Last updated: October 15, 2025

Overview of Novo Nordisk

Novo Nordisk, a global healthcare company headquartered in Denmark, has established itself as a dominant player in the pharmaceutical industry, primarily focusing on diabetes care, obesity, hemophilia, and other chronic conditions. With over 90 years of operational history, the firm has built a robust portfolio backed by groundbreaking R&D, strategic acquisitions, and a strong global footprint. Its market capitalization places it among the most valuable pharmaceutical companies worldwide, reflecting investor confidence and market influence.

Market Position in the Pharmaceutical Industry

Leadership in Diabetes Care

Novo Nordisk maintains a commanding position in the diabetes therapeutics segment, holding over 40% of the global insulin market share as of 2022 (Source: IQVIA). Its flagship products, including long-acting insulins such as Tresiba and weekly injectables like Viktoza, exemplify its innovation-driven approach. The company's dominance stems from a comprehensive product pipeline, extensive distribution networks, and longstanding relationships with healthcare providers.

Expanding into Obesity and Hormonal Therapies

In recent years, Novo Nordisk has strategically diversified into obesity management and hormonal disorders. The approval and launch of Wegovy (semaglutide) for weight management marked a pivotal expansion, aligning with oncogenic trends and unmet medical needs. Its push into these segments underscores a broader vision to become a leading biopharmaceutical entity addressing non-communicable diseases (NCDs).

Global Footprint and Market Penetration

With subsidiaries and manufacturing facilities across North America, Europe, Asia, and emerging markets, Novo Nordisk's geographic reach is formidable. Its initiatives to penetrate rising markets—such as China and India—are supplemented by collaborations with local distributors and tailored pricing strategies, fostering sustainable growth.

Core Strengths

1. Robust R&D and Innovation Pipeline

Novo Nordisk invests approximately 20% of its revenue into R&D, leading to a steady pipeline of novel therapies. The company pioneered GLP-1 receptor agonists, with semaglutide showing superior efficacy for glycemic control and weight loss. Its recent advancements include oral formulations of semaglutide, broadening patient compliance options and market access.

2. Intellectual Property and Patent Portfolio

The company's patent estate secures competitive advantages, protecting its blockbuster drugs against generics for extended periods. Strategic patent filings for delivery mechanisms, formulations, and combination therapies fortify its market leadership.

3. Strategic Collaborations and Acquisitions

Acquiring startups and biotech firms, such as the recent acquisition of Emisphere Technologies for oral peptide delivery technology, enhances its technological capabilities. Collaborations with academic institutions further accelerate innovation.

4. Brand Equity and Patient Loyalty

Longstanding patient relationships and a reputation for quality foster brand loyalty. Its patient-centric approach, including education and support programs, enhances adherence and positive health outcomes, boosting repeat sales.

5. Sustainable and Ethical Business Practices

Novo Nordisk’s commitment to sustainability—aimed at becoming carbon-neutral by 2030—and ethical practices bolster corporate reputation and stakeholder trust, translating into long-term competitive advantages.

Strategic Insights and Competitive Dynamics

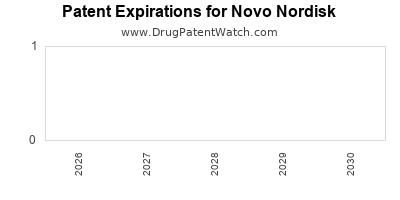

1. Navigating Patent Expirations

Patent expirations of key drugs like NovoLog (insulin aspart) pose significant revenue challenges. The firm’s proactive strategy involves diversifying product lines, developing biosimilar offerings, and investing in next-generation therapies to maintain market share.

2. Responding to Competitive Innovation

Major rivals like Eli Lilly, Sanofi, and emerging biotech companies are intensifying R&D investments. Notably, Eli Lilly's launch of most advanced GLP-1 drugs, such as tirzepatide, signals a competitive escalation. Novo Nordisk’s emphasis on oral semaglutide and combination therapies aims to secure therapeutic differentiation.

3. Digital Health and Data Analytics

Harnessing digital health tools and real-world evidence (RWE) enhances drug efficacy monitoring, personalized treatment regimens, and market insights. Novo Nordisk’s digital platform initiatives aim to improve patient engagement, adherence, and overall health outcomes.

