Last updated: July 30, 2025

Introduction

Esperion Therapeutics Inc. operates within the highly competitive cardiovascular pharmaceutical landscape, primarily focusing on therapies addressing lipid management, notably hypercholesterolemia. As the market for LDL-C (low-density lipoprotein cholesterol)-lowering agents expands, driven by rising cardiovascular disease (CVD) prevalence and evolving regulatory frameworks, understanding Esperion's positioning, strengths, and strategic moves becomes critical for investors, partners, and industry analysts alike.

This comprehensive analysis evaluates Esperion’s market standing, delineates its core strengths, and offers strategic insights to grasp its future trajectory amid intensifying competition.

Market Position of Esperion Therapeutics

Core Focus and Product Portfolio

Esperion’s flagship product, Nexletol (bempedoic acid), and its combination, Nexlizet (bempedoic acid/ezetimibe), target patients intolerant to statins or inadequately managed on existing therapies. These offerings position Esperion as an alternative or adjunct therapy for hypercholesterolemia, especially in high-risk demographics.

Market Penetration and Commercial Reach

Since its US FDA approval in 2019, Esperion has strived to establish a foothold in the lipid-lowering market, targeting physicians wary of statin-associated side effects. Despite the competitive presence of established drugs like PCSK9 inhibitors (e.g., Regeneron’s Repatha), Esperion’s oral, once-daily oral pill offers ease of administration, crafting a niche in the preventive cardiology market.

However, market share remains modest relative to dominant players, constrained by factors such as limited geographic reach, evolving reimbursement policies, and competition from increasingly aggressive pipeline products.

Competitive Landscape Overview

The lipid-lowering landscape is primarily characterized by:

- Statins: First-line, cornerstone therapies.

- PCSK9 Inhibitors: High efficacy but high cost, limiting broad use.

- Ezetimibe: Oral, lower-cost alternative.

- Bempedoic Acid: Novel, oral agent filling critical treatment gaps, especially for statin-intolerant patients.

Major competitors include AbbVie (with cholesterol drug RYOWI), Amgen, Novartis, and emerging biotech firms developing next-generation agents with improved efficacy profiles.

Strengths of Esperion Therapeutics

1. Innovation with Bempedoic Acid

Esperion's core strength lies in its novel active compound, bempedoic acid, which acts upstream of the cholesterol synthesis pathway and offers an alternative mechanism to statins. Its activation in the liver minimizes muscle-related side effects, positioning it as a suitable option for statin-intolerant populations.

Clinical evidence supports its efficacy, demonstrating significant LDL-C reduction (~18-28%) when added to background therapies, with a favorable safety profile—crucial for differentiating in the crowded hypercholesterolemia market.

2. Strategic Focus on Statin-Intolerant Patients

By targeting patients who cannot tolerate statins, Esperion identified a dedicated niche with unmet needs. This focus informs targeted marketing strategies and expedites patient acceptance among clinicians wary of adverse effects linked with statins.

3. Orally Administered, Convenient Therapy

Compared to injectable PCSK9 inhibitors, bempedoic acid affords a simple oral dosing, facilitating patient compliance and adherence. This ease of use translates into improved market uptake among primary care physicians.

4. Cost-Effective Alternative

Esperion’s therapies are priced lower than PCSK9 inhibitors, providing a cost-effective option suitable for payers emphasizing value-based care. This pricing advantage enhances reimbursement prospects and broadens access.

5. Collaborations and Supply Chain Infrastructure

Strategic collaborations with manufacturing entities and distribution channels bolster Esperion's ability to scale production and distribution swiftly, ensuring supply chain robustness.

Strategic Insights and Future Outlook

1. Capitalizing on Market Growth and Regulatory Trends

The global hypercholesterolemia market is projected to grow driven by aging populations, increasing CVD burden, and proactive lipid management guidelines. Esperion can leverage this by expanding its commercialization efforts, especially in high-risk populations and underserved markets.

Recent discussions around expanding indications, such as combination therapy for familial hypercholesterolemia, could significantly boost sales volume if approved, representing an important growth vector.

