Last updated: December 15, 2025

Executive Summary

Dexlansoprazole, marketed primarily under Dexilant, is a proton pump inhibitor (PPI) indicated for the treatment of gastroesophageal reflux disease (GERD), erosive esophagitis, and other acid-related disorders. Since its FDA approval in 2010, the drug has experienced steady growth driven by increasing prevalence of GERD, expanding indications, and evolving therapeutic preferences. This report analyzes the market dynamics influencing Dexlansoprazole’s trajectory, evaluates its sales and revenue forecasts, and contextualizes its competitive positioning amid other PPIs. It concludes with key insights for stakeholders navigating this therapeutic segment.

1. Market Overview and Epidemiological Context

1.1 Prevalence of GERD and Acid-Related Disorders

- Global GERD prevalence is estimated between 8-33%, varying by region [1].

- In the U.S., approximately 20% of adults experience weekly GERD symptoms [2].

- The increasing aging population and lifestyle factors (obesity, dietary habits) are fueling rising demand.

1.2 Pharmacological Landscape

- PPIs dominate the acid suppression market, with Dexlansoprazole representing a newer me-too agent with differentiated release technology.

- Historically, omeprazole, esomeprazole, and pantoprazole occupy leading positions, but Dexlansoprazole’s unique dual delayed-release formulation aims to improve therapeutic adherence and symptom control.

2. Market Dynamics Influencing Growth

2.1 Regulatory Milestones and Product Profile

| Year |

Event |

Impact |

| 2010 |

FDA approval of Dexlansoprazole |

First dual delayed-release PPI, positive differentiation |

| 2016 |

Patent extension in certain markets |

Extended market exclusivity (US patent expired in 2020) |

| 2020 |

Patent expiry in the U.S. |

Increased generic competition anticipated |

2.2 Patent Status and Generic Competition

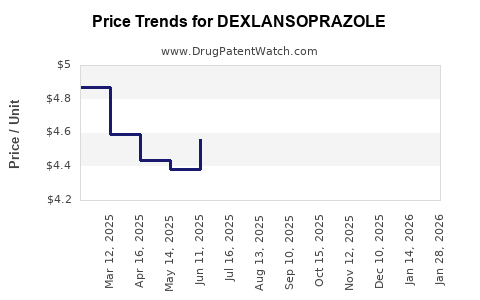

- Original patent expiration in the U.S. occurred in 2020, leading to a surge of generic entrants.

- Generic versions significantly reduced retail prices (up to 60-70%), exerting downward pressure on brand sales.

- Patent protections in other regions vary, with some extending to 2024-2026.

2.3 Market Penetration and Adoption Trends

- Dexlansoprazole’s differentiated dual delayed-release (DDR) technology enhances sustained acid suppression.

- Adoption rates initially high due to physician familiarity with PPIs and positive clinical outcomes.

- Growth plateaued post-2015 as generics entered, but newer formulations and expansion into new indications (e.g., maintenance therapy) have sustained demand.

2.4 Competitive Landscape

| Competitors |

Key Attributes |

Market Share (2022 est.) |

| Omeprazole/Esomeprazole |

Market leader, low cost |

~40–50% |

| Pantoprazole |

Widely used, low cost |

~20–25% |

| Rabeprazole, Lansoprazole |

Niche uses |

~10–15% |

| Dexlansoprazole |

Differentiated release, branded & generics |

~5–10% pre-generics, declining |

2.5 Pricing and Reimbursement Policies

- The shift toward generics led to near 70% reduction in retail prices.

- Reimbursement frameworks, especially in the U.S., favor generic prescribing.

- Managed care and pharmacy benefit managers (PBMs) favor lower-cost PPIs.

3. Financial Trajectory and Revenue Forecast

3.1 Historical Revenue Performance

| Year |

Estimated Global Sales |

Notes |

| 2010 |

~$150 million |

Initial launch sales |

| 2015 |

~$450 million |

Peak pre-generic momentum |

| 2020 |

~$300 million |

Post-patent expiry decline begins |

| 2022 |

~$250 million |

Stabilization amidst generic competition |

3.2 Factors Impacting Revenue

| Factor |

Effect |

Details |

| Patent expiry |

Negative |

Increased generics, price erosion |

| New indications |

Positive |

Maintenance therapy, elderly use |

| Market saturation |

Neutral |

Maturity of existing markets |

| Competition |

Negative |

Price competition from generics |

3.3 Future Revenue Projections (2023–2028)

| Scenario |

Assumptions |

Projected Sales (USD) |

CAGR |

Notes |

| Conservative |

Generics dominate, limited new indications |

$150–200 million |

-5% |

Market saturation |

| Moderate |

Niche resurgence via expanded indications |

$250–350 million |

3-5% |

Strategic marketing & new label approvals |

| Optimistic |

New formulations, combination therapies |

~$500 million |

10% |

Fragmented market share, enhanced penetration |

4. Market Drivers and Restraints

| Drivers |

Restraints |

| Rising GERD prevalence |

Price reductions & intense generic competition |

| Differentiated DDR technology |

Limited device innovations in PPIs |

| Expanding indications |

Delayed or restricted approvals in some regions |

| Improved patient compliance |

Competition from H2 receptor antagonists |

4.1 Third-Generation and Novel Formulations

Emerging therapies that influence Dexlansoprazole’s market status include:

