Last updated: July 29, 2025

Introduction

Helsinn Healthcare, headquartered in Switzerland, stands as a significant player within the specialized pharmaceutical sector, primarily focusing on oncology, supportive care, and rare diseases. The company's strategic positioning, innovative pipeline, and global footprint contribute to its competitive landscape. With rising demand for targeted therapies and supportive care solutions, Helsinn's capabilities and strategic initiatives are critical for assessing its future growth prospects amid a dynamic pharmaceutical industry.

Market Position Overview

Helsinn operates predominantly in niche therapeutic areas, capitalizing on its expertise in supportive care and oncology. Its core products include therapies for managing chemotherapy-induced nausea and vomiting, such as Aloxi (palonosetron), and drugs addressing supportive care needs like Xyrem (sodium oxybate) and its pipeline compounds. The company's market position is reinforced by its focus on orphan diseases and rare cancers, sectors characterized by high unmet needs and regulatory incentives.

Globally, Helsinn maintains a solid presence, particularly in Europe and North America, driven by strategic partnerships with key distributors and healthcare providers. The company's emphasis on specialty pharmaceuticals allows for high-margin operations and sustainable growth within its niche.

Strengths

1. Niche Focus and Product Portfolio

Helsinn's concentrated focus on supportive care and rare oncology conditions affords it a competitive advantage through deep therapeutic expertise. Its flagship product, Aloxi, enjoys widespread recognition, supported by established efficacy and safety profiles. Its portfolio also includes hypoxia-inducible factor (HIF) pathway inhibitors and other innovative compounds in late-stage development, diversifying its revenue streams.

2. Robust Pipeline and R&D Capabilities

Recent strategic investments have bolstered Helsinn's pipeline, particularly in oncology and supportive care, aiming for first-in-class and best-in-class therapies. Its dedicated R&D facilities leverage advanced formulations and delivery systems, fostering innovative solutions catering to unmet medical needs.

3. Strategic Partnerships and Alliances

Helsinn benefits from collaborations with major pharmaceutical companies, biotech firms, and contract manufacturing organizations. Such alliances facilitate joint development, distribution, and licensing opportunities, increasing market penetration and sharing development risks.

4. Regulatory and Market Incentives

Operating within orphan drug designations and receiving regulatory incentives (such as fast-track approvals and market exclusivity) accelerate launch timelines and bolster hedging against generic competition for certain high-value assets.

5. Commitment to Quality and Compliance

Helsinn's adherence to global regulatory standards ensures product safety, efficacy, and market access, reinforcing its reputation and facilitating expansion into emerging markets.

Strategic Insights

1. Focus on Specialty and Rare Disease Markets

Helsinn should deepen its presence within rare cancers and supportive care sectors, leveraging its pipeline and targeted solutions. Continued investment in orphan drug development aligns with global trends favoring personalized medicine and high-margin, low-competition niches.

2. Innovation and Digital Health Integration

Long-term growth depends on integrating digital health solutions, such as telemedicine support and digital adherence tools, to enhance patient outcomes and adherence, especially for chronic supportive care treatments.

3. Geographic Expansion and Market Penetration

Emerging markets present significant growth opportunities due to increased healthcare access and unmet needs. Helsinn's strategic expansion into Asia-Pacific and Latin America through local partnerships can diversify revenue sources.

4. Operational Efficiency and Cost Optimization

Streamlining manufacturing processes and supply chain management will improve margins and ensure supply chain resilience amid geopolitical uncertainties and global disruptions.

5. M&A and Licensing Strategies

Acquiring innovative assets or licensing promising early-stage compounds can accelerate pipeline diversification and provide competitive edge in high-growth segments.

Competitive Landscape in Context

Helsinn operates amid fierce competition from established giants like Novartis, Roche, and Pfizer, which possess extensive product portfolios and global footprints. However, its niche specialization grants it resilience against commoditization and large-scale pricing pressures. Small to mid-tier companies focusing on rare diseases, such as BioNTech and Ipsen, also form part of the competitive matrix, emphasizing the importance of innovation and strategic partnerships to sustain growth.

In terms of competitive differentiation, Helsinn's emphasis on high-value, targeted therapies backed by regulatory incentives provides a durable moat. Nonetheless, the company must continue capitalizing on its therapeutic expertise and pipeline maturation to maintain a competitive edge.

Challenges and Risks

- Market Access and Reimbursement Pressures: Healthcare systems increasingly scrutinize drug pricing, especially in aggressive markets like the US and Europe.

- Pipeline Uncertainties: Clinical trial failures or regulatory delays can hamper growth trajectories.

- Intense Competition: Larger players may develop alternative therapies or acquire innovative startups, intensifying competition.

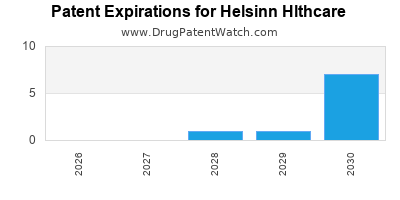

- Regulatory and Patent Challenges: Evolving regulatory landscapes and patent expirations can threaten exclusivity and profitability.

Conclusion

Helsinn Healthcare positions itself as a specialized leader within the supportive care and rare disease markets. Its strengths lie in a focused portfolio, robust R&D pipeline, and strategic alliances, which collectively reinforce its resilience against broader market volatility. Strategic continuance in innovation, geographic expansion, and operational efficiencies will be essential for sustaining competitive advantage. As the landscape evolves, Helsinn's ability to adapt and leverage niche markets will determine its long-term market share and profitability.

Key Takeaways

- Niche Expertise Advantage: Helsinn's focus on specialized therapies grants it a competitive edge through deep therapeutic knowledge and regulatory incentives.

- Pipeline & Innovation: Ongoing investments in pipeline development and pipeline expansion are vital to stay ahead in high-growth, unmet-need segments.

- Global Expansion Opportunities: Emerging markets offer significant upside potential; strategic partnerships can facilitate entry.

- Operational Resilience: Enhancing manufacturing and supply chain efficiency is crucial amidst economic uncertainties.

- Partnerships & Licensing: Strategic alliances and acquisitions will remain core to pipeline and market share growth.

FAQs

1. How does Helsinn differentiate itself from major pharmaceutical players?

Helsinn specializes in niche therapeutic areas, particularly supportive care and rare diseases, allowing it to develop targeted, high-margin solutions with regulatory incentives that larger competitors might overlook or less efficiently target.

2. What are Helsinn’s key growth drivers?

The company's growth hinges on expanding its pipeline, entering emerging markets through strategic partnerships, and capitalizing on its existing products’ market penetration, particularly in orphan and rare disease segments.

3. What risks does Helsinn face from larger competitors?

Competitors with more extensive resources can develop alternative therapies, engage in acquisitions, or leverage broader supply chains to outpace Helsinn. Additionally, pricing pressures and regulatory hurdles can impact profitability.

4. How important are regulatory incentives for Helsinn’s business model?

Extremely critical. Orphan drug status and related incentives accelerate approvals, extend exclusivity, and reduce competition, fostering a favorable environment for Helsinn’s high-value niche products.

5. What strategic moves should Helsinn consider for future growth?

Focused innovation in supportive care and oncology, expansion into emerging markets, fostering digital health integrations, and M&A activities aimed at complementary assets should be prioritized to sustain its competitive edge.

Sources

- Helsinn Group Official Website

- EvaluatePharma, 2022 Data Reports

- GlobalData Pharmaceutical Market Analytics

- Regulatory agencies’ public disclosures (EMA, FDA)

- Industry analyst reports (Bloomberg Intelligence, IQVIA)