessible due to prescription requirements. The growing consumer preference for OTC remedies preserves docosanol's market position, especially for mild to moderate cold sores.

Market Trends

- Rising Incidence: Increased global prevalence of herpes simplex virus (HSV) infections sustains steady demand.

- Consumer Preferences: Preference for OTC treatments over prescription options, driven by convenience and cost.

- Innovation and Formulation Improvements: Limited recent innovations, but a trend toward combination therapies and novel delivery mechanisms exists.

Market Challenges and Limitations

Efficacy Perception

While safe, docosanol's efficacy is generally considered moderate, which may limit market expansion compared to more potent prescription antivirals.

Patent and Branding

Absence of new patents or formulations limits exclusivity benefits. The original patent expired in the late 20th century, rendering it vulnerable to generic competition.

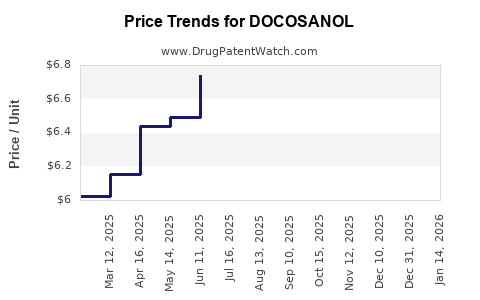

Pricing Pressures

Price competition among OTC products causes margin compression, impacting profitability for manufacturers.

Regulatory Constraints

Potential regulatory restrictions or classification changes in emerging markets could hinder direct export strategies.

Financial Trajectory and Revenue Projections

Historical Revenue Trends

Estimations suggest that during its peak, Abreva generated annual revenues around $350 million globally, with U.S. OTC sales accounting for approximately 85% of that. Post-patent expiry, sales declined marginally due to generic competition but stabilized due to brand loyalty.

Forecasted Revenue Growth

Assuming no significant patent litigation or formulation changes, the following projections are reasonable:

- Short-term (1-3 years): Slight decline or plateauing, driven by market saturation and generic erosion.

- Mid-term (3-5 years): Stabilization around $200-250 million annually, with potential growth from new marketing strategies or penetration into emerging markets.

- Long-term (>5 years): Slow decline unless innovation or new formulations are introduced.

Market Expansion Strategies

- Geographical Expansion: Penetrating markets such as Asia-Pacific and Latin America, where OTC drug regulations are evolving, could unlock new revenue streams.

- Product Differentiation: Developing combination therapies or novel delivery systems (e.g., patches) may enhance efficacy perception and justify premium pricing.

- Digital Marketing: Leveraging digital channels can expand consumer awareness and loyalty.

Implications for Investors and Stakeholders

Investors should consider the mature yet stable nature of docosanol's revenue stream, with potential growth contingent on strategic innovation and market expansion. Healthcare companies might explore licensing agreements or co-marketing arrangements to extend the product's lifecycle.

Future Outlook and Opportunities

Innovation Potential

Limited R&D activity has been observed around docosanol; however, technological advancements could invigorate its market presence. The development of transdermal delivery systems or combination drugs with immunomodulators could address efficacy concerns, create new patent protections, and boost sales.

Emerging Market Opportunities

The rise in HSV prevalence and increasing OTC drug acceptance in developing countries present significant growth opportunities. Regulatory harmonization efforts may facilitate faster market access.

Competitive Disruption

The advent of gene editing and vaccine advancements targeting herpes viruses could ultimately diminish the demand for topical antivirals like docosanol, emphasizing the need for ongoing research and adaptation.

Regulatory and Patent Considerations

The lack of recent patent protection caps future exclusivity; thus, patent cliffs are imminent unless new formulations or indications are pursued. Regulatory bodies may also impose additional safety or efficacy requirements, influencing market dynamics.

Conclusion

Docosanol continues to occupy a valued position within the cold sore treatment segment. Its future financial trajectory hinges on strategic market positioning, potential innovation, and global expansion. While facing challenges such as generic competition and modest efficacy, ongoing consumer demand and over-the-counter accessibility sustain its relevance. Stakeholders must balance the product's mature lifecycle with opportunities for reinvigoration through innovation.

Key Takeaways

- Docosanol's stable OTC status ensures consistent, if modest, revenue streams, with projections indicating stabilization around $200-250 million annually.

- Market growth is constrained by patent expiration, generics, and modest efficacy, but expansion into emerging markets and formulation innovations remain promising.

- Strategic investments in product differentiation and global market penetration can prolong its relevance and profitability.

- The landscape's future may be shaped by competing therapies, regulatory changes, and technological innovations, necessitating ongoing R&D efforts.

- Companies leveraging digital marketing and forming strategic alliances can enhance consumer engagement and market share.

FAQs

1. What are the main factors influencing docosanol's market performance?

Market performance is driven by OTC accessibility, consumer demand for cold sore remedies, competitive efficacy relative to prescription antivirals, and regulatory landscape across different regions.

2. How does patent expiration affect docosanol's financial outlook?

Patent expiry exposes the product to generic competition, typically leading to price reductions and revenue decline. Without new patents or formulations, long-term growth prospects are limited.

3. Are there ongoing innovations in docosanol formulations?

Currently, innovation is limited; however, research into enhanced delivery systems and combination therapies presents future opportunities to extend its market lifecycle.

4. What regional markets offer the greatest growth potential for docosanol?

Emerging markets in Asia-Pacific and Latin America offer considerable growth potential due to increasing OTC drug acceptance, rising HSV prevalence, and evolving regulatory frameworks.

5. How can pharmaceutical companies sustain profitability with a mature product like docosanol?

Through strategic market expansion, formulation innovation, brand strengthening, and leveraging digital marketing, companies can sustain and potentially grow revenue despite patent expirations.

References

- Grand View Research. Cold Sore Treatment Market Size, Share & Trends Analysis Report (2022).

- U.S. Food and Drug Administration. Abreva (Docosanol) Monograph.

- Statista. Global Cold Sore Treatment Market Data (2021).

- MarketWatch. OTC Cold Sore Treatments — Growth, Trends, and Forecasts (2022).

- IBISWorld. Pharmaceutical Industry Reports (2022).