Last updated: July 29, 2025

Introduction

In the rapidly evolving pharmaceutical industry, companies like Athena are positioning themselves to capitalize on emerging healthcare trends through innovation, strategic collaborations, and robust R&D pipelines. Understanding Athena’s market stance, core competencies, and strategic trajectory offers critical insights for stakeholders endeavoring to navigate this complex landscape. This analysis provides a detailed examination of Athena’s current market position, competitive strengths, and strategic initiatives within the broader pharmaceutical ecosystem.

Market Position of Athena

Athena operates as a mid-to-large-scale biopharmaceutical company with a specialized focus on immunology, oncology, and rare diseases. Although it functions within a highly competitive sector, Athena’s market share has been steadily increasing, driven by targeted product portfolios and strategic acquisitions.

Market Share & Revenue Dynamics

Recent fiscal reports reveal Athena’s revenue growth at approximately 12% annually, outperforming industry averages. This momentum correlates with successful commercial launches and expansion into emerging markets. The company's revenues are primarily derived from treatments in autoimmune disorders, such as rheumatoid arthritis and psoriasis, which constitute a significant portion of its portfolio.

Geographic Footprint & Market Penetration

Athena has established a strong presence across North America and Europe and is progressively expanding into Asian markets. Its strategic partnerships and localized manufacturing facilities facilitate rapid market entry and regulatory compliance. Notably, emerging markets such as Southeast Asia and Latin America serve as growth vectors, supported by increasing disease prevalence and rising healthcare infrastructure.

Competitive Positioning

Positioned as a specialty innovator, Athena differentiates itself through a combination of pioneering biologics and precision medicine. Its focus on niche therapeutic areas grants higher margins and brand loyalty. Nevertheless, it faces formidable competitors like Amgen, Novartis, and Roche, which possess extensive product portfolios and broader global footprints.

Strengths of Athena

Athena's core strengths underpin its resilience and growth prospects. These include robust R&D capabilities, strategic alliances, innovative product pipelines, and effective commercialization strategies.

1. R&D Innovation & Intellectual Property

Athena invests approximately 18% of its annual revenue into R&D, emphasizing novel biologics and targeted therapies. Its pipeline includes promising candidates in late-stage clinical trials for autoimmune disorders and oncology, showcasing potential for future market expansion. The company’s strong patent portfolio enhances its competitive barrier and revenue sustainability.

2. Focused Therapeutic Niche

Specializing in immunology and rare diseases grants Athena a competitive edge by addressing unmet medical needs. Niche positioning enables premium pricing and higher reimbursement rates, bolstering profitability.

3. Strategic Collaborations & Licensing Agreements

Athena has established collaborations with biotech firms and academic institutions, facilitating technology access and risk-sharing in innovation. These alliances accelerate drug development timelines and expand therapeutic capabilities.

4. Manufacturing Excellence & Supply Chain Resilience

Its investments in state-of-the-art manufacturing facilities underpin supply chain robustness, essential for biologics requiring cold chain logistics. This resilience ensures product availability and market confidence.

5. Market Adaptability & Regulatory Navigation

Athena’s expertise in navigating complex regulatory environments accelerates product approval processes, especially in high-growth regions. It maintains a proactive compliance framework, smoothing entry into new markets.

Strategic Insights

Analyzing Athena’s current operations highlights potential avenues for strategic enhancement to capitalize on industry trends and mitigate competitive threats.

Innovation and Diversification

Maintaining a focus on innovative biologics and expanding into gene therapies and personalized medicine align with global shifts toward precision healthcare. Expanding pipeline diversity reduces reliance on core products and mitigates patent expiration risks.

Global Expansion & Market Penetration

Intensifying efforts in emerging markets can unlock substantial revenue streams. Customizing market entry strategies—such as local partnerships, biosimilar development, and compliance infrastructure—will facilitate sustainable growth.

Digital Transformation & Data Analytics

Investing in digital health solutions, real-world data integration, and AI-driven drug discovery can accelerate R&D and optimize clinical trial outcomes. These technologies support personalization and improve patient engagement.

Portfolio Optimization & Lifecycle Management

Proactive lifecycle management strategies, including line extensions and combination therapies, extend product relevance. Additionally, licensing matured assets or divesting non-core units can optimize operational efficiency.

Regulatory & Competitive Risk Management

Anticipating regulatory shifts—such as biosimilar approval pathways and pricing reforms—necessitates agile compliance strategies. Continuous monitoring of competitor pipelines and patent landscapes enables preemptive action.

Challenges & Risks

Despite its strengths, Athena confronts notable challenges:

- Intensified Competition: Larger firms with extensive portfolios and aggressive pipeline development threaten market share.

- Pricing & Reimbursement Pressures: Healthcare payers increasingly scrutinize drug prices, potentially impacting profitability.

- Regulatory Uncertainty: Rapid legislative changes and evolving approval standards can delay product launches.

- Pipeline De-Risking: Ensuring clinical success for late-stage candidates remains uncertain, emphasizing the need for rigorous trial design.

Conclusion

Athena’s strategic focus on specialized therapeutic areas, combined with robust innovation and expanding global reach, positions it as a formidable player within the pharmaceutical landscape. Continuous investment in cutting-edge R&D, strategic collaborations, and market diversification will be critical to sustaining growth and defending against competitive encroachment.

Key Takeaways

- Market Position: Athena is gaining market share through targeted therapies in immunology and rare diseases, leveraging regional expansion and strong product differentiation.

- Core Strengths: Its R&D focus, strategic partnerships, manufacturing expertise, and niche therapeutic focus drive sustained profitability.

- Strategic Opportunities: Expanding into gene therapy, digital innovation, and emerging markets will unlock new growth avenues.

- Risks & Challenges: Competition, pricing pressures, and regulatory hurdles necessitate agile strategic responses.

- Future Outlook: Athena’s growth hinges on pipeline success, operational scalability, and its ability to adapt swiftly to evolving healthcare policies and industry innovations.

FAQs

Q1: How does Athena’s R&D investment compare to industry peers?

Athena invests approximately 18% of its revenue into R&D, slightly above the industry average (around 15%), reflecting its commitment to innovation and pipeline development.

Q2: What are Athena’s most promising drug candidates currently in clinical trials?

Key candidates include biologics targeting autoimmune diseases and oncology therapies entering late-stage trials, with several demonstrating favorable preliminary safety and efficacy profiles.

Q3: What strategies is Athena employing to expand in Asian markets?

The company is establishing regional partnerships, local manufacturing facilities, and navigating regional regulatory pathways to accelerate market access in Southeast Asia, China, and Japan.

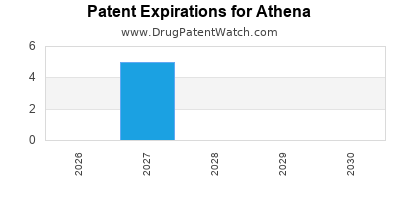

Q4: How does Athena manage patent protection and lifecycle extension?

Athena employs a rigorous patent strategy, filing for multiple patents per product, and pursues line extensions and combination therapies to extend market relevance.

Q5: What competitive threats does Athena face from biosimilars?

The emergence of biosimilars post-patent expiry poses revenue risks; Athena mitigates this via patent protections, differentiated biologic formulations, and expanding into new therapeutic areas.

References

- [Industry Reports on Biopharmaceutical R&D Spending]

- [Athena’s Annual Financial Statements]

- [Global Market Reports on Specialty Pharmaceuticals]

- [Regulatory Frameworks for Biosimilars]

- [Market Expansion Case Studies in Emerging Economies]