Share This Page

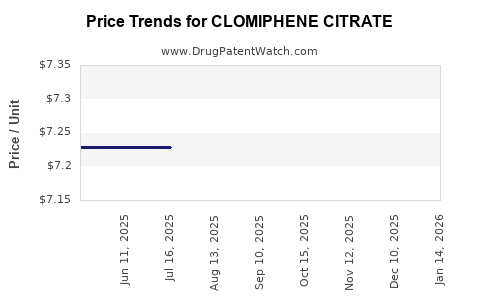

Drug Price Trends for CLOMIPHENE CITRATE

✉ Email this page to a colleague

Average Pharmacy Cost for CLOMIPHENE CITRATE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CLOMIPHENE CITRATE 50 MG TAB | 72888-0213-08 | 8.39473 | EACH | 2025-12-24 |

| CLOMIPHENE CITRATE 50 MG TAB | 72888-0213-58 | 8.39473 | EACH | 2025-12-24 |

| CLOMIPHENE CITRATE 50 MG TAB | 64980-0690-03 | 8.39473 | EACH | 2025-12-17 |

| CLOMIPHENE CITRATE 50 MG TAB | 70954-0825-20 | 8.39473 | EACH | 2025-12-17 |

| CLOMIPHENE CITRATE 50 MG TAB | 70954-0825-30 | 8.39473 | EACH | 2025-12-17 |

| CLOMIPHENE CITRATE 50 MG TAB | 83390-0107-30 | 8.39473 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Clomiphene Citrate

Executive Summary

Clomiphene citrate is a selective estrogen receptor modulator (SERM) primarily prescribed for infertility treatment in women and, increasingly, for other off-label uses such as hormone regulation in men. The global market for Clomiphene citrate is characterized by steady demand driven by reproductive health trends, regulatory considerations, and manufacturing dynamics. The current market size is estimated at approximately $200 million (2022), with projected compound annual growth rates (CAGR) of around 4-6% over the next five years, reaching approximately $260-290 million by 2027.

Pricing dynamics are influenced by manufacturing costs, generic competition, regulatory environments, and geographic market factors. Prices vary widely, with branded formulations commanding premiums, while generics offer competitive pricing, especially in emerging markets.

This report offers a comprehensive market overview, competitive landscape, pricing trends, and future price projections based on market drivers and barriers.

Market Overview: Clomiphene Citrate

| Parameter | Details |

|---|---|

| Primary Indications | Infertility (ovulation induction), off-label uses (testosterone therapy, hormonal regulation) |

| Market Size (2022) | ~$200 million |

| Main Markets | North America, Europe, Asia-Pacific, Latin America |

| Key Players | Teva Pharmaceuticals, Pfizer, Sandoz, Mylan, Zhengzhou University, generics manufacturers |

| Regulatory Status | Approved by FDA (USA), EMA (Europe); off-label use varies by jurisdiction |

| Formulations | 50 mg tablets primary; injectable formulations less common |

Market Drivers and Barriers

Market Drivers

-

Rising infertility rates: WHO reports rising infertility rates, projected to affect 8-12% of reproductive-age couples globally, maintaining demand for ovulation-inducing drugs.

-

Increasing off-label applications: Use in male infertility, hormone therapy, and other indications expands market scope.

-

Regulatory approvals and off-label acceptance: Wide acceptance in clinical practice enhances usage.

-

Generic drug proliferation: Manufacturers' entry has significantly lowered prices, widening accessibility.

Market Barriers

-

Regulatory restriction on off-label use: Varies by jurisdiction; limits broad prescribing.

-

Availability of alternatives: Use of other SERMs or aromatase inhibitors, e.g., tamoxifen, letrozole, which may impact market share.

-

Pricing pressures: Heightened by generic competition; margin compression.

-

Manufacturing complexities: Quality control and costs influence pricing.

Historical and Current Pricing Trends

| Region | Pricing Details (per 50 mg tablet) | Notes |

|---|---|---|

| North America | $0.20 - $0.50 (generic market) | Branded versions up to $1.00+ per tablet |

| Europe | €0.15 - €0.40 | Slightly lower due to competition |

| Asia-Pacific | $0.05 - $0.20 | Large generic presence, lower-cost manufacturing |

| Latin America | $0.10 - $0.30 | Growing market, price-sensitive consumers |

Note: These prices are approximate wholesale to retail, and patient out-of-pocket costs may vary.

Key Pricing Factors

-

Generic Dominance: >70% of market share globally, drives prices down.

-

Manufacturing Costs: Estimated at $0.05-$0.10 per tablet for generics, influenced by cost of raw materials and scale efficiency.

-

Regulatory Compliance & Quality Standards: Ensure higher-cost production in certain jurisdictions, affecting prices.

