Last updated: November 20, 2025

Introduction

TALTZ (ixekizumab), a monoclonal antibody developed by Eli Lilly and Co., is an innovative biologic therap y approved for the treatment of immune-mediated conditions such as plaque psoriasis, psoriatic arthritis, and moderate-to-severe ankylosing spondylitis. Since its FDA approval in 2016, TALTZ has experienced significant market penetration, driven by evolving epidemiology, expanding indications, and competitive dynamics within the biologics space. This report delves into the market drivers, competitive landscape, revenue forecasts, and strategic factors influencing the financial trajectory of TALTZ.

Market Landscape and Epidemiological Drivers

Growing Prevalence of Targeted Indications

The global burden of psoriasis and psoriatic arthritis (PsA) is substantial, with estimates indicating approximately 125 million people affected worldwide by psoriasis alone [1]. The increasing recognition of these conditions' systemic and comorbid nature has accelerated diagnosis rates, enabling targeted biologic therapies like TALTZ to capture larger patient segments.

For psoriasis, the standard of care has shifted decisively towards biologics, especially for moderate-to-severe cases, due to superior efficacy and safety profiles compared to traditional systemic agents [2]. The expanding indication landscape further broadens TALTZ’s market potential; recent approvals for psoriatic arthritis and ankylosing spondylitis have reinforced its position within the IL-17 inhibitor class.

Medical Advances and Treatment Paradigms

Recent shifts toward personalization and early intervention in autoimmune diseases underpin the increased adoption of biologics such as TALTZ. The drug’s mechanism—IL-17A inhibition—targets pivotal inflammatory pathways, leading to high rates of skin clearance and disease control [3].

Moreover, the COVID-19 pandemic has highlighted the critical need for effective, targeted biologics, reinforcing the preference for agents with well-characterized safety profiles, such as TALTZ. Still, the pandemic has temporarily constrained healthcare utilization, but long-term impacts favor sustained biologics market growth.

Competitive Dynamics

Market Position and Differentiators

TALTZ faces competition primarily from other IL-17 inhibitors, including Cosentyx (secukinumab) by Novartis and Siliq (brodalumab) by AstraZeneca, as well as from biologics targeting alternative pathways such as Humira (adalimumab) and Stelara (ustekinumab). Its differentiators include rapid onset of action and high psoriasis clearance rates [4].

Eli Lilly employs strategic marketing, differentiated dosing regimens, and expanded indications to bolster TALTZ’s market share. Clinical data showcasing superior efficacy and favorable safety profiles continue to bolster TALTZ’s competitive edge.

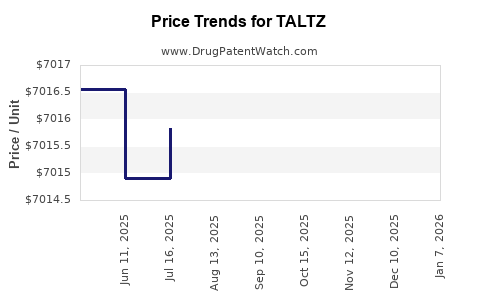

Pricing, Reimbursement, and Access

Pricing strategies and reimbursement policies significantly influence TALTZ's access and adoption. Historically, biologics like TALTZ adopt premium pricing reflective of innovation, but payer negotiations, formularies, and biosimilar pressures affect revenue realization. Lilly’s engagement with healthcare payers for value-based agreements enhances market penetration.

Biosimilar and Patent Landscape

While biosimilars threaten traditional biologics, patent protections for TALTZ remain robust until 2029 [5], providing a window of exclusivity. Nonetheless, impending biosimilar entrants for competing IL-17 inhibitors could exert pricing pressure and impact market share in the latter half of the decade.

Financial Trajectory and Revenue Projections

Historical Performance and Current Revenue

Since its launch, TALTZ has demonstrated robust growth. In 2021, Lilly’s immunology segment, driven partly by TALTZ and other biologics, posted revenues exceeding $7 billion. TALTZ contributed a significant portion, reflecting increasing prescriptions and expanding indications.