4. Regulatory Environment and Policy Trends

Stringent regulatory regimes, especially concerning biosimilars and drug pricing, impact strategic planning. Novo Nordisk actively participates in policy dialogues, advocating for favorable frameworks that secure innovation incentives while balancing affordability.

5. Mergers and Acquisitions as Growth Drivers

Ongoing M&A efforts target enhancing pipeline breadth and technological prowess. Recent acquisitions emphasize lipidology, obesity, and advanced delivery platforms, positioning the company for future growth trajectories.

Strengths in Addressing Emerging Market Opportunities

Focus on Personalized Medicine: Novo Nordisk is investing in precision medicine approaches, aiming to tailor treatments based on genetic profiles. This strategy promises improved efficacy and market differentiation.

Digital and Remote Healthcare Integration: Expanding telemedicine collaborations enhances access and adherence, especially vital amid the global shift towards digital health post-pandemic.

Sustainability as a Competitive Edge: Aligning sustainability initiatives with product development not only fulfills corporate social responsibility but also appeals to ethically conscious stakeholders, influencing market perceptions.

Challenges and Risk Factors

- Patent Cliffs and Biosimilar Competition: The impending expiration of key patents necessitates innovative pivots to sustain profitability.

- Pricing Pressures: Healthcare payers are increasingly demanding cost-effective solutions, which may limit pricing flexibility.

- Regulatory Hurdles: Increasing scrutiny over drug approvals, especially biosimilars and new modalities, can delay market entry.

- Rapid Technological Disruption: Advances in gene editing, digital therapeutics, and alternative delivery methods threaten traditional product paradigms.

Conclusion: Strategic Outlook

Novo Nordisk's entrenched leadership in diabetes care, combined with its strategic diversification into obesity and other NCDs, positions it favorably in the evolving pharmaceutical landscape. Its relentless innovation focus, reinforced by strategic acquisitions and robust R&D, sustains its competitive edge. However, resilience depends on how effectively the firm navigates patent expirations, competitive pressures, and regulatory challenges.

To maintain dominance, Novo Nordisk must leverage digital health, embrace personalized medicine, and sustain its sustainability commitments. The company's ability to adapt swiftly to market shifts and technological innovations will determine its future trajectory.

Key Takeaways

- Market Leadership: Novo Nordisk leads global insulin and GLP-1 receptor agonist markets, with expanding influence in obesity care.

- Innovative Edge: Heavy investments in R&D secure a continuous pipeline of superior therapies, especially oral formulations.

- Strategic Diversification: The firm's expansion into obesity and hormonal disorders diversifies revenue streams and mitigates risks associated with patent cliffs.

- Competitive Threats: Rival firms' innovation in GLP-1 and biosimilars necessitate accelerated product development and portfolio management.

- Growth Strategies: Leveraging digital health tools, fostering strategic alliances, and emphasizing sustainability will be pivotal to sustaining growth.

FAQs

1. How does Novo Nordisk maintain its market dominance in insulin therapies?

Through continuous innovation, patent protection, and expanding its portfolio with long-acting and biosimilar insulin products, complemented by a robust global distribution network.

2. What is Novo Nordisk’s strategy for competing with emerging biosimilar entrants?

Investing in proprietary formulations, extending patent protections, accelerating biosimilar development, and emphasizing brand loyalty help defend its market share.

3. How significant is digital health integration to Novo Nordisk’s future?

Digital health enhances patient engagement, improves adherence, and facilitates personalized treatments, reinforcing Novo Nordisk’s patient-centric approach and competitive positioning.

4. What are the main risks facing Novo Nordisk’s growth plans?

Patent expirations, regulatory hurdles, pricing pressures, and intense competition from rivals like Eli Lilly pose considerable risks.

5. In what ways is sustainability impacting Novo Nordisk’s strategic initiatives?

Commitments to carbon neutrality and ethical practices strengthen corporate reputation, attract socially responsible investors, and align with global health and environmental goals.

References

- IQVIA. “Global Insulin Market Report 2022.”

- Novo Nordisk Annual Report 2022.

- Industry analysis reports from GlobalData and EvaluatePharma.

- Company press releases and strategic updates.