Last updated: July 29, 2025

Introduction

Portola Pharmaceuticals Inc. stands as a notable player in the specialized sector of anticoagulant and hemostasis management. Since its inception, the company has focused on developing targeted therapies to address unmet medical needs, primarily in the fields of thrombosis, bleeding disorders, and cardiology. This analysis dissects Portola’s current market position, identifies its distinctive strengths, and offers strategic insights to inform stakeholders in the competitive pharmacy landscape.

Market Position Overview

Core Therapeutic Focus and Product Portfolio

Portola’s portfolio is centered around innovative anticoagulant agents and reversal agents. Its flagship drug, Andexxa (coagulation factor Xa recombinant, inactivated-zhzo), approved by the FDA in 2018, is a critical reversal agent for rivaroxaban and apixaban, two major NOACs (Novel Oral Anticoagulants). The drug addresses a significant clinical need for rapid reversal of anticoagulation during major bleeding events or urgent surgery [1].

In addition, the company developed Bevyxxa (betrixaban), approved for venous thromboembolism (VTE) prophylaxis in hospitalized patients, which, despite a modest commercial footprint, highlights its commitment to niche anticoagulation therapies [2].

Market Penetration and Commercial Reach

Portola commands a specialized but growing niche in the anticoagulant reversal market, competing against larger pharmaceutical giants such as Bayer, BMS/Pfizer, and Roche, which also have anticoagulant management solutions. The company’s market penetration is bolstered by the critical necessity of Andexxa in emergency settings, though broad adoption is tempered by the high cost of therapies and limited awareness outside specialized hospitals.

According to financial disclosures, Portola’s revenue from Andexxa has experienced rapid growth since launch, reaching approximately $150 million in 2022, indicating increasing acceptance and utilization in acute care settings [3]. However, the company remains reliant on a few key products, which exposes it to market-specific risks.

Competitive Positioning

While Portola maintains a leadership position in the VP or factor Xa reversal segment, the company faces challenges from newer entrants and alternative therapies. The competitive landscape is characterized by:

- Limited Number of Players: The niche nature limits direct competition but invites new entrants seeking to exploit unmet needs.

- Barrier of Entry: High development costs and regulatory hurdles maintain a small, specialized field.

- Pricing Dynamics: Reversal agents like Andexxa are expensive, influencing hospital adoption decisions and reimbursement policies.

Strengths Analysis

Innovative and FDA-Approved Therapeutics

Portola’s pioneering role in developing one of the first approved specific reversal agents confers a strong market advantage. The FDA approval of Andexxa set a precedent, establishing the company as a trusted provider in a high-stakes environment [1].

Strategic Focus on High-Need Indications

Targeting critical care applications positions Portola in a segment with urgent demand, facilitating rapid adoption and reimbursement negotiations. The company’s emphasis on niche indications mitigates broad competition and allows for niche dominance.

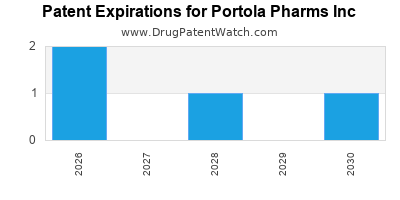

Intellectual Property and Patent Portfolio

Portola maintains a robust patent estate protecting its core products, delaying imitation and establishing a competitive moat. This includes patents related to formulation, delivery, and specific indications.

Agile Development and Collaborations

The company’s strategic partnerships with healthcare providers and clinical research institutions enable swift advancement of pipeline candidates and post-market surveillance activities, fostering innovation and compliance.

Market Niche and Reimbursement Environment

The high value and critical nature of reversal agents justify premium reimbursement rates, providing favorable revenue streams, especially in the US. This niche positioning aids in sustaining margins despite intense pricing scrutiny.

Strategic Insights and Future Outlook

Expanding Therapeutic Indications and Pipeline Development

Portola should diversify beyond reversal agents to expand its pipeline into broader anticoagulation management and bleeding control solutions, including combination therapies and portable diagnostics. Investment in pipeline expansion can reduce dependence on a single product and tap into adjacent markets.