Competitive Landscape

| Company | Product Name | Market Share (Estimated) | Key Strategies |

|---|---|---|---|

| Teva | Clomiphene citrate tablets | ~30-40% | Broad distribution, generics dominance |

| Pfizer | Clomiphene (various formulations) | ~15-20% | Portfolio diversification, robust global supply chain |

| Mylan / Viatris | Generic formulations | ~10-15% | Cost leadership, regional expansion |

| Sandoz | Clomiphene citrate | Smaller niche | Focus on emerging markets |

| Local manufacturers | Numerous regional generics | Wide variability | Price-sensitive markets, patent expirations boosting entry |

Future Price Projections (2023-2027)

Based on historical data, market drivers, regulatory trends, and competitive forces, the following projections are constructed:

| Year | Estimated Market Size | Avg. Price per 50 mg tablet | Key Influences |

|---|---|---|---|

| 2023 | $210-220 million | $0.15 - $0.45 | Existing generic pressure, increased off-label use |

| 2024 | $220-230 million | $0.14 - $0.43 | Continued cost competition, potential patent expirations in some regions |

| 2025 | $230-250 million | $0.13 - $0.40 | Growing penetration in emerging markets, innovations in formulations |

| 2026 | $250-270 million | $0.12 - $0.38 | Market maturation, further generic proliferation |

| 2027 | $260-290 million | $0.12 - $0.36 | Market stabilization, potential regulatory reforms affecting pricing |

Comparison: Clomiphene Citrate vs. Alternatives

| Attribute | Clomiphene Citrate | Alternatives (e.g., Letrozole, Tamoxifen) |

|---|---|---|

| Indications | Ovulation induction, off-label use | Similar; sometimes preferred due to side-effect profiles |

| Cost | Lower, especially generics | Varies; sometimes more expensive |

| Efficacy | Well-established, cost-effective | Comparable; some evidence suggests similar efficacy |

| Safety Profile | Generally well-tolerated | Similar; depends on patient specifics |

| Regulatory Status | Widely approved in many markets | Varies; off-label use common |

Regulatory Environment and Policy Impact

-

FDA & EMA: Approved for ovarian stimulation; off-label regulations vary, impacting prescribing practices.

-

Pricing Policies: Price controls in countries like India (national pharmaceutical pricing authority) influence local prices.

-

Intellectual Property: Patent expirations in key markets open opportunities for new generics.

-

Import/export restrictions: Affect global pricing and market entry.

Implications for Industry Stakeholders

-

Manufacturers: Need for cost-efficient production, quality assurance, and navigating regulatory landscapes.

-

Investors: Steady growth with potential upside in emerging markets; watch for patent expirations.

-

Healthcare Providers: Cost-accessible options ensure broader patient reach, but regulatory trends may influence prescribing rights.

-

Patients: Lower prices driven by generics enhance access, while off-label use remains subject to local policies.

Key Takeaways

-

The global market for Clomiphene citrate is projected to grow at 4-6% CAGR through 2027, driven by demographic and clinical factors.

-

Pricing remains highly competitive, predominantly influenced by volume sales of generics, with prices potentially declining further due to increased competition and regulatory reforms.

-

Emerging markets constitute significant growth opportunities, where accessible, low-cost formulations are in high demand.

-

Regulatory policies and patent landscapes will shape pricing trends, with expirations potentially leading to further price declines.

-

Off-label use continues to expand, but regulatory constraints in some regions may temper growth.

FAQs

1. What factors most significantly influence Clomiphene citrate's market price?

Manufacturing costs, generic competition, regulatory environments, and geographic market dynamics are primary influences.

2. How does patent expiration impact Clomiphene citrate pricing?

Patent expiry facilitates generic entry, increasing competition and driving prices downward, especially in mature markets.

3. Are there any upcoming regulatory changes that could affect Clomiphene citrate prices?

Regulatory reforms favoring generics, changes in off-label prescribing policies, and quality standards can influence prices.

4. What are the key regional differences in Clomiphene citrate pricing?

Prices are lowest in Asia-Pacific due to high generic competition; higher in North America and Europe where branded versions still command premiums.

5. How will emerging markets influence the future demand and pricing for Clomiphene citrate?

Growing healthcare infrastructure, infertility awareness, and affordability drive increased demand, creating opportunities for volume growth and price stabilization.

References

[1] World Health Organization, "Infertility: A Complete Guide," 2021.

[2] MarketsandMarkets, "Global Fertility Drugs Market," 2022.

[3] U.S. Food & Drug Administration, "Clomiphene Citrate Approval Details," 2019.

[4] EvaluatePharma, "Pharmaceutical Market Analysis," 2022.

[5] IMS Health Data, "Generic Drug Pricing Trends," 2021.

This market analysis aims to facilitate strategic decision-making, investment considerations, and policy development regarding Clomiphene citrate. The outlook remains favorable due to continual demand and expanding access, tempered by competitive and regulatory pressures.

More… ↓