Last updated: September 29, 2025

Introduction

CIMZIA (certolizumab pegol) is a biologic agent developed by UCB, designed primarily for the treatment of inflammatory conditions such as rheumatoid arthritis (RA), Crohn’s disease, psoriatic arthritis, and ankylosing spondylitis. As a PEGylated anti-TNF-alpha monoclonal antibody, CIMZIA operates by inhibiting tumor necrosis factor-alpha (TNF-α), a pivotal cytokine involved in systemic inflammation. Its market performance reflects evolving therapeutic landscapes, patent expirations, and increasing adoption of personalized medicine approaches in immunology.

This analysis explores CIMZIA's current market dynamics, competitive positioning, financial trends, and future growth prospects, providing insights for stakeholders navigating the biologic therapeutics sector.

Market Overview and Key Drivers

1. Therapeutic Indications and Market Penetration

CIMZIA holds approvals across multiple autoimmune and inflammatory indications, initially gaining approval for Crohn’s disease in 2007 and subsequently expanding into RA (2009), psoriatic arthritis (2013), and ankylosing spondylitis (2014). The breadth of indications broadens its revenue base, particularly in chronic illnesses requiring long-term management.

2. Growing Prevalence of Autoimmune Diseases

The global burden of diseases like RA and Crohn’s disease continues to rise due to aging populations and environmental factors [1]. The increasing prevalence fuels demand for biologics such as CIMZIA. According to the CDC, approximately 1.3 million Americans suffer from RA, with similar trends observed globally.

3. Shift Toward Biologics and Biosimilars

Biologics dominate the autoimmune therapeutics market, expected to surpass $300 billion globally by 2025 [2]. CIMZIA, as an established biologic, faces mounting competition from biosimilars and newer agents. However, the uniqueness of its PEGylation technology offers distinct pharmacokinetic advantages, including less frequent dosing.

4. Competitive Landscape

CIMZIA competes with other anti-TNF agents like Humira (adalimumab), Enbrel (etanercept), and Remicade (infliximab). The expiration of patents for some competitors (e.g., Humira) increased biosimilar penetration, but CIMZIA's patent exclusivity in key markets remains a critical factor for its revenue stability.

Market Dynamics Influencing CIMZIA

1. Patent Cliffs and Biosimilar Encroachment

The expiry of biologic patents exerts significant pressure on CIMZIA’s market share. UCB’s patent for CIMZIA in the U.S. is scheduled to expire in 2024 [3], opening pathways for biosimilar competition. European markets face similar patent cliffs, necessitating strategic focus on differentiators and preferential prescribing.

2. Evolving Treatment Guidelines and Adoption

Clinical guidelines increasingly favor biologics with proven efficacy and safety profiles. CIMZIA’s PEGylation offers less frequent administration (every 4 weeks), potentially improving patient adherence and satisfaction. Nonetheless, physicians often select newer agents with favorable safety profiles or cost advantages.

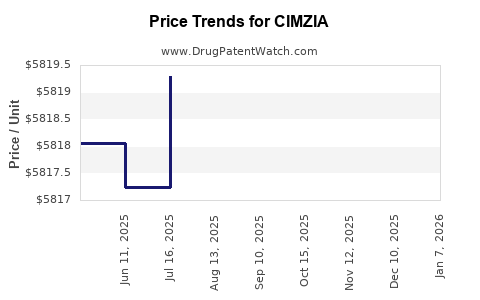

3. Price Competition and Reimbursement Policies

Pricing strategies significantly influence market access. Biologists like CIMZIA are premium-priced therapies; thus, insurers and payers’ reimbursement policies directly impact uptake. Cost-effectiveness analyses and health technology assessments influence formulary placements, especially as biosimilars introduce lower-cost alternatives.

4. Patient-Centric Trends and Biologic Route

The convenience of subcutaneous administration at home aligns with patient preferences, bolstering market viability. CIMZIA’s pegol formulation confers longer dosing intervals, reducing healthcare utilization burdens.

Financial Trajectory and Revenue Analysis

1. Historical Revenue Performance

UCB reports CIMZIA as one of its flagship assets. In 2022, CIMZIA generated approximately €1.54 billion, marking a 7% increase year-over-year [4]. North America remains the largest revenue contributor, followed by Europe and emerging markets.