Global Market Expansion

Currently focused predominantly on North America, there is significant upside in expanding into European and Asian markets. Tailoring products for regulatory approval and addressing regional reimbursement policies could catalyze revenue growth.

Strategic Partnerships and Alliances

Forming alliances with large hospital chains, insurance companies, and technology firms can bolster market uptake. Collaborations for rapid diagnostics, patient monitoring, and data analytics can position Portola as an end-to-end solution provider.

Pricing Strategy and Cost Management

To enhance market penetration, Portola must balance premium pricing with payer negotiations and value-based pricing models, emphasizing clinical and economic benefits of its therapies.

Investing in Digital and Real-World Evidence (RWE)

Leveraging digital health platforms allows real-time data collection and outcome monitoring—key factors influencing physician adoption and reimbursement negotiations.

Potential Challenges and Risks

- Competitive Disruption: Larger pharmaceutical companies expanding into reversal agents or developing generic formulations pose significant threats.

- Regulatory Hurdles: Navigating approvals for new indications or markets could delay growth.

- Pricing Pressures: Increasing payer pushback on high-cost therapeutics could impact revenue streams.

- Market Saturation: The niche nature of current products may limit rapid growth unless diversified.

Conclusion

Portola Pharmaceuticals occupies a niche yet strategically vital position within the anticoagulant and bleeding management landscape. Its leadership with FDA-approved reversal agents grants it a competitive edge, though it must navigate pricing pressures, competitive threats, and global expansion challenges. By diversifying product pipelines, forging strategic alliances, and expanding geographically, Portola can solidify and increase its market footprint. Its agility and focus on high-need indications underpin its current strengths, providing a foundation for sustained growth amid evolving industry dynamics.

Key Takeaways

- Niche Focus Advantage: Portola’s leadership in anticoagulant reversal agents like Andexxa provides a strong competitive moat in critical care.

- Market Growth Potential: Increasing adoption driven by rising anticoagulant use and accidental bleeding cases offers substantial upside, especially in expanding markets.

- Pipeline Diversification Needed: To reduce reliance on current products, investment in pipeline expansion into broader anticoagulation and bleeding solutions is crucial.

- Global Expansion Strategy: Venturing into Europe and Asia can unlock further revenue streams, contingent on regulatory and reimbursement strategies.

- Pricing and Partnerships: Balancing premium pricing with payer engagement, along with strategic collaborations, can enhance market access and financial sustainability.

FAQs

1. What sets Portola Pharmaceuticals apart from competitors?

Portola’s pioneering development of FDA-approved reversal agents, notably Andexxa, positions it as a leader in this niche field. Its focus on high-need clinical indications and a robust patent portfolio further distinguish it from emerging competitors.

2. What are the main challenges facing Portola in maintaining its market position?

Challenges include intense pricing pressures, potential competition from larger pharma firms developing generic or alternative solutions, regulatory delays in expanding indications or markets, and limited product diversification.

3. How can Portola expand its global footprint effectively?

The company should tailor its regulatory strategies to target key markets like Europe and Asia, develop localized partnerships with healthcare providers and payers, and adapt its products to regional needs and reimbursement frameworks.

4. What are the growth opportunities for Portola’s pipeline?

Opportunities include developing next-generation reversal agents, expanding indications such as perioperative bleeding management, and integrating digital health solutions for real-world evidence collection.

5. How does pricing strategy impact Portola’s competitive positioning?

Given the high cost of reversal agents, strategic pricing aligned with demonstrated clinical value and cost savings is vital. Engaging payers early through value-based agreements can facilitate broader adoption.

References

[1] U.S. Food and Drug Administration. FDA approves Portola’s anticoagulant reversal agent Andexxa. 2018.

[2] Portola Pharmaceuticals Inc. Annual Report 2022.

[3] MarketWatch. Portola Pharmaceuticals Revenue Data. 2022.