Last updated: July 28, 2025

Introduction

Valeant Pharmaceuticals International, now operating under its new identity Bausch + Lomb and previously renaming as Bausch Health Companies Inc., has carved a distinctive niche within the global pharmaceutical industry. Known for its focus on specialty drugs, dermatology, and ophthalmology, the company exemplifies a strategic pivot toward high-margin, innovative therapies. This analysis examines Valeant's current market position, core strengths, competitive landscape, and strategic insights to aid stakeholders in navigating its future trajectories.

Market Position and Strategic Footprint

Valeant, rebranded as Bausch + Lomb in 2013 after acquiring the eye health division from Valeant, maintains a significant footprint in ophthalmology, dermatology, and gastrointestinal segments. Its core markets span North America, Europe, and emerging economies, emphasizing a balanced geographical footprint that mitigates regional risk.

Historically, Valeant gained prominence through aggressive acquisitions, expanding its portfolio rapidly—most notably its 2010 purchase of Sirna Therapeutics and subsequent deals that bolstered its dermatology and ophthalmology franchises. However, the company faced a turbulent phase in 2015-2016 due to scrutiny over its pricing strategies and accounting practices, impacting investor confidence and stock valuation.

Post-2018, Bausch + Lomb's strategic focus shifted towards sustainable growth driven by innovation, operational efficiency, and targeted acquisitions. The company's emphasis on specialty pharmaceuticals and device segments aligns with broader industry trends favoring high-margin, patent-protected products.

Core Strengths

1. Robust Brand Portfolio and Market Leadership

Bausch + Lomb holds a commanding market share in ophthalmic devices and eye health solutions in the US and Europe. Its flagship products, such as Lumigan, and its extensive surgical portfolio, consistently outperform competitors in market penetration and brand loyalty.

2. Focused Segmentation & Innovative R&D

Strategically focusing on high-growth niches such as dry eye treatments, intraocular lenses, and laser vision correction positions Bausch + Lomb favorably. Its investment in R&D, driven by a pipeline of novel therapies, enhances its competitive edge, especially amid rising demand for minimally invasive ophthalmological procedures.

3. Strong Distribution Channels & Customer Relationships

The company's direct sales force, coupled with established relationships with healthcare providers, hospitals, and optometrists, facilitates rapid product adoption and market expansion.

4. Geographic Diversification

While North America remains its dominant market, emerging markets—including Asia Pacific—represent lucrative growth opportunities due to increasing healthcare infrastructure investment and rising healthcare awareness.

5. Resilient Financial Profile

Following restructuring efforts, Bausch + Lomb has improved its financial stability. Its focus on high-margin products, cost efficiencies, and disciplined capital deployment underpin sustainable profitability.

Competitive Landscape Analysis

1. Key Competitors

-

Johnson & Johnson (J&J): A global leader with a diversified portfolio across pharmaceuticals, consumer health, and medical devices. Its ophthalmology segment, primarily through J&J Vision, presents fierce competition with comparable innovations and brand recognition.

-

Alcon (Novartis): A prominent player specializing in surgical and vision care products, Alcon's extensive R&D capabilities and global reach pose significant strategic competition.

-

Bausch Health / Bausch + Lomb: The company's own evolution into a focused ophthalmology and eye health enterprise positions it against specialized ophthalmology companies.

-

Abbott Laboratories: Especially via its acquisition of Johnson & Johnson’s vision care business, Abbott’s diversified health offerings include eye health segments, intensifying the competitive landscape.

2. Market Dynamics and Trends

-

Innovation & Differentiation: Companies investing heavily in R&D to develop minimally invasive devices and personalized therapies are gaining market share.

-

Regulatory Advocacy & Pricing Strategies: Differential regulatory approvals and pricing power influence competitive positioning, with industry players leveraging reimbursement strategies to optimize market access.

-

Digital Health and Telemedicine: The shift toward digital ophthalmology evaluations and remote patient monitoring opens new avenues for competition and innovation.