2. Revenue Drivers

- Indication Expansion: New approvals boost potential patient populations.

- Pricing Strategies: Premium positioning sustains high revenue margins.

- Market Penetration: Expansion into new geographies and intensified clinical adoption enhance growth prospects.

3. Impact of Patent Expiration

The impending patent cliff in 2024 in key markets is expected to temper revenue growth unless UCB effectuates strategic measures such as pipeline expansion or dose optimization.

4. Competitive Pressures and Biosimilar Impact

Biosimilar entries typically erode margins and market share. However, CIMZIA’s differentiated delivery and robust clinical data may mitigate rapid erosion. UCB’s pipeline includes biosimilar development programs and next-generation biologics to sustain its competitiveness.

5. Future Growth Projections

Analysts project a compound annual growth rate (CAGR) of 4-6% for CIMZIA through 2027, driven by expanding indications (such as dermatology and other inflammatory diseases), ongoing clinical trials, and geographic expansion into Asia-Pacific markets, which are witnessing rising autoimmune disease prevalence.

Strategic Factors Shaping CIMZIA’s Future

1. Pipeline and Innovation

UCB invests in next-generation biologics and biosimilars, aiming to extend its market leadership. Clinical trials investigating CIMZIA in additional indications such as hidradenitis suppurativa and ulcerative colitis signify its strategic expansion.

2. Digital and Patient Engagement

Enhanced patient support programs and digital health integrations improve adherence, a crucial factor in chronic disease management. A focus on personalized medicine approaches can elevate CIMZIA’s profile.

3. Regulatory Environment

Stringent regulatory processes and price controls in regions like the EU and Asia pose challenges but also create opportunities for differentiated manufacturing and data exclusivity strategies.

4. Mergers, Collaborations, and Market Entry

UCB’s collaborations with generic manufacturers for biosimilars, and potential mergers with biotech entities, could influence CIMZIA’s market dynamics favorably or adversely depending on strategic execution.

Key Takeaways

- Market expansion and growing disease prevalence underpin demand for CIMZIA. Despite competition, its PEGylation technology and broad indication portfolio support sustained sales.

- Patent expirations looming in 2024 are critical inflection points. UCB’s proactive pipeline development and biosimilar strategies are vital to mitigate erosion.

- Pricing and reimbursement policies remain central to market access. Value-based pricing and health technology assessments will influence CIMZIA’s profitability.

- Geographic diversification presents growth opportunities, especially in emerging markets. Local healthcare policies and market penetration strategies are pivotal.

- Innovation and personalized medicine approaches will define CIMZIA’s long-term competitiveness. Investment in new indications and formulations will expand its therapeutic footprint.

FAQs

1. When is CIMZIA’s patent set to expire, and how will it impact the market?

CIMZIA’s key patent protections in the U.S. are scheduled to expire in 2024, paving the way for biosimilar competition. This is likely to exert downward pressure on prices and market share unless UCB introduces new formulations or indications.

2. How does CIMZIA differentiate itself from other anti-TNF biologics?

Its PEGylation technology prolongs dosing intervals, enhancing patient convenience. Clinical data affirm comparable efficacy and safety, while its flexible administration options support adherence.

3. What are the main markets for CIMZIA’s future growth?

North America and Europe remain primary markets, but expanding into emerging economies like Asia-Pacific offers significant upside owing to rising autoimmune disease prevalence.

4. How does biosimilar competition influence CIMZIA’s financial outlook?

Biosimilars may erode revenues post-patent expiry. However, CIMZIA’s unique formulation and clinical positioning can slow erosion, especially if UCB leverages its pipeline and continued innovation.

5. What strategic measures can sustain CIMZIA’s market position?

Diversification of indications, approval of next-generation formulations, strategic alliances, and investment in digital health initiatives are essential to maintain competitive advantage amid patent expirations and market evolution.

References

[1] Centers for Disease Control and Prevention. “Autoimmune Diseases.” 2022.

[2] Grand View Research. “Biologics Market Size & Trends.” 2022.

[3] UCB Annual Report 2022.

[4] UCB Financial Results 2022.

In conclusion, CIMZIA’s landscape embodies the complexities of the biologic market, balancing scientific innovation, patent strategies, and evolving healthcare policies. Its trajectory will depend on proactive pipeline development, strategic market diversification, and adaptive pricing frameworks in the face of biosimilar competition.