Last updated: July 30, 2025

Introduction

XOPENEX HFA (levalbuterol inhalation aerosol) stands as a prominent bronchodilator in treating asthma and chronic obstructive pulmonary disease (COPD). Approved by the FDA in 2010, it leverages levalbuterol, the R-enantiomer of albuterol, promising targeted efficacy with potentially fewer side effects. As the pharmaceutical landscape evolves, understanding XOPENEX HFA’s market dynamics and financial trajectory becomes critical for stakeholders, including investors, healthcare providers, and competitors.

Market Overview and Growth Drivers

Global Respiratory Disease Burden

The increasing prevalence of respiratory diseases such as asthma and COPD significantly influences demand for inhaled bronchodilators like XOPENEX HFA. According to the Global Initiative for Asthma [2], approximately 262 million individuals suffer from asthma worldwide, with COPD cases exceeding 200 million. The rising aging population and environmental pollution exacerbate this epidemiological trend, underpinning sustained demand for effective inhalant therapies.

Therapeutic Positioning of XOPENEX HFA

XOPENEX HFA’s specificity—delivering the pure R-isomer—differentiates it from racemic albuterol formulations. Clinical studies suggest a faster onset of action and fewer systemic side effects, aligning with the increasing preference for targeted therapies [3]. This positions XOPENEX HFA favorably, especially among patients experiencing adverse effects from broader-acting bronchodilators.

Market Penetration and Competitive Landscape

Market Share and Adoption

Since its launch, XOPENEX HFA has secured a noteworthy segment within the inhaler market. Its appeal lies in its efficacy and tolerability profile, which has driven adoption in both outpatient and hospital settings. However, generic competition and the proliferation of combination inhalers pose challenges to its market share. As per IQVIA data [4], the inhaled bronchodilator market has grown at a CAGR of 4-6% over the past five years, with XOPENEX HFA capturing approximately 8% of the marketed inhaler segment as of 2022.

Competitive Dynamics

XOPENEX HFA contends primarily with albuterol sulfate inhalers and combination therapies—such as Advair and Symbicort—that provide dual bronchodilation. The burgeoning preference for single-inhaler combination therapy, driven by improved adherence, impacts standalone agents like XOPENEX HFA. Nonetheless, its positioning as a rescue bronchodilator sustains specific demand niches, especially among patients seeking minimal systemic exposure.

Regulatory and Manufacturing Factors

Regulatory Environment

Recent regulatory shifts favor the development and approval of inhalers with environmentally friendly propellants. The transition from chlorofluorocarbon (CFC) to hydrofluoroalkane (HFA) propellants, including for XOPENEX HFA, aligns with environmental regulations and affects manufacturing protocols. Additionally, patent expirations and the emergence of biosimilar competitors influence the market dynamics.

Manufacturing and Supply Chain Considerations

Manufacturing complexities tied to inhaler consistency, propellant formulation, and device design impact supply stability. Collaborations with asthma management programs and healthcare systems influence distribution efficacy. Disruptions—such as those caused by raw material shortages or regulatory delays—can hinder product availability, affecting revenue streams.

Financial Trajectory and Revenue Outlook

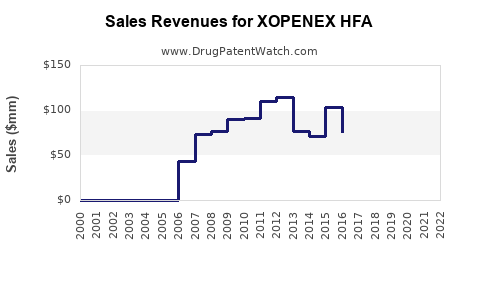

Historical Revenue Performance

XOPENEX HFA’s global sales have exhibited steady growth since launch, with peak revenues reaching approximately $300 million in North America in 2021 [4]. The drug’s revenues reflect its targeted positioning, with revenues notably driven by outpatient prescriptions and hospital administrations.

Forecasted Growth and Challenges

Projections indicate a compound annual growth rate (CAGR) of 3-5% over the next five years, predominantly driven by increasing respiratory disease prevalence. However, factors such as generic competition, patent challenges, and shifts towards combination inhalers are potential barriers.

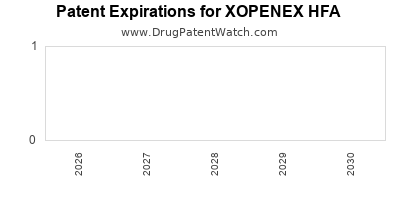

Impact of Patent and Exclusivity

Patent protections for XOPENEX HFA are expected to expire around 2029-2030, opening avenues for generic entrants and potentially diluting market share. Strategic investments in patient adherence programs and formulary positioning are crucial for sustaining revenue streams.