2. Investing in Clinical and Pipeline Development

Further clinical trials evaluating synergistic combinations (e.g., with PCSK9 inhibitors) or novel formulations could widen therapeutic appeal. Strategic investments into head-to-head studies demonstrating superior safety or efficacy over competitors will enhance market perception.

3. Geographic Expansion

Currently US-centric, expansion into European and Asian markets is critical. Clinical validation, local regulatory approvals, and tailored marketing are prerequisites for global growth.

4. Competitive Differentiation and Intellectual Property

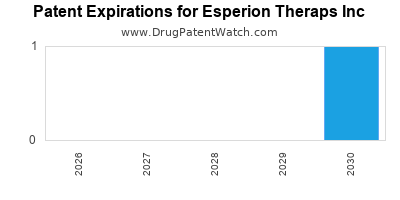

Maintaining a strong patent portfolio around bempedoic acid formulations, dosing regimens, and combination products will safeguard market share against generic and biosimilar incursions. Differentiation through real-world effectiveness data further consolidates brand reputation.

5. Partnership and Acquisition Strategies

Aligning with larger pharmaceutical players or biotech firms through licensing, co-marketing, or acquisitions could accelerate product access, combine complementary portfolios, and mitigate competitive pressures.

Challenges and Risks

- Intense Competition: PCSK9 inhibitors and next-generation agents continually threaten market share.

- Regulatory Hurdles: Approvals for additional indications or formulations require substantial clinical evidence.

- Market Penetration: Reimbursement hurdles and physician adoption inertia may slow uptake.

- Pricing Pressures: Payers and formulary restrictions could diminish profitability margins.

Conclusion

Esperion Therapeutics stands poised as an innovative player with a targeted focus on unmet clinical needs within lipid management. Its strengths—novel mechanism of action, favorable safety profile, and oral formulation—provide a competitive edge, especially in the statin-intolerant segment.

Strategic expansion, clinical validation, and partnership opportunities are vital to capitalize on the burgeoning hypercholesterolemia market. Although challenges persist amid fierce competition, Esperion’s tailored approach and focus on value-based care underpin its potential for sustained growth.

Key Takeaways

- Core Strength: Esperion’s bempedoic acid introduces a novel, oral LDL-C lowering therapy ideal for statin-intolerant patients.

- Market Niche: Focused positioning fills an unmet need, capturing a growing segment of hypercholesterolemia treatment.

- Growth Drivers: Expanding indications, geographic markets, and combination therapies could significantly elevate revenue.

- Strategic Priorities: Strengthening clinical evidence, fostering partnerships, and navigating reimbursement landscapes are essential.

- Risks: Competition from established biologics and emerging therapies necessitates continuous innovation and strategic agility.

FAQs

1. What distinguishes Esperion’s bempedoic acid from existing lipid-lowering therapies?

Bempedoic acid operates upstream of the cholesterol synthesis pathway, with liver-specific activation reducing muscle-related side effects common with statins, making it suitable for statin-intolerant patients. Its oral, once-daily administration ensures convenience, contrasting with injectable PCSK9 inhibitors.

2. How does Esperion compare financially to larger pharmaceutical competitors?

While smaller, Esperion’s lower-cost therapy model appeals to payers emphasizing value. However, limited market penetration constrains revenue relative to industry giants like Pfizer or Novartis. Growth hinges on expanding indications and markets.

3. What are the main barriers to Esperion’s market expansion?

Reimbursement challenges, physician adoption inertia, and stiff competition from established therapies present significant hurdles. Additionally, clinical approval timelines for new indications are unpredictable.

4. Are there recent developments that could enhance Esperion’s competitive position?

Yes. Pending data from ongoing trials assessing combination therapies and broader indications can increase product utility. Regulatory approvals for international markets also represent growth opportunities.

5. What strategic moves should Esperion pursue to maximize its market share?

Priorities include expanding geographically, investing in clinical trials for new indications, forming strategic partnerships, enhancing payer relationships, and safeguarding intellectual property.

Sources:

[1] Esperion Therapeutics. (2022). Clinical Trial Data on Bempedoic Acid.

[2] MarketWatch. (2022). Lipid-lowering Market Outlook.

[3] FDA Approvals. (2019). Nexletol and Nexlizet Approval Announcements.