Forecasting Future Revenues

Projections indicate that TALTZ’s global sales could reach approximately $4–6 billion annually by 2027, assuming steady uptake, expanding indications, and optimized market access. Several factors underpin this forecast:

- Market Penetration: Continued uptake in existing indications, with expansion into psoriatic arthritis and ankylosing spondylitis markets.

- Pipeline Expansion: Potential approvals for other immune-mediated diseases could elevate revenues further.

- Geographic Expansion: Greater access in emerging markets, where biologics adoption is gaining momentum, supports growth.

- Pricing Dynamics: Sustained premium pricing, coupled with value-based agreements, bolsters revenue—although biosimilar threat and policy changes could temper growth.

Revenue Risks and Challenges

Key risks include patent expirations, biosimilar competition, reimbursement hurdles, and late-stage safety data concerns. Additionally, the emergence of oral or small-molecule alternatives could alter treatment paradigms.

Strategic Factors Influencing Market Trajectory

Clinical and Regulatory Milestones

Achieving new indications and expedited approvals in unmet needs regions will be vital. Demonstrating long-term safety and real-world effectiveness will sustain demand.

Investment in Market Expansion

Strategic investments in sales force expansion, patient support programs, and partnerships with payers will enhance market access, especially in regions with nascent biologics markets.

Innovation and Pipeline Development

Innovative formulations, dosing regimens, and combination therapies could distinguish TALTZ from competitors, driving long-term revenue stability.

Conclusion

TALTZ is positioned at a favorable crossroads of a growing immunology therapeutics market characterized by high unmet medical needs and rapid innovation. Its mature market presence, coupled with expansion into new indications and geographical territories, indicates a promising financial trajectory. However, competitive pressures, patent expiries, and evolving payer landscapes necessitate continuous strategic adaptation.

Key Takeaways

- The global prevalence of psoriasis and psoriatic arthritis underpins TALTZ’s long-term growth prospects.

- Capitalizing on expanding indications and geographic markets will drive revenue growth toward an estimated $4–6 billion annually by 2027.

- Competitive differentiation, pricing strategies, and payer negotiations are critical to maintaining market share amid biosimilar threats.

- Innovation, clinical data, and pipeline expansion will influence TALTZ’s future market dominance and revenue trajectory.

- Strategic adaptability in response to regulatory, competitive, and market dynamics remains essential for sustained financial success.

FAQs

1. What distinguishes TALTZ from other IL-17 inhibitors?

TALTZ offers rapid onset of action, high skin clearance rates, and flexible dosing schedules, which differentiate it from competitors like Cosentyx and Siliq. Its safety profile and expanding indications also contribute to its competitive position.

2. How will biosimilar entry impact TALTZ’s market share?

While biosimilars for IL-17 inhibitors are anticipated post-2029 patent expiry, current protections support TALTZ’s market dominance for the near- to medium-term. Biosimilar competition may lead to pricing pressure once approved, influencing revenue.

3. What are the key risks to TALTZ’s financial trajectory?

Patent expiries, biosimilar competition, payer reimbursement challenges, and safety or efficacy concerns pose significant risks to sustained revenue growth.

4. Which emerging indications could expand TALTZ’s marketability?

Potential approvals for additional autoimmune conditions, such as hidradenitis suppurativa or other inflammatory diseases, could further diversify its patient base and revenue streams.

5. How has COVID-19 influenced TALTZ’s market dynamics?

Pandemic-related healthcare disruptions temporarily reduced biologics prescriptions, but the long-term impact favors biologics like TALTZ due to their targeted treatment advantages and safety profiles.

Sources:

[1] World Health Organization. “Global psoriasis prevalence estimates.” 2020.

[2] Lebwohl, M. et al. “Guidelines of care for the management of psoriasis with biologics,” J Am Acad Dermatol. 2019.

[3] Blauvelt, A. et al. “Efficacy and Safety of Ixekizumab in Psoriasis,” N Engl J Med. 2017.

[4] Senthilnathan, P. et al. “Comparative efficacy of IL-17 inhibitors,” Expert Opin Pharmacother. 2020.

[5] U.S. Patent and Trademark Office. “Patent status for TALTZ,” 2022.