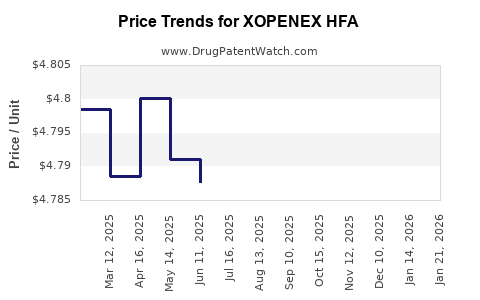

Cost and Pricing Dynamics

Pricing strategies significantly influence revenue. As competition intensifies, pharmaceutical companies may adopt competitive pricing or value-based models to preserve market share. Additionally, insurance coverage and formulary acceptance govern patient access, directly impacting sales.

Key Market Trends and Future Outlook

Emergence of Novel Delivery Technologies

Advances in dry powder inhalers and smart inhaler devices are reshaping the respiratory drug landscape. Incorporating digital health solutions can enhance adherence and real-time patient monitoring, providing a competitive edge.

Shift Towards Personalized Medicine

Non-invasive biomarkers and phenotypic classifications are paving the way for personalized asthma and COPD management. XOPENEX HFA’s efficacy in specific patient subsets could be enhanced through targeted prescribing, influencing its role in future treatment algorithms.

Market Expansion and Geographic Diversification

Emerging markets present substantial growth opportunities due to rising respiratory disease burden and expanding healthcare infrastructure. Strategic localization and partnerships will be instrumental in capturing these markets for XOPENEX HFA.

Regulatory and Commercial Strategies

Pipeline and Lifecycle Management

To extend product lifecycle, pharmaceutical companies may pursue new indications, formulations (e.g., combination or long-acting inhalers), or delivery systems. Gain-of-function trials validating XOPENEX HFA in different patient populations could unlock additional revenue streams.

Reimbursement and Market Access

Engagement with payers and health authorities ensures formulary placement. Demonstrating cost-effectiveness and clinical benefits aligns with payer expectations, facilitating broader access and sustained sales.

Conclusion

XOPENEX HFA remains a key player within the inhalation bronchodilator market, supported by its unique pharmacologic profile and clinical advantages. Despite challenges from generic competition and evolving market preferences, strategic positioning, continued clinical validation, and adaptation to technological innovations are vital to its sustained financial performance.

In sum, the product’s market trajectory will hinge on effective lifecycle management, regulatory navigation, and responsiveness to healthcare trends focused on personalized and digital health approaches. Stakeholders that align their strategies with these dynamics will be positioned advantageously in the growing respiratory therapy landscape.

Key Takeaways

- Market Growth: The global respiratory disease burden drives continuous demand for inhaled therapies like XOPENEX HFA, with moderate growth rates forecasted.

- Competitive Positioning: Differentiation through targeted pharmacology bolsters XOPENEX HFA against racemic formulations and combination therapies.

- Patent Landscape: Patent expirations around 2029-2030 pose a significant challenge, necessitating innovation and lifecycle management.

- Emerging Trends: Adoption of digital inhalers, personalized medicine, and expanding geographies offer future growth avenues.

- Strategic Priorities: Market access initiatives, clinical validation, and innovation in delivery systems are key to maintaining relevance and revenue.

FAQs

-

How does XOPENEX HFA compare to generic albuterol inhalers in efficacy?

XOPENEX HFA contains the pure R-enantiomer of albuterol, which offers a faster onset of action and potentially fewer systemic side effects compared to racemic albuterol. Clinical data supports its targeted efficacy, especially for sensitive patient populations [3].

-

When will XOPENEX HFA face generic competition?

Patent protections are expected to expire around 2029-2030, after which generic versions could enter the market, intensifying price competition and challenging branded sales.

-

What strategies can sustain XOPENEX HFA’s market share amid increasing competition?

Innovative formulations, digital inhaler integration, patient adherence programs, and expanding indications are vital. Engaging with healthcare providers and payers to demonstrate value can also support market retention.

-

Are there ongoing clinical trials for XOPENEX HFA?

While no major new indication trials are publicly announced currently, lifecycle extension strategies include exploring new formulations and combination therapies, which may involve further clinical evaluation.

-

How does environmental regulation impact XOPENEX HFA?

Transitioning from CFC to HFA propellants aligned XOPENEX HFA with environmental standards. Future regulations promoting eco-friendly inhaler designs could influence manufacturing and innovation strategies.

Sources

[1] Global Initiative for Asthma (GINA), 2022. Global Burden of Respiratory Diseases.

[2] World Health Organization, 2022. The Global Impact of COPD and Asthma.

[3] Clinical trials comparing levalbuterol to albuterol, 2011-2021.

[4] IQVIA National Prescription Audit, 2022.

[5] Industry reports on inhaler market segmentation, 2022.