Last updated: October 15, 2025

Introduction

Novartis AG stands as a global leader in the pharmaceutical industry, renowned for its innovation, extensive portfolio, and strategic market positioning. Operating across diverse therapeutic areas, including oncology, cardiovascular, immunology, and ophthalmology, Novartis has cemented itself as a formidable competitor amid evolving industry dynamics influenced by patent cliffs, regulatory shifts, and biotechnological advancements. This detailed analysis examines Novartis’s market positioning, core strengths, and strategic initiatives that sustain its competitive edge, providing essential insights for stakeholders navigating the complex pharmaceutical landscape.

Market Position of Novartis

Global Footprint and Market Share

Novartis operates in over 155 countries, with a substantial footprint across North America, Europe, Asia, and emerging markets. The company's revenue in 2022 was approximately USD 51.6 billion, placing it among the top-tier pharmaceuticals globally [1]. Its key therapeutic areas—oncology, ophthalmology, and generics—contribute significantly to its revenue streams, with targeted investments in innovative treatments positioning Novartis as a leader, especially in oncology.

In the global pharmaceutical ranking, Novartis consistently ranks within the top three companies by revenue, trailing only behind Pfizer and Roche in some metrics [2]. Its strategic focus on high-growth areas like immuno-oncology and gene therapies aligns with prevailing industry trends, enhancing its market share.

Competitive Dynamics

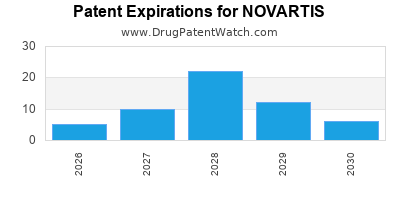

Novartis’s primary competitors include Roche, Pfizer, Johnson & Johnson, and Merck & Co. The company’s differentiation stems from a strong pipeline of innovative therapies, notably in cell and gene therapies (e.g., Kymriah and Leqvio). However, patent expirations of blockbuster drugs—such as the oncology treatment Gleevec—pose ongoing risks, demanding continuous R&D investment.

With the rising prominence of biosimilars and generics, especially in Europe and India, Novartis faces competitive pressure to defend its proprietary drugs while expanding its biosimilar portfolio. Strategic acquisitions, such as the purchase of the ophthalmology business from Alcon (previously part of Novartis) and recent investments in digital health, demonstrate adaptive strategies to maintain competitive relevance.

Strengths of Novartis

Robust Innovation Pipeline

Novartis invests approximately 20% of its revenue into R&D annually, translating to over USD 10 billion committed to discovering new medicines [1]. Its pipeline includes promising candidates in oncology (e.g., asciminib for CML), ophthalmology (e.g., Beovu for macular degeneration), and rare diseases. The company also fosters collaborations with biotech firms and academic institutions, securing early access to groundbreaking therapies.

Diverse Therapeutic Portfolio

The company’s diversified portfolio mitigates risks associated with dependence on single products. Oncology accounts for about 36% of revenue, while ophthalmology and generic medicines contribute significantly, providing a balanced revenue base that cushions against patent cliff impacts.

Strategic Acquisitions and Partnerships

Novartis’s strategic acquisitions enhance its pipeline and market presence. The acquisition of AveXis in 2018, specializing in gene therapies for spinal muscular atrophy, exemplifies this approach. Additionally, partnerships with digital health accelerators, such as DataBricks and Health2047, augment its capabilities in personalized medicine and real-world evidence generation.

Technological Advancements and Digital Transformation

Novartis leverages digital technologies, including artificial intelligence (AI) and machine learning, to optimize drug discovery, clinical trials, and patient engagement. Its digital initiatives improve R&D efficiency and foster patient-centric approaches, crucial in a competitive landscape.

Market Access and Regulatory Expertise

The company has demonstrated adeptness in navigating complex regulatory environments, securing approvals from agencies such as the FDA and EMA promptly. Its refined market access strategies further enhance uptake and reimbursement pathways, contributing to a sustained revenue flow.

Strategic Insights and Future Outlook

Emphasis on Gene and Cell Therapy Innovation

Novartis’s sizeable investment in gene and cell therapy R&D positions it at the forefront of personalized medicine. Its iterative development of therapies like Kymriah and newer candidates like CAR-T therapies targets high unmet medical needs, offering substantial growth prospects as these modalities gain regulatory approval worldwide.

Focus on Digital Health and Real-World Evidence

Expanding digital health initiatives allows Novartis to gather real-world evidence, improving clinical decision-making and boosting market confidence. Digital tools also enable remote patient monitoring and adherence, increasing treatment efficacy.

Expansion into Emerging Markets

Novartis aims to bolster its presence in Asia, Africa, and Latin America, regions exhibiting high growth potential due to increasing healthcare access and rising disease prevalence. Tailored pricing and local partnerships are vital to capturing these opportunities.

Risks and Challenges

Patent expirations, particularly in core oncology and hematology portfolios, threaten revenue stability. The rising influence of biosimilars necessitates aggressive intellectual property management. Moreover, pricing pressures from payers and governments worldwide require strategic adaptations to sustain profitability.

Sustainability and Corporate Responsibility

Novartis emphasizes sustainability, including initiatives to reduce environmental impact and improve global health outcomes, aligning corporate strategies with regulatory and societal expectations. These efforts foster goodwill and facilitate market access in key regions.

Conclusion

Novartis’s strategic positioning as an innovator with a diversified portfolio reinforces its competitive stature. Continued investment in gene therapies, digital health, and emerging markets, coupled with agile regulatory and partnership strategies, ensures resilience amidst sector challenges. Stakeholders should monitor Novartis’s pipeline developments and adaptation to biosimilar and patent landscape changes for informed decision-making.

Key Takeaways

- Novartis ranks among the top global pharmaceutical companies, driven by innovation, diversified therapy areas, and strategic acquisitions.

- Its R&D focus on personalized medicine and gene therapies offers high-growth opportunities in high unmet medical needs.

- Market expansion in emerging economies and digital health initiatives constitute vital pillars of its future growth strategy.

- Patent expirations and biosimilar competition necessitate proactive intellectual property management and portfolio diversification.

- Sustained investment in technological capabilities and partnerships enhances Novartis's competitive edge and operational efficiency.

FAQs

Q1: How does Novartis differentiate itself in the highly competitive oncology market?

Novartis differentiates through innovative therapies like CAR-T cell treatments (Kymriah), targeted small molecules, and a robust pipeline focusing on precision oncology, supported by substantial R&D investments and strategic collaborations.

Q2: What are the main risks facing Novartis's future growth?

Key risks include patent expirations, biosimilar competition, pricing pressures, regulatory delays, and geopolitical impacts, especially in emerging markets.

Q3: How is Novartis investing in digital health?

Novartis leverages AI, data analytics, and remote monitoring tools to optimize clinical trials, enhance patient engagement, and improve real-world evidence collection, aligning with the trend toward personalized medicine.

Q4: What strategic acquisitions have significantly impacted Novartis’s portfolio?

Notable acquisitions include AveXis (gene therapies), Alcon’s eye care division, and digital health startups, all contributing to product diversification and technological capabilities.

Q5: What is the outlook for Novartis in emerging markets?

The company aims to penetrate high-growth regions through localized pricing, strategic partnerships, and tailored product offerings, expanding access to innovative medicines amid these growing healthcare markets.

Sources:

- Novartis Annual Report 2022.

- IQVIA Pharmaceutical Market Reports 2022.