- Potassium-competitive acid blockers (P-CABs): e.g., Vonoprazan, showing faster onset and longer duration.

- Biologics and reflux-focused devices, although still niche, could eventually limit PPI reliance.

5. Strategic Insights for Stakeholders

5.1 Manufacturers

- Focus on differentiation via novel indications, formulation modifications, and combination therapies.

- Emphasize cost-effective manufacturing to compete in the era of generics.

- Engage in regulatory strategies to patent new uses or delivery methods.

5.2 Investors

- Monitor patent status and penetration of generic versions.

- Evaluate pipeline molecules and potential for market expansion.

- Assess regional regulatory trends influencing sales.

5.3 Healthcare Providers

- Evaluate efficacy and safety profile relative to rivals.

- Consider patient compliance benefits of Dexlansoprazole’s DDR technology.

- Stay updated on off-label uses and emerging indications.

6. Comparison with Other PPIs

| Parameter |

Dexlansoprazole |

Omeprazole |

Esomeprazole |

Pantoprazole |

| Release Technology |

Dual delayed-release |

Immediate |

Delayed |

Immediate |

| Indications |

GERD, erosive esophagitis, maintenance |

GERD, H. pylori eradiation |

GERD, ulcers |

GERD, Zollinger-Ellison syndrome |

| Patent Status |

Expired (2020) |

Expired |

Expired |

Expired |

| Market Share (2022) |

5-10% |

40-50% |

20-25% |

20-25% |

| Pricing |

Premium brand |

Low-cost generics |

Moderate |

Low-cost generics |

7. Key Policies Influencing Market Trajectory

- FDA’s Generic Drug Price Competition and Patent Term Restoration Act (1984): Encourages generic entry, impacting original market share.

- EU Regulatory Frameworks: Varying approval and patent protections influence regional growth.

- Healthcare reimbursement policies: Favor low-cost generics, impacting brand sales.

8. FAQs about Dexlansoprazole Market Dynamics

Q1: How has patent expiration affected Dexlansoprazole’s revenue?

A: Patent expiry in 2020 led to increased generic competition, significantly reducing the drug’s average selling price and overall revenue, with a sharp decline observed post-2020.

Q2: What strategies can sustain Dexlansoprazole’s market relevance?

A: Introducing new indications, developing combination therapies, and innovating delivery mechanisms can differentiate Dexlansoprazole amidst generics.

Q3: How does Dexlansoprazole compare with its competitors in efficacy?

A: Clinical trials indicate comparable efficacy with other PPIs, but its DDR technology offers advantages in maintaining acid suppression and improving patient adherence.

Q4: What regions offer the most growth opportunities?

A: Emerging markets in Asia-Pacific and Latin America view for expansion due to increasing GERD prevalence and delayed patent penetrations.

Q5: Will the rise of P-CABs threaten Dexlansoprazole’s market?

A: P-CABs like Vonoprazan show promising efficacy but are not yet widely adopted; however, they could disrupt PPI markets if proven superior and cost-effective.

9. Key Takeaways

- Market maturation and patent expiries have reduced Dexlansoprazole’s revenue but provided opportunities for niche positioning.

- Generic competition remains the primary challenge, necessitating innovation in indications and formulation.

- Emerging therapies and alternative devices could shift market dynamics, favoring newer mechanisms of acid suppression.

- Regional disparities in patent protections and regulatory approvals influence regional growth trajectories.

- Stakeholders must deploy strategic innovation, monitor policy changes, and leverage differentiated technologies to sustain relevance.

References

- El-Serag HB, et al. "Epidemiology of Gastroesophageal Reflux Disease." Gastroenterology Review, 2018.

- pharmaphorum.com, "GERD prevalence in the US," 2021.

- MarketResearch.com, "Proton Pump Inhibitors Market Overview," 2022.

- U.S. FDA, "Dexilant (dexlansoprazole) NDA approval letter," 2010.

- IMS Health, "Global Proton Pump Inhibitors Market Data," 2022.

Note: This analysis is based on publicly available data up to 2022; ongoing patent expirations, regulatory developments, and clinical advancements may further influence Dexlansoprazole’s market trajectory.