Last updated: July 28, 2025

Introduction

Lupin Limited stands as a prominent player within the global pharmaceutical sector, renowned for its diverse portfolio spanning generic formulations, active pharmaceutical ingredients (APIs), biosimilars, and specialty medicines. As the industry continues to evolve amidst increasing regulatory complexities, patent expirations, and technological advancements, understanding Lupin’s position offers vital insights for stakeholders. This analysis explores Lupin’s current market stance, competitive strengths, challenges, and strategic outlook, providing a comprehensive basis for informed decision-making.

Market Position and Global Footprint

Lupin ranks among the top 10 generic pharmaceutical manufacturers worldwide, with a significant presence across North America, India, Europe, and emerging markets in Asia and Latin America. Its global revenue streams are primarily driven by the United States, which accounts for approximately 30-40% of the company's turnover, primarily through its generic drug portfolio. The company’s strategic focus on North America aligns with the overall industry trend, where market competitiveness relies on robust R&D and regulatory agility.

Lupin’s international expansion has been facilitated through its dedicated manufacturing facilities, numerous filings with regulatory bodies such as the FDA, EMA, and other health authorities, and strategic acquisitions. Notably, its forays into biosimilars and specialty segments mark a diversification effort to reduce reliance on generics, positioning the company favorably for long-term growth amid patent cliffs.

Core Strengths

Robust R&D Capabilities and Product Pipeline

Lupin’s investment in R&D, accounting for approximately 8-10% of its revenues, underscores its strategic emphasis on innovation. The company's pipeline encompasses complex generics, biosimilars, inhalation products, and fixed-dose combinations. This diversified pipeline enhances its ability to withstand generic price erosion and regulatory hurdles while penetrating high-value therapeutic areas.

Regulatory Expertise and Global Approvals

A pivotal competitive advantage lies in Lupin’s proven regulatory track record. The company’s sustained success in securing FDA approvals has fortified its market access, particularly in the US. Maintaining high-quality standards has minimized compliance risks, bolstering brand credibility and customer trust.

Manufacturing and Supply Chain Excellence

Lupin operates numerous manufacturing facilities adhering to Good Manufacturing Practices (GMP). Its strategic geographic distribution of manufacturing units ensures supply chain resilience amid global disruptions, bolstering confidence among partners and customers.

Strategic Diversification

Lupin has strategically diversified into biosimilars, specialty medicines, and injectables, sectors characterized by higher entry barriers, prolonged product lifecycle, and premium pricing. This approach mitigates vulnerabilities associated with commoditized generics.

Cost Leadership and Pricing Strategy

Lupin’s efficient manufacturing and procurement strategies enable competitive pricing, especially in price-sensitive markets like Latin America and Asia. Its focus on operational efficiencies directly translates into sustained profitability amid intense price competition.

Challenges and Weaknesses

Profit Margin Pressures

The commoditization of several generic products and intense price erosion, particularly within the US market, exert downward pressure on margins. Lip service to cost reduction strategies is essential but insufficient if revenue growth stagnates.

Regulatory and Litigation Risks

With frequent regulatory audits and patent litigations prevalent in the industry, Lupin faces ongoing risks of delays or denial of approvals, adversely affecting product launches and revenues.

Limited Presence in High-Growth Biotech and Specialty Domains

Despite strides into biosimilars, Lupin’s market share in high-growth biotech segments remains limited compared to global giants like Pfizer or Novartis, constraining its ability to capture the lucrative segments of the value chain.

Geopolitical and Political Risks

Operating across diverse geographies exposes Lupin to geopolitical tensions, policy shifts, and currency fluctuations, which can impact profitability and strategic execution.

Strategic Insights

Focus on Innovation and Complex Generics

Lupin should continue investing in complex generics and biosimilars, leveraging its R&D strengths. These segments offer higher margins and longer lifecycle protections, alleviating the impact of price erosion in traditional generics.

Enhance Regulatory Capabilities and Compliance

Proactive engagement with regulatory authorities and strengthening quality management systems will streamline approvals, reduce delays, and mitigate compliance risks.

Expansion into High-Growth Biotech and Specialty Markets

Prioritizing collaborations, licensing agreements, or acquisitions in biotech and specialty therapeutics can diversify revenue sources and reduce dependence on traditional generics.