3. Strategic Challenges

-

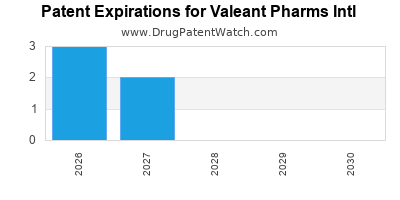

Pricing Pressures and Patent Expirations: The industry faces ongoing pricing scrutiny, and upcoming patent cliffs threaten revenue stability.

-

Regulatory Risks: Stringent regulations across markets may delay product launches or impose additional compliance costs.

-

Supply Chain Disruptions: Complex manufacturing processes, especially for ophthalmic devices, are vulnerable to supply chain disruptions, impacting product availability.

Strategic Insights

1. Emphasize Innovation in Portfolio Development

Investing in R&D for novel ophthalmic therapeutics and devices is essential. Focus areas include gene therapy, sustained-release formulations, and personalized eye care solutions that address unmet needs.

2. Expand Geographic Footprint in Emerging Markets

Harnessing growth in Asia-Pacific, Latin America, and Africa can unlock new revenue streams. Tailored market entry strategies, including local partnerships and tailored marketing, will facilitate this expansion.

3. Pursue Targeted Acquisitions and Alliances

Strategic acquisitions of niche ophthalmology or dermatology companies can enhance product pipelines and technological capabilities. Partnerships with biotech firms for cutting-edge research can establish competitive advantages.

4. Leverage Digital and Data-Driven Healthcare

Implement teleophthalmology initiatives and digital patient engagement platforms to deepen provider relationships and improve treatment adherence.

5. Maintain Operational Efficiency

Streamlining manufacturing processes, optimizing supply chains, and controlling costs will bolster margins and resilience against market fluctuations.

Key Takeaways

-

Market Position: Bausch + Lomb stands as a dominant ophthalmology and eye health player, benefitting from strong brand recognition and geographic diversification. Its strategic focus on high-margin, innovative products positions it favorably moving forward.

-

Competitive Strengths: Key strengths include a robust product portfolio, focused R&D investment, established distribution channels, and operational resilience cultivated through restructuring and efficiency gains.

-

Competitive Risks & Challenges: Industry competition from giants like J&J and Alcon, patent expirations, regulatory hurdles, and pricing pressures pose ongoing threats.

-

Strategic Opportunities: Innovation investment, geographic expansion, targeted acquisitions, and digital health integration are vital to sustaining growth and competitive advantage.

-

Strategic Recommendations: Prioritize pipeline diversification, foster international growth, and adopt digital health strategies to strengthen market positioning.

FAQs

1. How does Valeant’s rebranding impact its market strategy?

The rebranding to Bausch + Lomb shifted the company's focus towards a more specialized ophthalmology and eye health strategy, emphasizing innovation and operational stability to restore investor confidence and market credibility.

2. What are the primary growth drivers for Bausch + Lomb?

Key drivers include technological advancements in ophthalmic devices, aging populations increasing demand for eye care, expansion into emerging markets, and pipeline innovations in dry eye and intraocular lens treatments.

3. How does Bausch + Lomb differentiate itself from competitors like J&J?

Bausch + Lomb emphasizes high-quality, specialized eye health solutions with a focus on surgical and consumer ophthalmology. Its targeted product portfolio and R&D focus on unmet needs differentiate it from more diversified conglomerates.

4. What risks could impede Bausch + Lomb’s future growth?

Risks include patent expirations, aggressive price competition, regulatory delays, supply chain vulnerabilities, and potential market saturation in core segments.

5. What strategic moves should Bausch + Lomb consider to sustain competitive advantage?

Investing in innovative R&D, expanding geographic reach, forming strategic alliances, embracing digital health solutions, and optimizing operational efficiencies are key to sustained leadership.

References

- Bloomberg Intelligence. "Bausch + Lomb: Company Profile and Strategic Overview." 2022.

- Fitch Ratings. "Bausch + Lomb Credit Analysis." 2023.

- MarketWatch. "Ophthalmic Devices Market Outlook and Competitive Landscape." 2022.

- Bausch + Lomb Annual Reports (2018–2022).

- Statista. "Global Ophthalmology Market Analysis." 2023.