Digital Transformation and Supply Chain Digitization

Embracing digital technologies and data analytics can optimize manufacturing, enhance forecasting accuracy, and improve supply chain agility, especially amid supply disruptions.

Market Diversification and Local Partnerships

Expanding deeper into emerging markets through local partnerships and tailored product portfolios will enable Lupin to capture unmet needs and mitigate geopolitical risks.

Competitive Positioning

Lupin’s core competitors include Dr. Reddy’s Laboratories, Sun Pharmaceutical Industries, Teva Pharmaceuticals, and Mylan (part of Viatris). Although Lupin holds a strong base within India and select global markets, it competes aggressively on cost and innovation fronts to maintain its market share. Its strategic focus on complex generics and biosimilars aims to carve out a niche against these competitors, emphasizing differentiation through product complexity and regulatory maturity.

Future Outlook

The pharmaceutical landscape underscores a shift towards specialized, high-margin segments and innovative therapies. Lupin’s strategic emphasis on biosimilars, inhalation products, and complex generics positions it well for sustainable long-term growth. However, agility in navigating regulatory landscapes, technological innovation, and market diversification will be critical.

In addition, the company must address margin pressures and geopolitical risks through proactive strategies, including operational efficiencies and diversified geographies. The focus on R&D and strategic collaborations will remain central to Lupin’s ambition to scale its global footprint and reinforce its competitive edge.

Key Takeaways

-

Market Position: Lupin ranks among the top global generic manufacturers, with a strong footprint in North America, India, and emerging markets. Its diversification into biosimilars and specialty sectors elevates its growth prospects.

-

Strengths: Competitive R&D capabilities, regulatory expertise, manufacturing resilience, and operational efficiencies underpin Lupin’s competitive advantage.

-

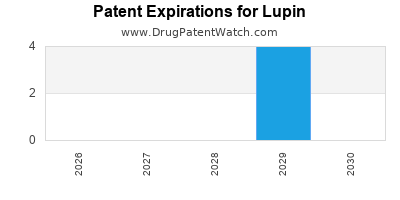

Challenges: Margins are under pressure from aggressive pricing and patent expirations; regulatory risks and geopolitical factors also pose ongoing threats.

-

Strategic Imperatives: Focus on complex generics and biosimilars, regulatory navigation, market diversification, and digital transformation to sustain growth.

-

Outlook: While facing industry headwinds, Lupin’s diversified pipeline and strategic shifts position it favorably to capitalize on high-value segments and emerging opportunities.

FAQs

1. What are Lupin’s core growth segments?

Lupin’s primary growth segments include complex generics, biosimilars, inhalation products, and specialty medicines. These segments offer higher margins and longer lifecycle protection compared to traditional generics.

2. How does Lupin compare to its competitors in the biosimilar space?

While Lupin has made significant strides in biosimilars, its market share remains smaller compared to established players like Samsung Bioepis or Amgen. Its focus is on establishing regulatory approvals in key markets to accelerate growth.

3. What are the primary markets for Lupin’s bulk of revenue?

North America, especially the US, accounts for the largest share of Lupin’s revenue, closely followed by India and other emerging markets such as Latin America and Asia.

4. How is Lupin addressing profitability pressures amid industry-wide price erosion?

Lupin leverages operational efficiencies, cost management, and product diversification into higher-margin segments to counteract falling prices. Strategic R&D also pursues complex and innovative products with better pricing power.

5. What strategic moves could Lupin undertake to enhance stakeholder value?

Expanding its biosimilar and specialty portfolio, pursuing strategic acquisitions, strengthening regulatory relationships, and embracing digital transformation are pivotal for increasing stakeholder value.

Conclusion

Lupin’s positioning within the pharmaceutical landscape demonstrates a strategic blend of operational excellence, innovation, and diversification. While industry headwinds impose challenges, its focus on complex generics, regulatory expertise, and emerging market penetration offers strong foundations for sustainable growth. Continued strategic investments and agile responses to regulatory, geopolitical, and technological shifts will determine its trajectory amid a highly competitive global market.

Sources:

[1] Lupin Limited Annual Reports and Investor Presentations

[2] IQVIA World Review of Generics & Biosimilars

[3] U.S. FDA Drug Approvals Database

[4] Industry Competitive Analyses - Evaluate Pharma and GlobalData